While the backup in bond yields over the past few months has impacted bond prices, it also sets the stage for stronger performance ahead as yields are typically the key driver of fixed-income returns. In this context, investing in penny stocks—often seen as a niche area—can still present growth opportunities, especially when these stocks are backed by strong financial health. Despite being considered somewhat outdated, penny stocks continue to offer potential for significant returns at lower price points by focusing on smaller or newer companies with solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.92 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.20 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.26 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.84 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 957 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tartisan Nickel (CNSX:TN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tartisan Nickel Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and Peru, with a market cap of CA$31.10 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$31.1M

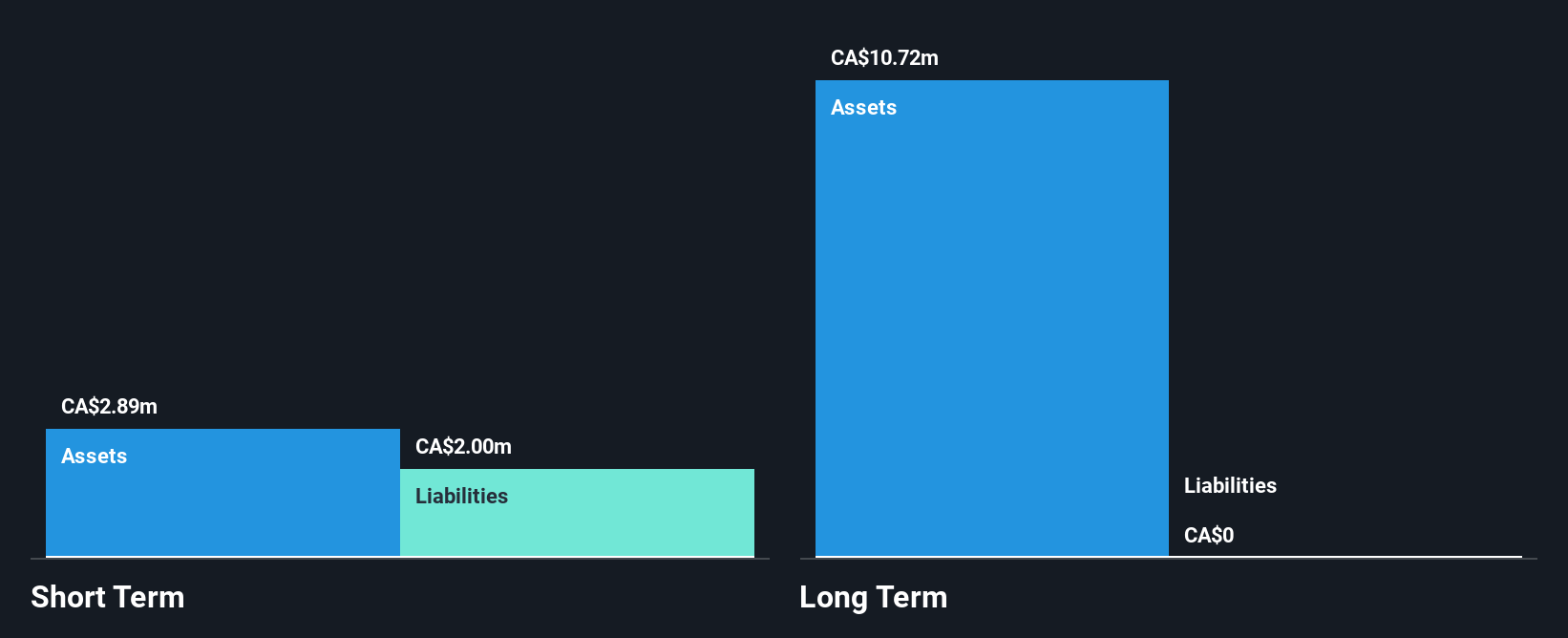

Tartisan Nickel Corp., with a market cap of CA$31.10 million, remains pre-revenue and unprofitable, having reported increased losses over the past five years. Despite this, the company has recently raised CA$1.5 million through a private placement to support its activities, including infrastructure development at the Kenbridge Nickel Project in Ontario. The company's short-term assets exceed liabilities, and it holds more cash than debt with no long-term liabilities. While volatility has decreased over the past year, Tartisan's negative return on equity highlights ongoing financial challenges amid its exploration efforts in Canada and Peru.

- Jump into the full analysis health report here for a deeper understanding of Tartisan Nickel.

- Explore historical data to track Tartisan Nickel's performance over time in our past results report.

California Nanotechnologies (TSXV:CNO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: California Nanotechnologies Corp. focuses on the research, development, and production of nanocrystalline materials through grain size reduction and has a market cap of CA$39.31 million.

Operations: California Nanotechnologies does not report distinct revenue segments.

