- Canada

- /

- Metals and Mining

- /

- TSXV:SMD

TSX Penny Stocks To Monitor In December 2024

Reviewed by Simply Wall St

While the recent backup in bond yields has impacted bond prices, it sets the stage for stronger performance ahead, with bonds expected to outperform cash as yields become a key driver of fixed-income returns. In this context, investors may find opportunities in penny stocks, which despite their vintage name, continue to highlight smaller or less-established companies that can offer intriguing value. By focusing on those with robust financials and clear growth trajectories, investors can uncover potential gems among these stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.53 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.94 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 957 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AI Artificial Intelligence Ventures (TSXV:AIVC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AI Artificial Intelligence Ventures Inc., previously ESG Global Impact Capital Inc., is a venture capital and private equity firm focusing on seed, early-stage, and growth capital investments with a market cap of CA$12.49 million.

Operations: AI Artificial Intelligence Ventures Inc. reported revenue from its unclassified services segment amounting to negative CA$0.92 million.

Market Cap: CA$12.49M

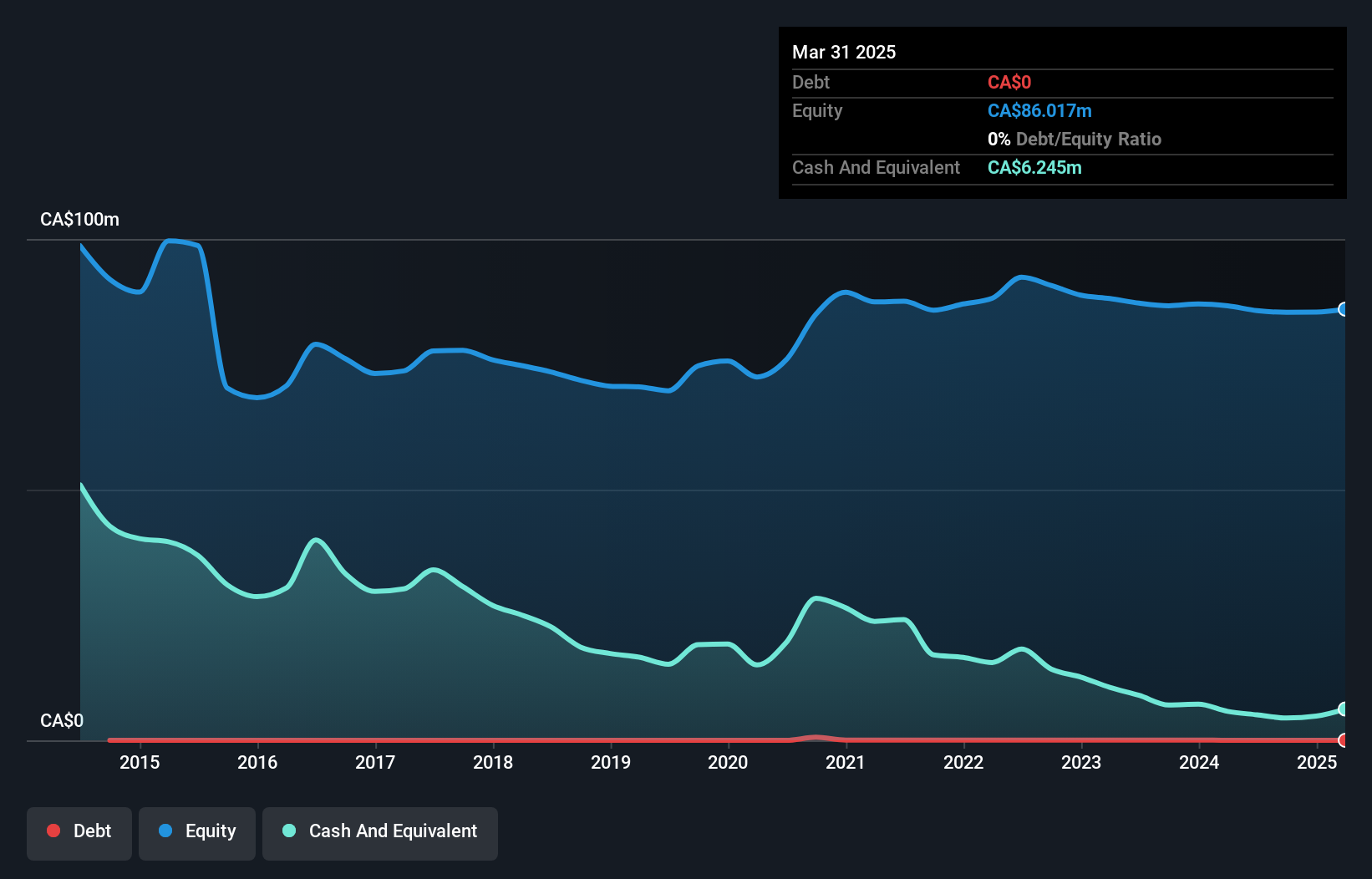

AI Artificial Intelligence Ventures Inc., with a market cap of CA$12.49 million, is pre-revenue and reported negative revenue of CA$0.92 million for the year ending August 31, 2024. Despite having more cash than debt and sufficient cash runway for over three years, the company remains unprofitable with increasing losses over the past five years at a rate of 17.7% annually. Recent earnings results showed an improvement in net loss from CA$2.06 million to CA$1.21 million year-over-year; however, auditors have expressed doubts about its ability to continue as a going concern due to ongoing financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of AI Artificial Intelligence Ventures.

- Gain insights into AI Artificial Intelligence Ventures' historical outcomes by reviewing our past performance report.

Noble Mineral Exploration (TSXV:NOB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noble Mineral Exploration Inc. is a junior exploration company focused on the exploration and evaluation of mineral properties in Canada, with a market cap of CA$8.31 million.

Operations: Noble Mineral Exploration Inc. does not currently report any revenue segments.

