- Canada

- /

- Metals and Mining

- /

- TSXV:OCI

3 Canadian Penny Stocks On TSX With Market Caps Up To CA$60M

Reviewed by Simply Wall St

As we move into 2025, the Canadian market is navigating a complex landscape of inflationary pressures and shifting leadership dynamics, with the Bank of Canada focusing on growth risks. In this context, investors may find value in penny stocks—an investment area that continues to hold relevance despite its outdated name. These smaller or newer companies can offer surprising opportunities for growth, particularly when they possess solid financial foundations capable of weathering current economic challenges.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.875 | CA$176.94M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$442.31M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$638.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.03 | CA$196.4M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$4.28 | CA$3.26B | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$416.12M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$183.5M | ★★★★★☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Minco Silver (TSX:MSV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Minco Silver Corporation focuses on the exploration, evaluation, and development of precious metal and mineral properties, with a market cap of CA$11.59 million.

Operations: Minco Silver Corporation has not reported any revenue segments.

Market Cap: CA$11.59M

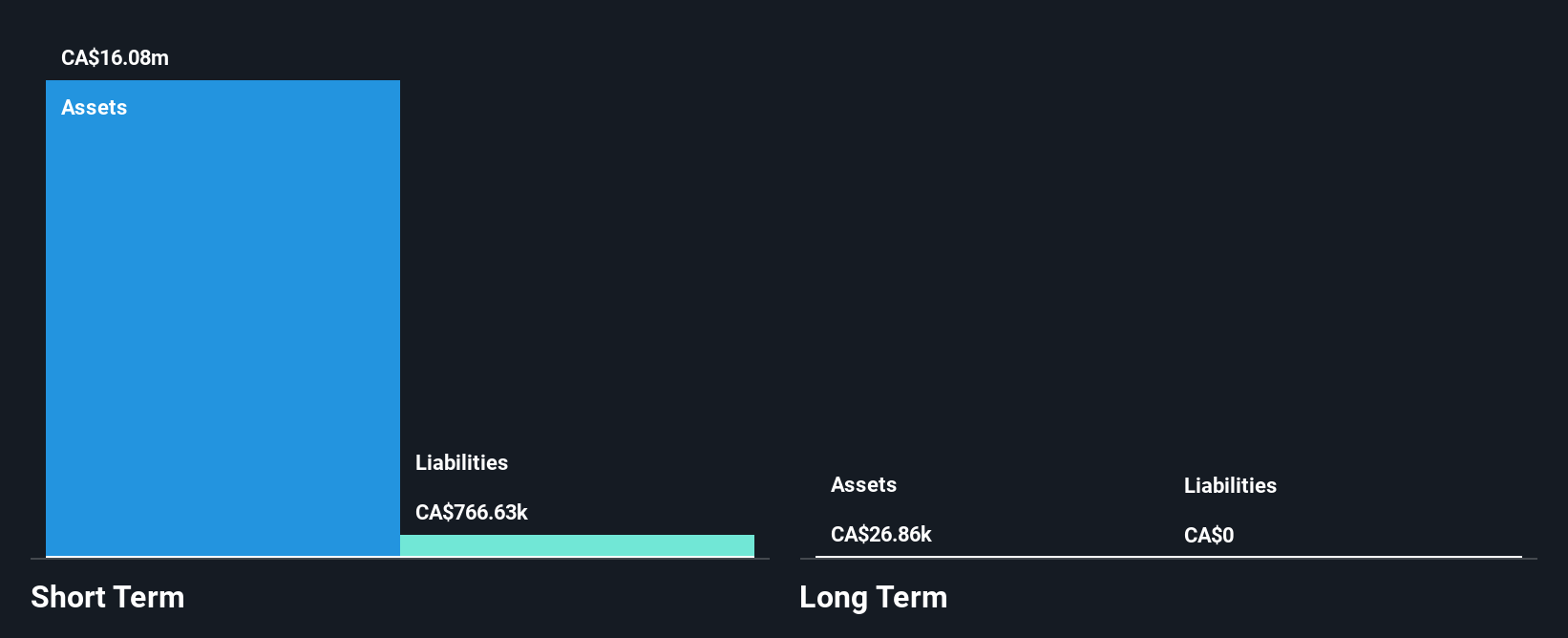

Minco Silver Corporation, with a market cap of CA$11.59 million, is a pre-revenue entity focused on precious metals exploration. The company has maintained a debt-free status for the past five years and has not significantly diluted shareholders recently. Despite being unprofitable, it has reduced its losses by 71.4% annually over five years and possesses sufficient cash to sustain operations for over three years at current free cash flow growth rates. Its short-term assets of CA$40.8 million comfortably cover both short-term and long-term liabilities, indicating strong financial resilience amidst market volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Minco Silver.