Market Cap: CA$39.31M

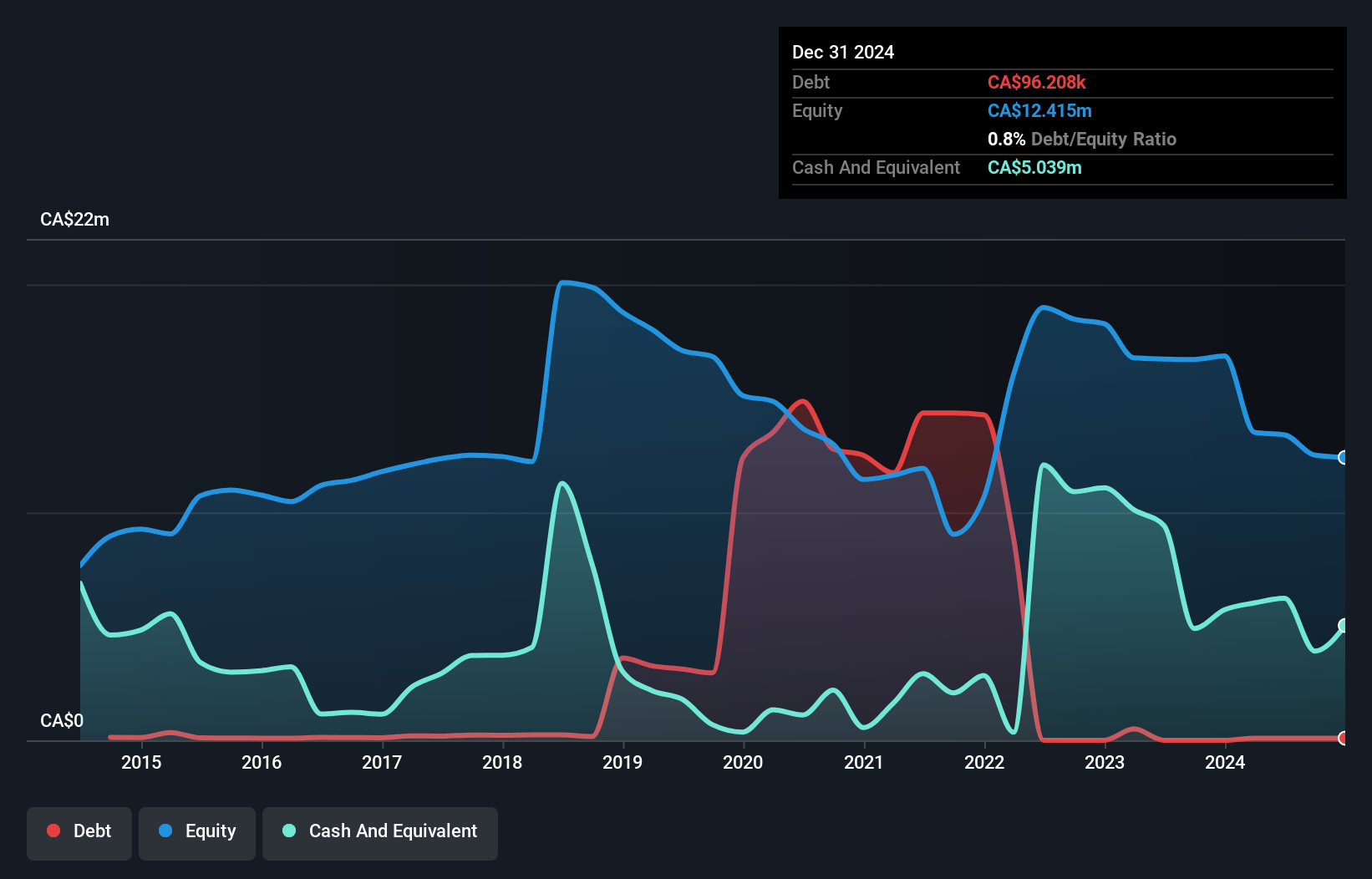

California Nanotechnologies Corp., with a market cap of CA$39.31 million, has shown mixed financial performance. While the company reported sales of US$1.52 million in the recent quarter, it incurred a net loss compared to a profit in the previous year. Despite negative earnings growth and shareholder dilution over the past year, its debt levels are well-managed, with more cash than total debt and strong interest coverage by EBIT. The management team is relatively new, but improvements in shareholder equity reflect progress over time. The company's high return on equity suggests some underlying operational strengths despite current challenges.

- Dive into the specifics of California Nanotechnologies here with our thorough balance sheet health report.

- Gain insights into California Nanotechnologies' past trends and performance with our report on the company's historical track record.

Avante (TSXV:XX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avante Corp. develops security technologies, products, and solutions across several countries including Canada, the United States, and the United Kingdom with a market cap of CA$33.04 million.

Operations: The company's revenue is primarily derived from its security segment, generating CA$26.99 million.

Market Cap: CA$33.04M

Avante Corp., with a market cap of CA$33.04 million, is navigating the penny stock landscape through strategic innovations and expansion plans. Despite being unprofitable with increased losses over five years, Avante maintains a strong cash position exceeding its debt and liabilities, ensuring financial stability. Recent product launches like the AI-powered Halo security system demonstrate technological advancement, potentially boosting future sales. The company reported substantial revenue growth to CA$16 million for six months ending September 2024 but faced widening net losses. Avante's focus on acquisitions could enhance its market presence in high-net-worth security solutions sectors.

- Navigate through the intricacies of Avante with our comprehensive balance sheet health report here.

- Understand Avante's track record by examining our performance history report.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 954 more companies for you to explore.Click here to unveil our expertly curated list of 957 TSX Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CNO

California Nanotechnologies

Engages in the research, development, and production of nanocrystalline materials through grain size reduction.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)