Kraken Robotics (TSXV:PNG): Valuation Check After Breakthrough KATFISH Maritime Security Demonstration

Reviewed by Simply Wall St

Kraken Robotics (TSXV:PNG) just showcased its KATFISH USV LARS system operating from TKMS ATLAS UK’s ARCIMS platform, delivering the first air deployable, 300 meter rated autonomous towed SAS survey solution for maritime security.

See our latest analysis for Kraken Robotics.

That successful KATFISH demonstration caps a run of solid news for Kraken, including fresh $12 million SAS and battery orders and new senior defence leadership. The stock’s strong year to date share price return suggests momentum is building rather than fading.

If this kind of defence tech story has your attention, it could be a good moment to explore other aerospace and security names through aerospace and defense stocks.

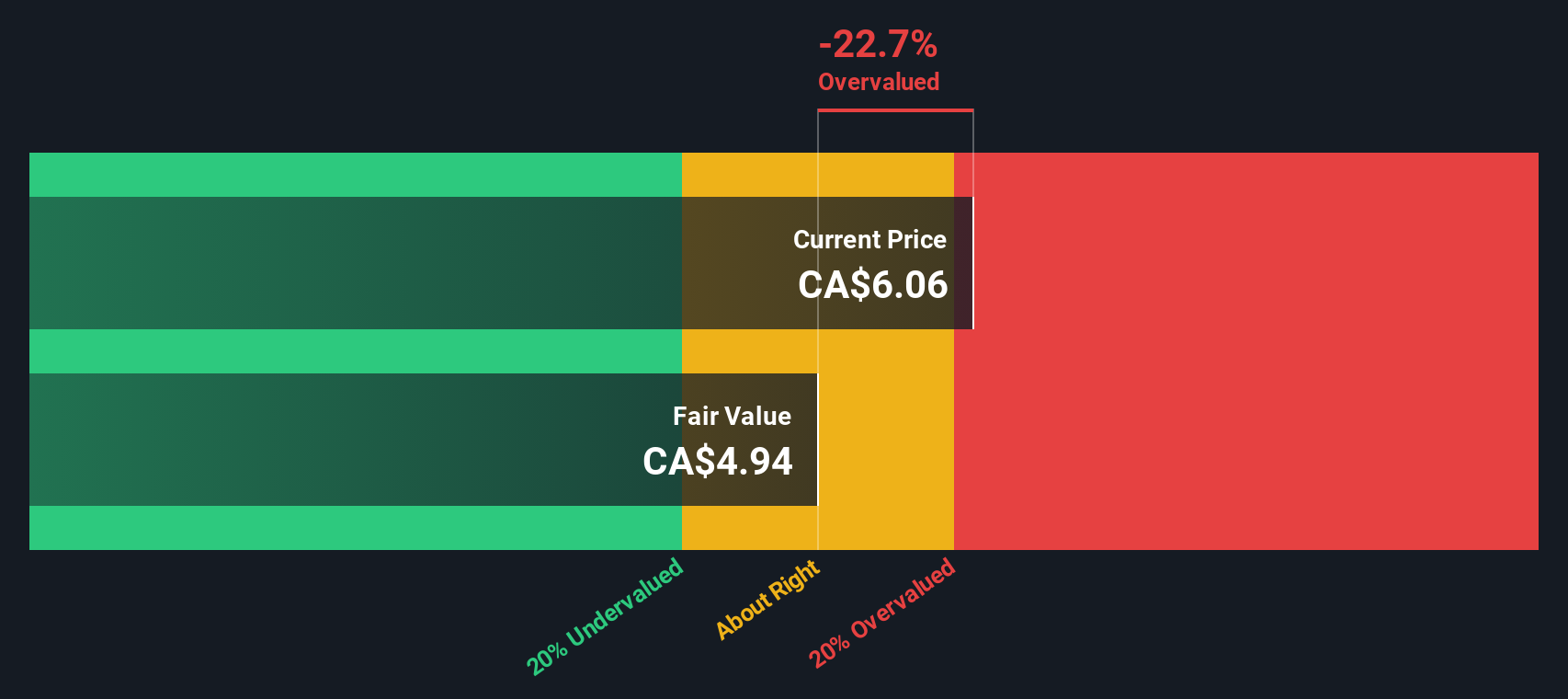

After a stellar multi year run and fresh contract wins, Kraken now trades close to analyst targets but at a hefty premium to estimated intrinsic value. Is there still a buying opportunity here, or is future growth already priced in?

Price to earnings of 114x: Is it justified?

On a trailing price to earnings basis, Kraken’s CA$6.13 share price equates to roughly 114 times earnings, a clear premium to peers and models.

The price to earnings ratio compares today’s share price with the company’s per share profits, making it a simple yardstick for how much investors are paying for each dollar of earnings. For a fast growing defence technology name like Kraken, a higher than average multiple can signal that investors are banking on strong future profit expansion rather than current income.

That premium is stark when set against the North American Electronic industry average of about 24.8 times earnings and a peer group closer to 38.1 times, as well as the estimated fair price to earnings ratio of 51.9 times suggested by regression analysis. In other words, the market price currently embeds expectations more than double what a fair ratio model points to, leaving little room for disappointment if growth slows or margins come under pressure.

Explore the SWS fair ratio for Kraken Robotics

Result: Price-to-earnings of 114x (OVERVALUED)

However, investors still face risks, including execution missteps on complex defence contracts and a sharp de rating if revenue or margin growth slows materially.

Find out about the key risks to this Kraken Robotics narrative.

Another View: What Does Our DCF Say?

While the price to earnings ratio suggests the shares are expensive, our DCF model gives a similar indication, with Kraken trading around CA$6.13 compared to an estimated fair value closer to CA$4.81. This implies meaningful downside if growth or margins disappoint.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kraken Robotics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kraken Robotics Narrative

If you are not fully convinced by this view or want to dig into the numbers yourself, you can build a custom story in minutes: Do it your way.

A great starting point for your Kraken Robotics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, explore a few new opportunities by putting the Simply Wall St screener to work for your next researched move.

- Identify potential mispricings by targeting quality companies trading below their cash flow value using these 908 undervalued stocks based on cash flows, tailored to value-focused investors.

- Focus on companies in automation and machine learning by identifying cutting-edge innovators through these 26 AI penny stocks with scalable growth stories.

- Support your income strategy by filtering for consistent payers and sustainable yields via these 13 dividend stocks with yields > 3% so you can evaluate opportunities for steady cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)