- Understand Minco Silver's track record by examining our performance history report.

C-Com Satellite Systems (TSXV:CMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C-Com Satellite Systems Inc. develops and deploys mobile auto-deploying satellite-based technology for high-speed Internet, VoIP, and video services across various regions including Canada, Europe, the United States, Asia, the Kingdom of Saudi Arabia, and Kazakhstan with a market cap of CA$50.29 million.

Operations: The company generates CA$10.34 million in revenue from the design and manufacture of auto-deploying mobile satellite antennas.

Market Cap: CA$50.29M

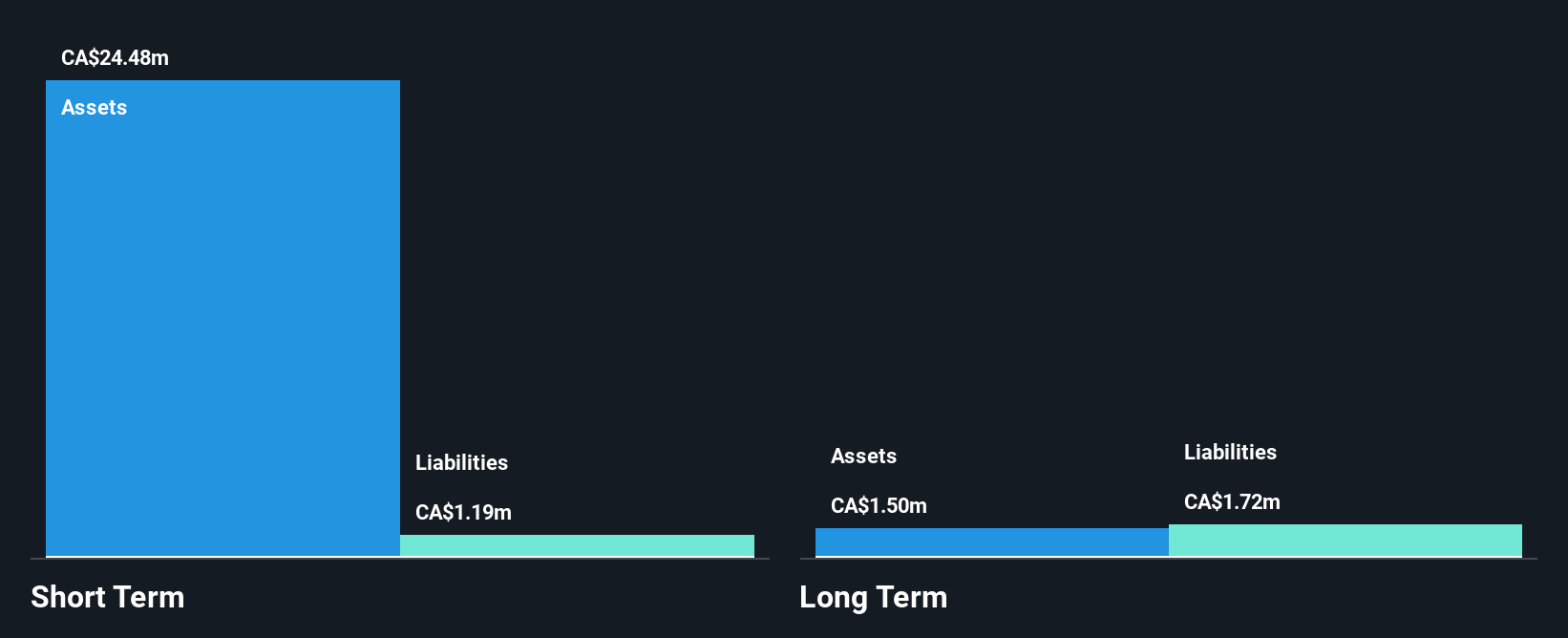

C-Com Satellite Systems, with a market cap of CA$50.29 million, has recently suspended its quarterly dividend to focus on strategic projects like the Ka-band Electronically Steered Antenna. Despite this, the company remains financially robust with short-term assets of CA$25.6 million covering both short and long-term liabilities. C-Com is debt-free and became profitable last year, though earnings have declined by 7% annually over five years. The board is experienced with an average tenure of 21 years, providing stability amidst its evolving competitive landscape in satellite technology markets across multiple regions.

- Click here to discover the nuances of C-Com Satellite Systems with our detailed analytical financial health report.

- Examine C-Com Satellite Systems' past performance report to understand how it has performed in prior years.

Orecap Invest (TSXV:OCI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orecap Invest Corp. is a company that invests in the natural resource sector and has a market cap of CA$14.86 million.

Operations: Orecap Invest Corp. has not reported any specific revenue segments.

