- Canada

- /

- Metals and Mining

- /

- TSX:LN

TSX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The Canadian market has experienced a pullback recently, with the TSX index losing ground amid political uncertainty and profit-taking. Despite this volatility, the underlying economic fundamentals remain strong, creating opportunities for investors willing to explore diverse options. Penny stocks, often associated with smaller or newer companies, continue to offer potential value by combining affordability with growth prospects; here we explore three such stocks that stand out for their financial strength.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$14.04M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.14 | CA$389.72M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.24 | CA$115M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$942.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.80 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$112.03M | ★★★★☆☆ |

Click here to see the full list of 956 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

GoGold Resources (TSX:GGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoGold Resources Inc. is involved in the exploration, development, and production of silver, gold, and copper mainly in Mexico with a market cap of CA$362.48 million.

Operations: The company's revenue segment primarily comprises Metals & Mining - Gold & Other Precious Metals, generating $36.50 million.

Market Cap: CA$362.48M

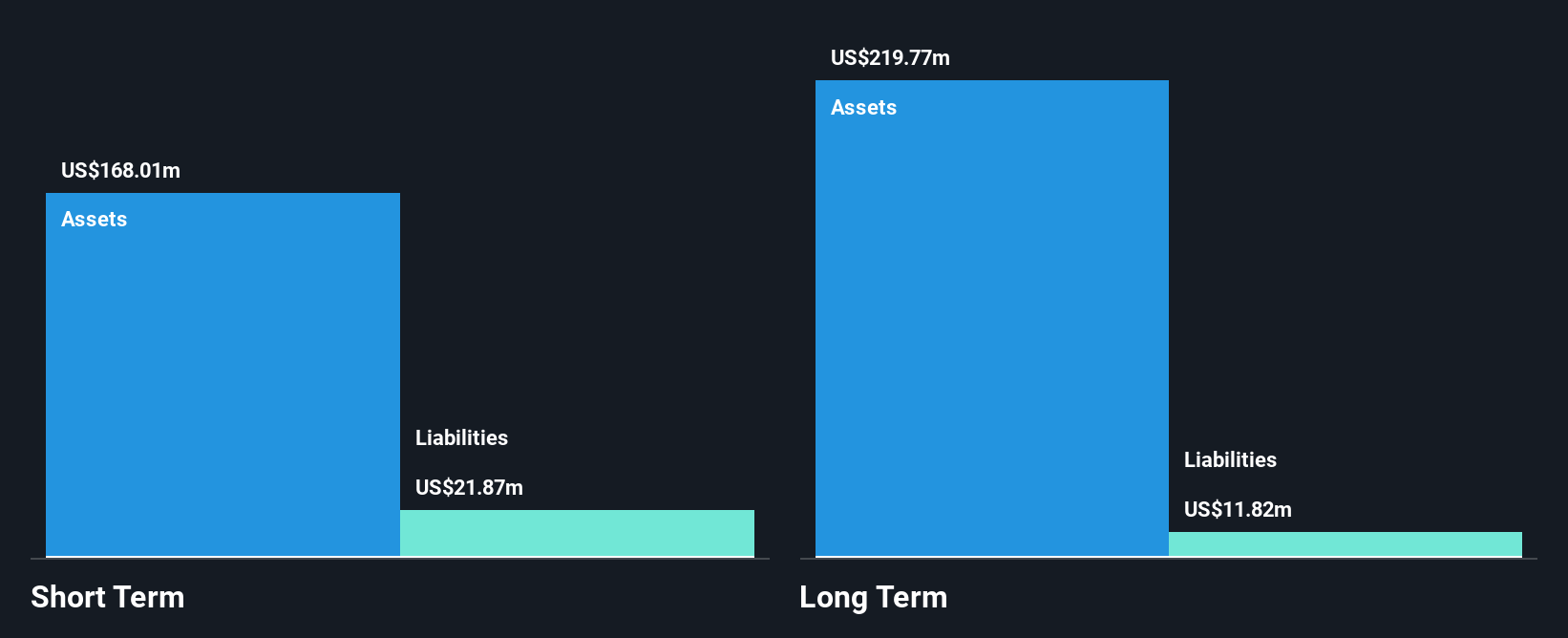

GoGold Resources has demonstrated a turnaround by becoming profitable in the past year, with net income of US$1.58 million for the full year ending September 30, 2024, compared to a net loss previously. The company reported sales of US$36.5 million and produced over 1.48 million silver equivalent ounces during this period. Despite having no debt and adequate short-term assets to cover liabilities, its return on equity remains low at 0.6%. The management team is experienced with an average tenure of nearly nine years, while shareholders have not faced significant dilution recently.

- Unlock comprehensive insights into our analysis of GoGold Resources stock in this financial health report.

- Gain insights into GoGold Resources' outlook and expected performance with our report on the company's earnings estimates.

Loncor Gold (TSX:LN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Loncor Gold Inc. is a gold exploration company focused on acquiring, exploring, and developing precious metal projects in the Ngayu greenstone belt of the Democratic Republic of the Congo and Canada, with a market cap of CA$77.31 million.

Operations: Loncor Gold Inc. does not have reported revenue segments as it is primarily engaged in gold exploration activities.

