- Canada

- /

- Transportation

- /

- TSX:CP

Be Sure To Check Out Canadian Pacific Railway Limited (TSE:CP) Before It Goes Ex-Dividend

It looks like Canadian Pacific Railway Limited (TSE:CP) is about to go ex-dividend in the next four days. Investors can purchase shares before the 24th of September in order to be eligible for this dividend, which will be paid on the 26th of October.

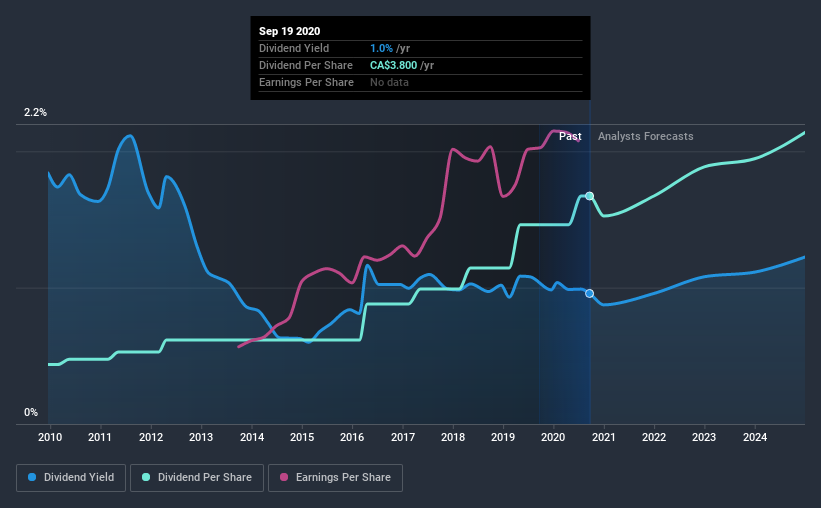

Canadian Pacific Railway's next dividend payment will be CA$0.95 per share, on the back of last year when the company paid a total of CA$3.80 to shareholders. Calculating the last year's worth of payments shows that Canadian Pacific Railway has a trailing yield of 1.0% on the current share price of CA$396.96. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Canadian Pacific Railway

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Canadian Pacific Railway has a low and conservative payout ratio of just 20% of its income after tax. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Fortunately, it paid out only 34% of its free cash flow in the past year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. For this reason, we're glad to see Canadian Pacific Railway's earnings per share have risen 15% per annum over the last five years. Earnings per share have been growing rapidly and the company is retaining a majority of its earnings within the business. This will make it easier to fund future growth efforts and we think this is an attractive combination - plus the dividend can always be increased later.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Canadian Pacific Railway has lifted its dividend by approximately 14% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

The Bottom Line

Has Canadian Pacific Railway got what it takes to maintain its dividend payments? Canadian Pacific Railway has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. There's a lot to like about Canadian Pacific Railway, and we would prioritise taking a closer look at it.

In light of that, while Canadian Pacific Railway has an appealing dividend, it's worth knowing the risks involved with this stock. Our analysis shows 1 warning sign for Canadian Pacific Railway and you should be aware of this before buying any shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Canadian Pacific Railway, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)