- Canada

- /

- Wireless Telecom

- /

- TSX:RCI.B

Should We Be Cautious About Rogers Communications Inc.'s (TSE:RCI.B) ROE Of 8.3%?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine Rogers Communications Inc. (TSE:RCI.B), by way of a worked example.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Rogers Communications

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Rogers Communications is:

8.3% = CA$879m ÷ CA$11b (Based on the trailing twelve months to June 2024).

The 'return' is the yearly profit. One way to conceptualize this is that for each CA$1 of shareholders' capital it has, the company made CA$0.08 in profit.

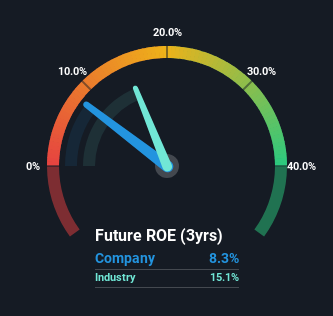

Does Rogers Communications Have A Good ROE?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. As is clear from the image below, Rogers Communications has a lower ROE than the average (15%) in the Wireless Telecom industry.

That certainly isn't ideal. Although, we think that a lower ROE could still mean that a company has the opportunity to better its returns with the use of leverage, provided its existing debt levels are low. When a company has low ROE but high debt levels, we would be cautious as the risk involved is too high. To know the 4 risks we have identified for Rogers Communications visit our risks dashboard for free.

The Importance Of Debt To Return On Equity

Virtually all companies need money to invest in the business, to grow profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

Combining Rogers Communications' Debt And Its 8.3% Return On Equity

It seems that Rogers Communications uses a huge volume of debt to fund the business, since it has an extremely high debt to equity ratio of 4.11. The combination of a rather low ROE and high debt to equity is a negative, in our book.

Conclusion

Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So you might want to check this FREE visualization of analyst forecasts for the company.

Of course Rogers Communications may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RCI.B

Rogers Communications

Operates as a communications and media company in Canada.

Very undervalued established dividend payer.