Market Cap: CA$14.86M

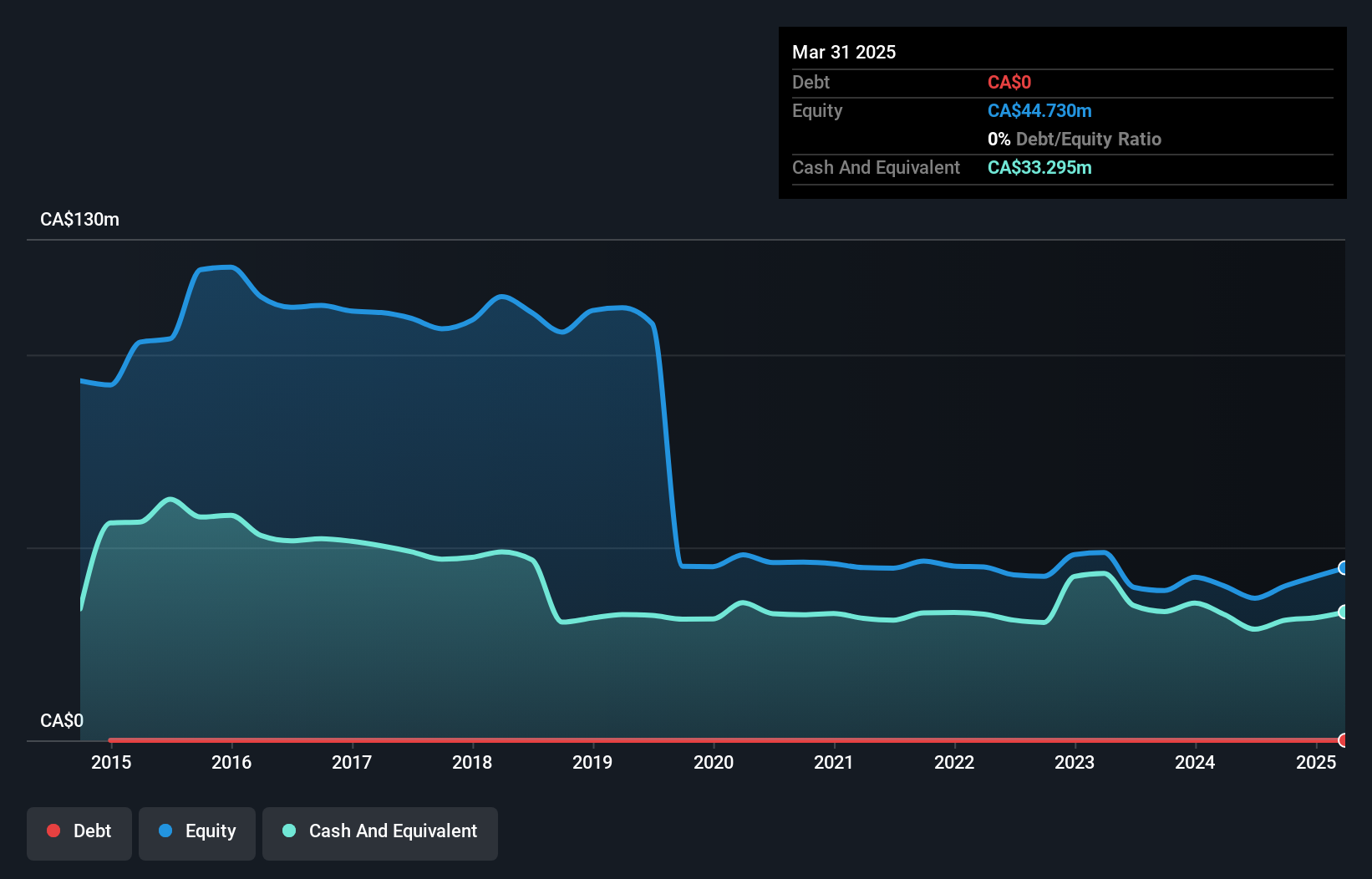

Orecap Invest Corp., with a market cap of CA$14.86 million, is pre-revenue and focuses on the natural resource sector. The company plans to reprocess historic tailings from the Kerr-Addison mine, aligning with Ontario's new simplified regulations for mine waste projects launching in July 2025. Orecap aims to partner through joint ventures or profit-sharing models, leveraging global precedents like South Africa's Witwatersrand Basin for potential success. Financially stable with no debt and short-term assets of CA$19.5 million exceeding liabilities of CA$3.6 million, Orecap has shown impressive earnings growth, driven by a significant one-off gain last year.

- Dive into the specifics of Orecap Invest here with our thorough balance sheet health report.

- Explore historical data to track Orecap Invest's performance over time in our past results report.

Taking Advantage

- Navigate through the entire inventory of 934 TSX Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OCI

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)