Market Cap: CA$8.31M

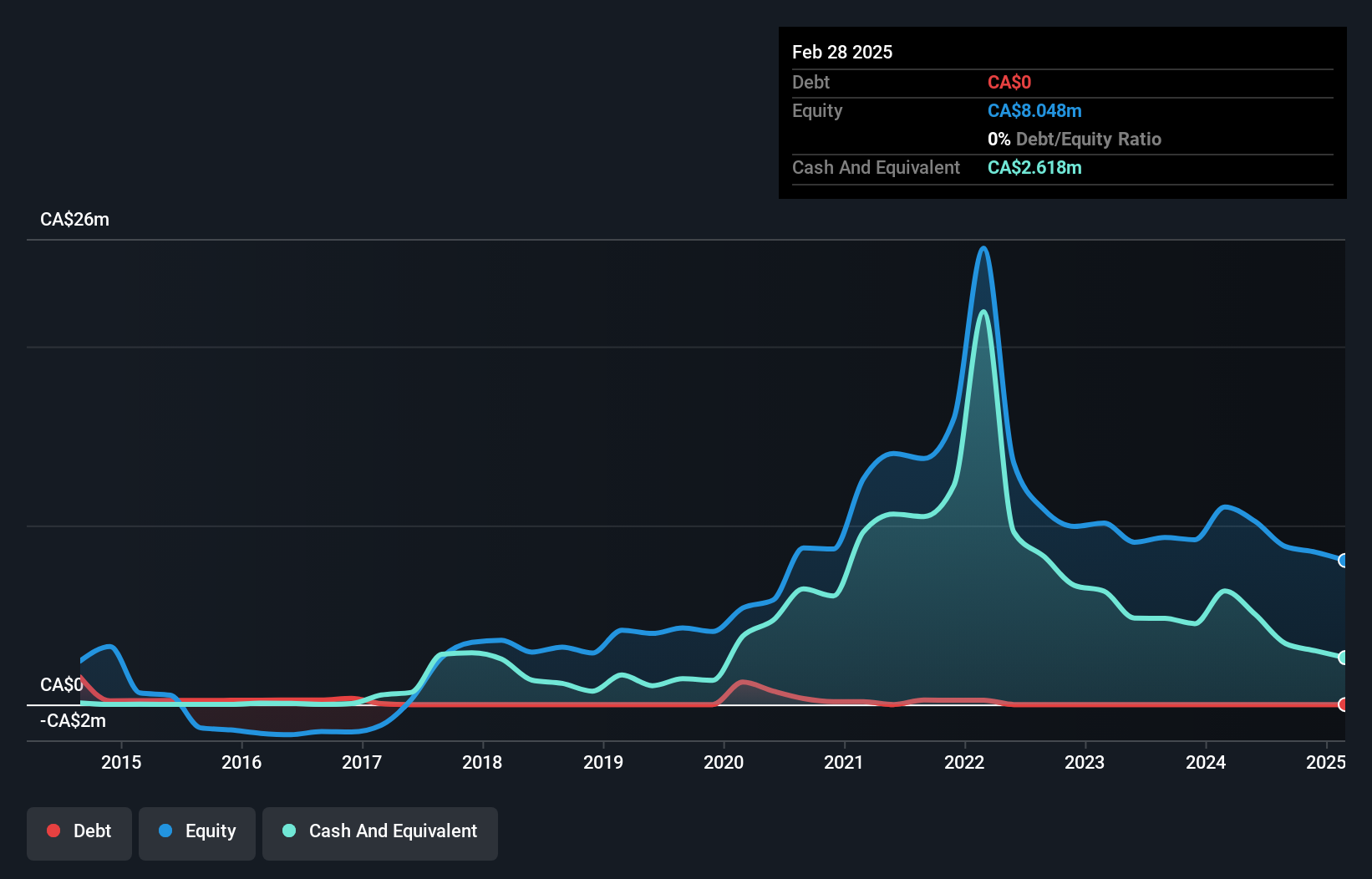

Noble Mineral Exploration Inc., with a market cap of CA$8.31 million, is pre-revenue and unprofitable, facing challenges highlighted by its auditor's going concern doubts. Despite this, the company maintains a debt-free balance sheet and has sufficient cash runway for over a year. Recent exploration efforts include drilling programs on joint venture properties near Timmins, Ontario, in collaboration with Canada Nickel. These initiatives aim to establish initial resource estimates by early 2025. However, the stock remains highly volatile and faces significant operational risks as it continues to explore mineral properties without current revenue streams.

- Get an in-depth perspective on Noble Mineral Exploration's performance by reading our balance sheet health report here.

- Learn about Noble Mineral Exploration's historical performance here.

Strategic Metals (TSXV:SMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Strategic Metals Ltd. is involved in acquiring, exploring, and evaluating mineral properties in Canada with a market cap of CA$17.75 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$17.75M

