The board of C-Com Satellite Systems Inc. (CVE:CMI) has announced that it will pay a dividend on the 15th of May, with investors receiving CA$0.0125 per share. This means the annual payment is 4.1% of the current stock price, which is above the average for the industry.

See our latest analysis for C-Com Satellite Systems

C-Com Satellite Systems Doesn't Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, C-Com Satellite Systems was paying out quite a large proportion of both earnings and cash flow, with the dividend being 194% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Looking forward, EPS could fall by 6.2% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 102%, which could put the dividend in jeopardy if the company's earnings don't improve.

C-Com Satellite Systems Has A Solid Track Record

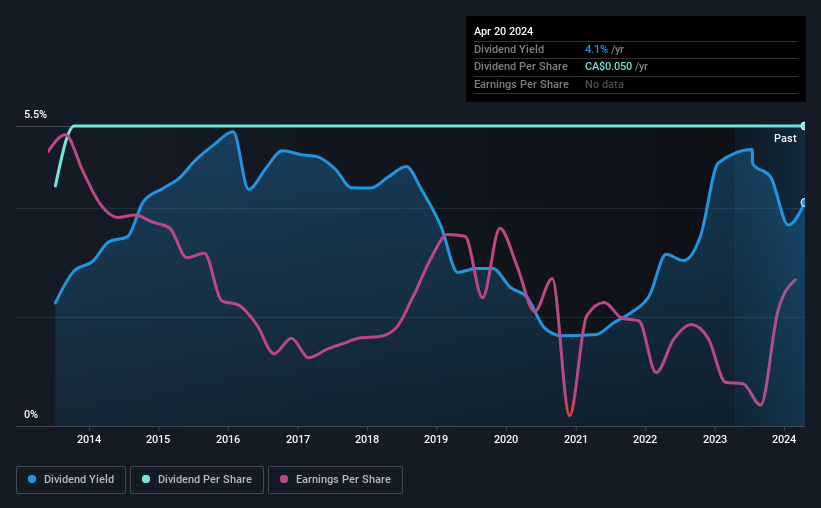

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was CA$0.04 in 2014, and the most recent fiscal year payment was CA$0.05. This means that it has been growing its distributions at 2.3% per annum over that time. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. C-Com Satellite Systems has seen earnings per share falling at 6.2% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

C-Com Satellite Systems' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for C-Com Satellite Systems you should be aware of, and 2 of them make us uncomfortable. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CMI

C-Com Satellite Systems

Designs, develops, manufactures, and sells transportable and mobile satellite-based antenna systems in Canada, Indonesia, Brazil, the United States, Bangladesh, Kazakhstan, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)