Market Cap: CA$77.31M

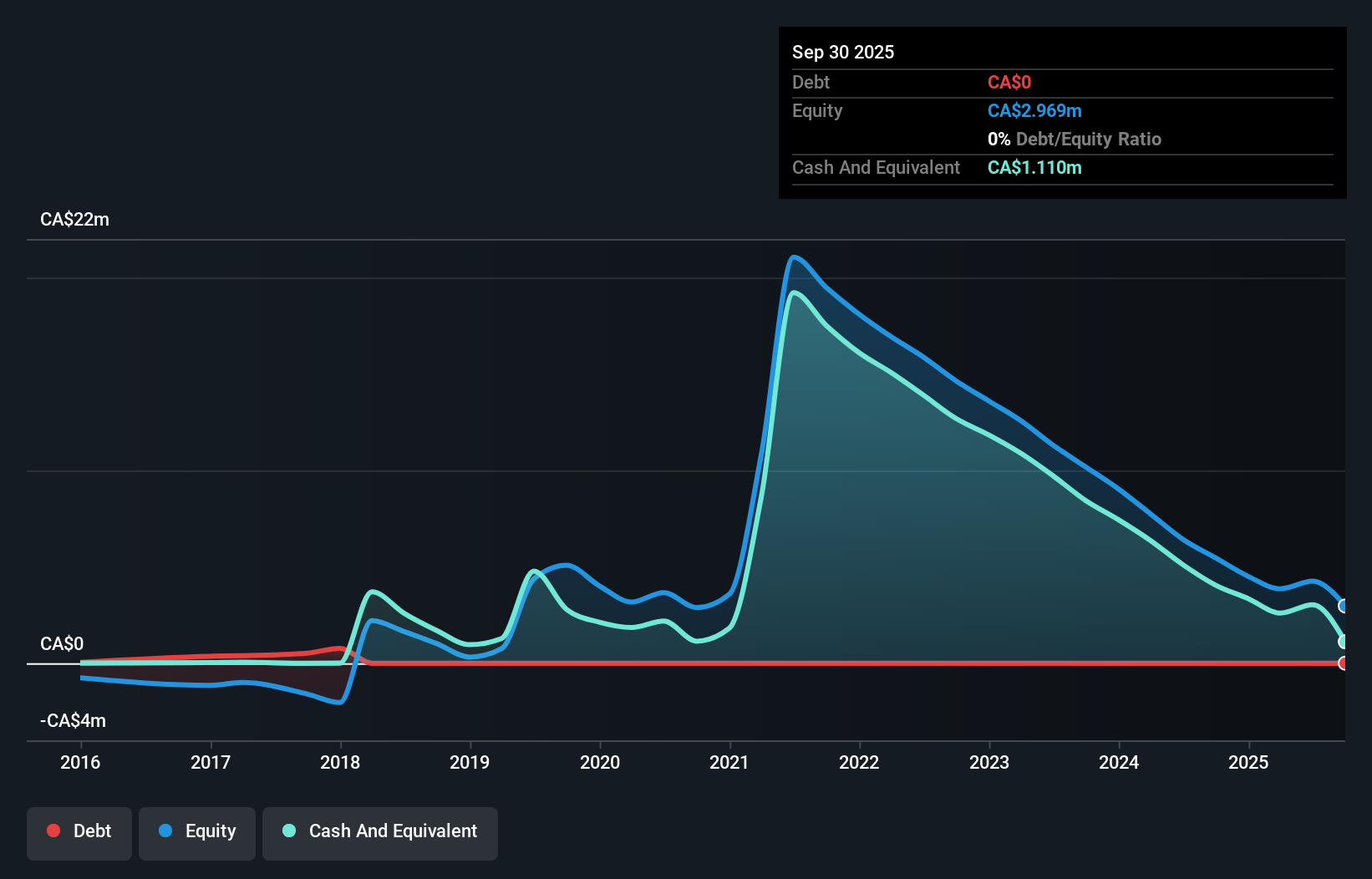

Loncor Gold Inc., a pre-revenue gold exploration company, is actively advancing its projects in the Ngayu greenstone belt. Despite being unprofitable with increasing losses over the past five years, Loncor remains debt-free and has stable short-term assets exceeding liabilities. The management and board are highly experienced, with average tenures of 14.8 and 16 years respectively. Recent developments include a significant drilling program at Adumbi, targeting deeper mineralization beyond existing resources of over 3 million ounces of gold. However, the company faces financial constraints with less than a year’s cash runway under current expenditure trends.

- Get an in-depth perspective on Loncor Gold's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Loncor Gold's track record.

Ynvisible Interactive (TSXV:YNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ynvisible Interactive Inc. develops and sells electrochromic displays in Europe and North America, with a market cap of CA$15.56 million.

Operations: Currently, there are no specific revenue segments reported for this company.

Market Cap: CA$15.56M

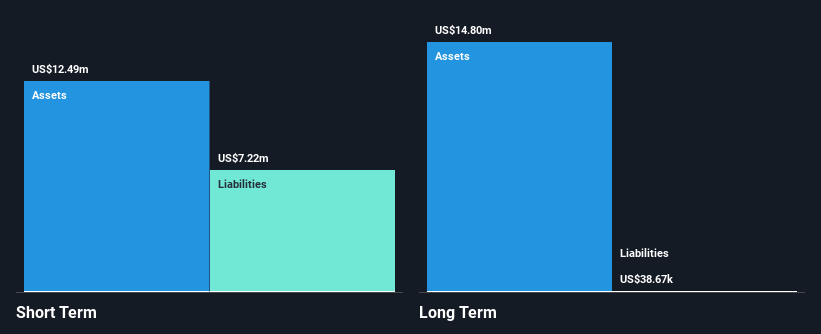

Ynvisible Interactive Inc., a pre-revenue company with a market cap of CA$15.56 million, is gaining attention through strategic partnerships and technological advancements in the e-paper display sector. Recent collaborations include integrating its displays into security systems and transit information solutions, highlighting potential for scalable revenue growth as initial orders are placed for testing. Despite being unprofitable with increasing losses over five years, Ynvisible remains debt-free and has adequate short-term assets covering liabilities. The management team is seasoned, contributing to the company's innovative approach in expanding its presence in Europe and North America through new distribution agreements.

- Dive into the specifics of Ynvisible Interactive here with our thorough balance sheet health report.

- Learn about Ynvisible Interactive's historical performance here.

Key Takeaways

- Take a closer look at our TSX Penny Stocks list of 956 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LN

Loncor Gold

A gold exploration company, engages in the acquisition, exploration, and development of precious metal projects in the Democratic Republic of the Congo.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)