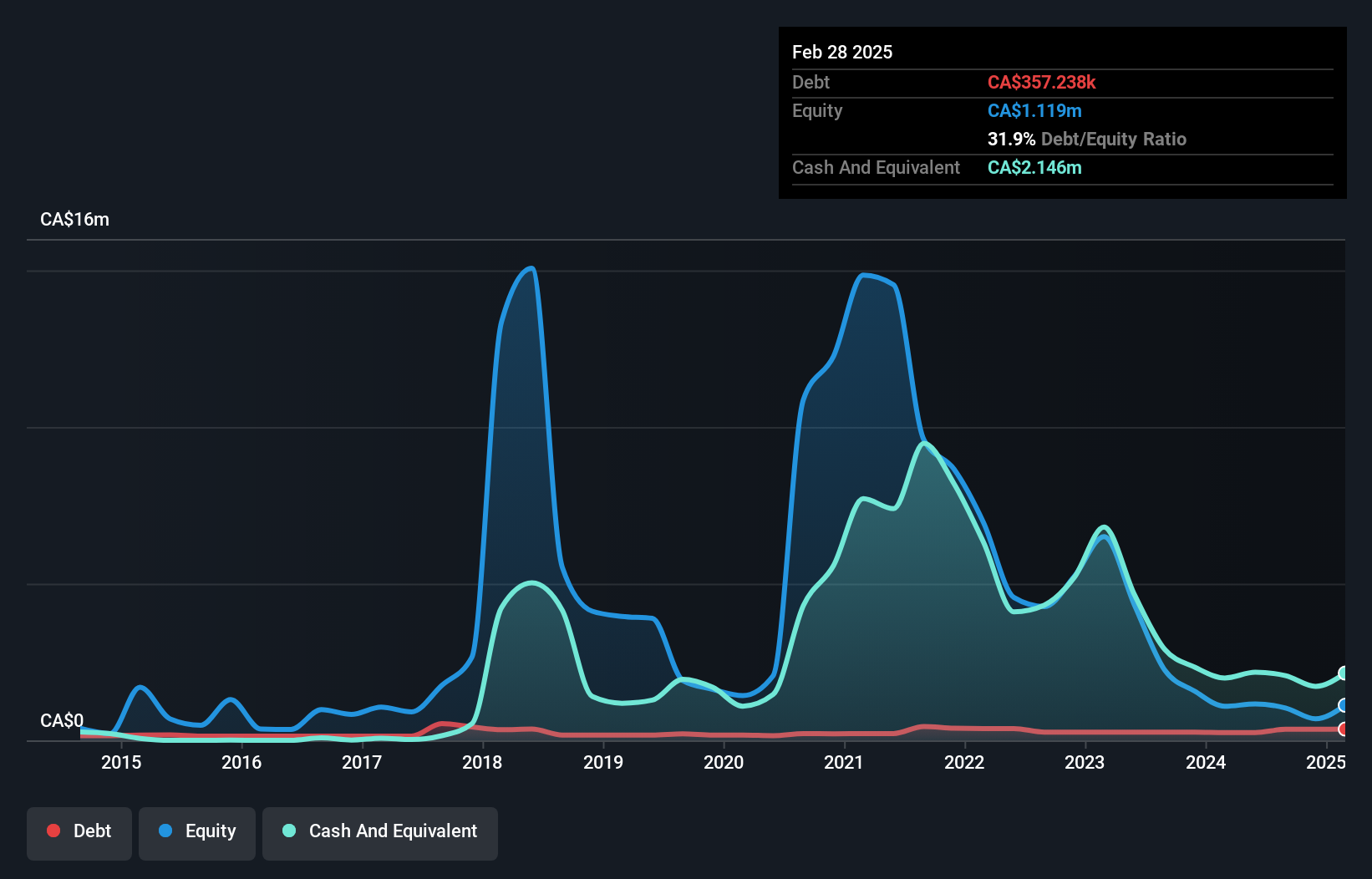

Strategic Metals Ltd., with a market cap of CA$17.75 million, is pre-revenue and currently unprofitable, with losses increasing annually by 18.9% over the past five years. The company has no debt and possesses sufficient cash to sustain operations for more than a year based on current free cash flow trends. Recent developments include the announcement of a share repurchase program aimed at capitalizing on potential price weaknesses, funded from unallocated cash resources. This move reflects strategic financial management despite ongoing challenges in generating revenue from its mineral exploration activities in Canada.

- Take a closer look at Strategic Metals' potential here in our financial health report.

- Explore historical data to track Strategic Metals' performance over time in our past results report.

Taking Advantage

- Reveal the 957 hidden gems among our TSX Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SMD

Strategic Metals

Acquires, explores for, and evaluates mineral properties in Canada.

Excellent balance sheet low.