- Canada

- /

- Wireless Telecom

- /

- TSX:RCI.B

Will Rogers’ (TSX:RCI.B) Xfinity StreamSaver Bundle Redefine Its Competitive Edge in Streaming?

Reviewed by Simply Wall St

- Rogers Communications recently launched the Rogers Xfinity StreamSaver, a bundled streaming plan combining Netflix, Disney+, and Apple TV+ into a single package on its Xfinity platform, offering customers over 30% monthly savings compared to subscribing separately.

- This move provides Rogers’ customers with streamlined access to leading streaming content and enhances the company’s appeal in the competitive media and entertainment segment.

- Next, we’ll explore how integrating a multi-streaming bundle could impact Rogers Communications’ broader investment narrative and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Rogers Communications Investment Narrative Recap

To be a shareholder in Rogers Communications, you need to believe in its ability to innovate and monetize both connectivity and digital content, while managing regulatory and competitive risks. The StreamSaver bundle is an interesting development, but its immediate impact may be modest given larger near-term catalysts such as subscriber growth and the ongoing threat to average revenue per user (ARPU) from industry price competition. The most important risk right now remains margin pressure as promotional activity persists in the wireless market.

Of the company’s recent announcements, the partnership with Bell to cross-distribute specialty channels stands out in relation to the StreamSaver news. Both moves underline Rogers’ effort to offer consumers broader and more attractive content choices, which may help to partially offset competitive and regulatory headwinds impacting subscriber and ARPU trends. Yet, the true measure of success will hinge on...

Read the full narrative on Rogers Communications (it's free!)

Rogers Communications is projected to reach CA$23.4 billion in revenue and CA$2.4 billion in earnings by 2028. This outlook is based on analysts forecasting 4.0% annual revenue growth and an increase in earnings of CA$0.9 billion from the current CA$1.5 billion.

Uncover how Rogers Communications' forecasts yield a CA$55.44 fair value, a 12% upside to its current price.

Exploring Other Perspectives

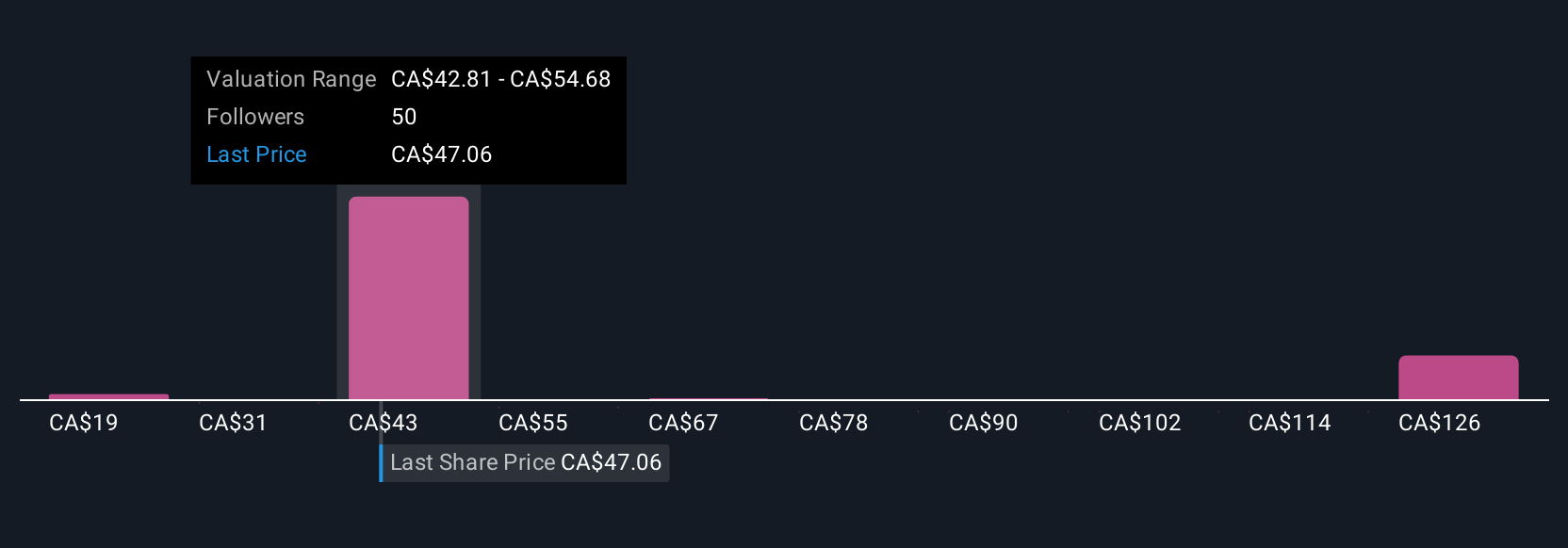

Ten members of the Simply Wall St Community estimate Rogers’ fair value across a wide CA$19.07 to CA$147.04 range. While opinions vary, margin compression driven by pricing pressure is a key issue investors should keep in mind.

Explore 10 other fair value estimates on Rogers Communications - why the stock might be worth over 2x more than the current price!

Build Your Own Rogers Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rogers Communications research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rogers Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers Communications' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RCI.B

Rogers Communications

Operates as a communications and media company in Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives