- Canada

- /

- Basic Materials

- /

- TSX:CEMX

3 TSX Penny Stocks With Market Caps Under CA$60M

Reviewed by Simply Wall St

Canadian equities have recently hit new record highs, buoyed by dovish signals from the Bank of Canada and cautious optimism from the Federal Reserve. In this context, penny stocks—often smaller or newer companies—remain a compelling area for investors seeking value and growth potential. Despite being an older term, penny stocks can still offer unique opportunities when backed by strong financials, and we'll explore three such stocks on the TSX that stand out in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.40 | CA$257.26M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.25 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.47 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.05 | CA$154.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.03 | CA$30.34M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.01 | CA$190.2M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Irving Resources (CNSX:IRV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Irving Resources Inc. is a junior resource exploration company focused on acquiring and exploring mineral properties in Canada and Japan, with a market cap of CA$20.84 million.

Operations: Irving Resources Inc. does not report any revenue segments.

Market Cap: CA$20.84M

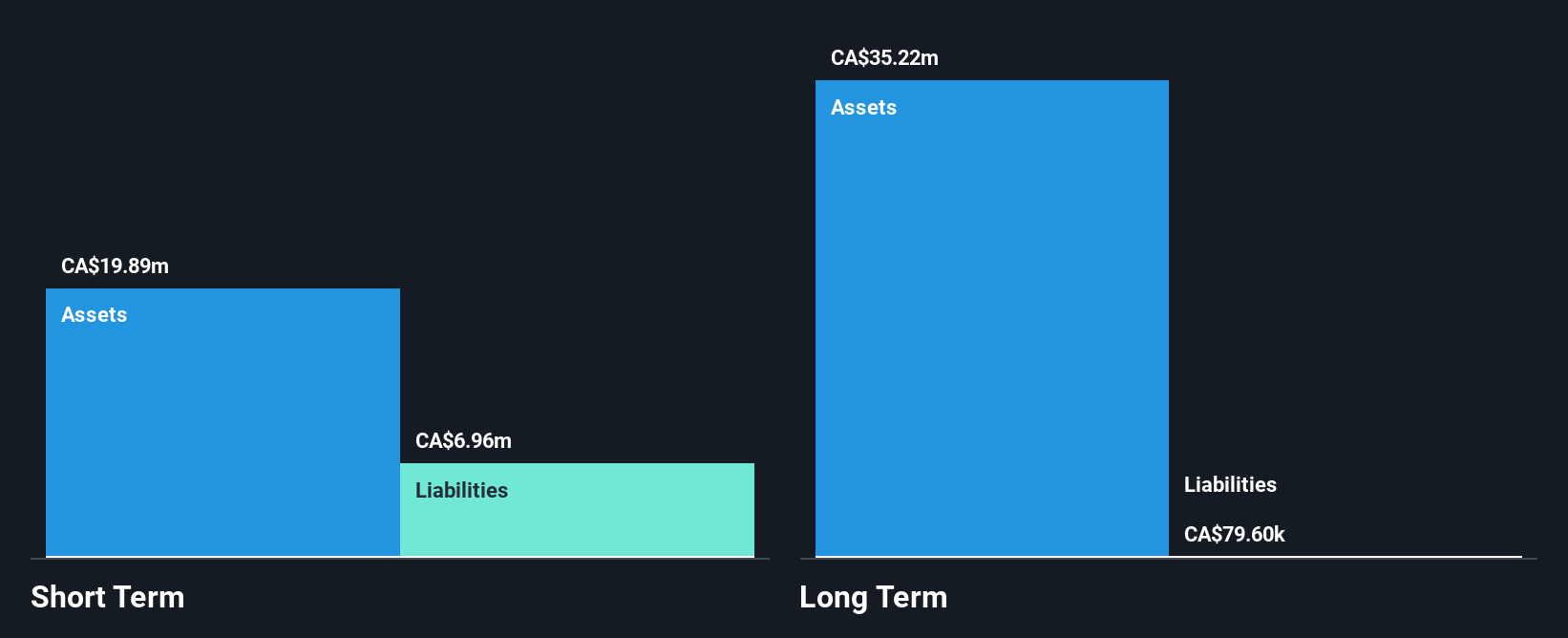

Irving Resources, a pre-revenue exploration firm, has made significant strides at its Omu Gold-Silver project in Japan. Recent drilling results show promising mineralized intercepts near the surface, potentially suitable for small-scale open-pit extraction. These findings include high-grade gold and silver zones and substantial silica content, which could serve as smelter flux. Despite being unprofitable with a net loss of CA$0.61 million over six months ending August 2025, Irving's financial stability is supported by sufficient cash runway and no debt obligations. The experienced management team continues to focus on advancing exploration efforts with partner JX Advanced Metals Corporation.

- Navigate through the intricacies of Irving Resources with our comprehensive balance sheet health report here.

- Evaluate Irving Resources' historical performance by accessing our past performance report.

CEMATRIX (TSX:CEMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CEMATRIX Corporation, with a market cap of CA$52.57 million, specializes in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets across North America through its subsidiaries.

Operations: The company generates revenue of CA$42.92 million from the supply and placement of cellular concrete.

Market Cap: CA$52.57M

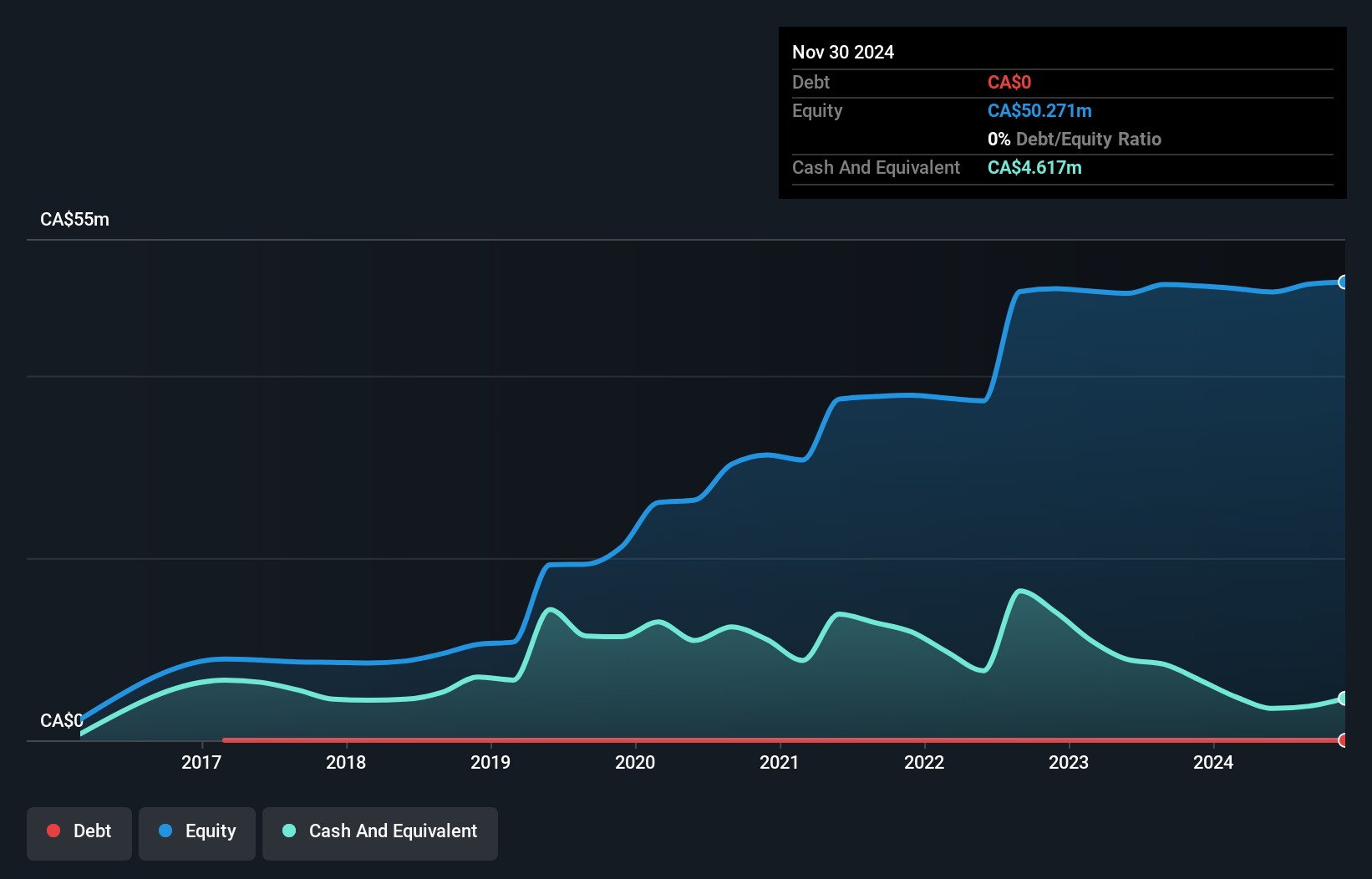

CEMATRIX Corporation, with a market cap of CA$52.57 million, is showing robust financial health and growth potential within the infrastructure sector. The company has demonstrated strong earnings growth, with net income reaching CA$1.91 million in Q3 2025 from CA$0.71 million a year prior, driven by increased sales of CA$15.31 million compared to CA$10.14 million previously. Recent contract awards totaling $6.9 million further bolster its project pipeline for 2026, enhancing revenue prospects across North America. Despite having an inexperienced management team, CEMATRIX benefits from a seasoned board and solid financial coverage metrics that support its operational stability and expansion plans.

- Jump into the full analysis health report here for a deeper understanding of CEMATRIX.

- Examine CEMATRIX's earnings growth report to understand how analysts expect it to perform.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pivotree Inc. is a company that designs, integrates, deploys, and manages digital platforms for commerce, data management, and supply chain solutions catering to retail and branded manufacturers globally, with a market cap of CA$46.07 million.

Operations: Pivotree generates revenue primarily from Professional Services, accounting for CA$41.50 million, and Managed & IP Solutions along with Legacy Managed Services, contributing CA$28.66 million.

Market Cap: CA$46.07M

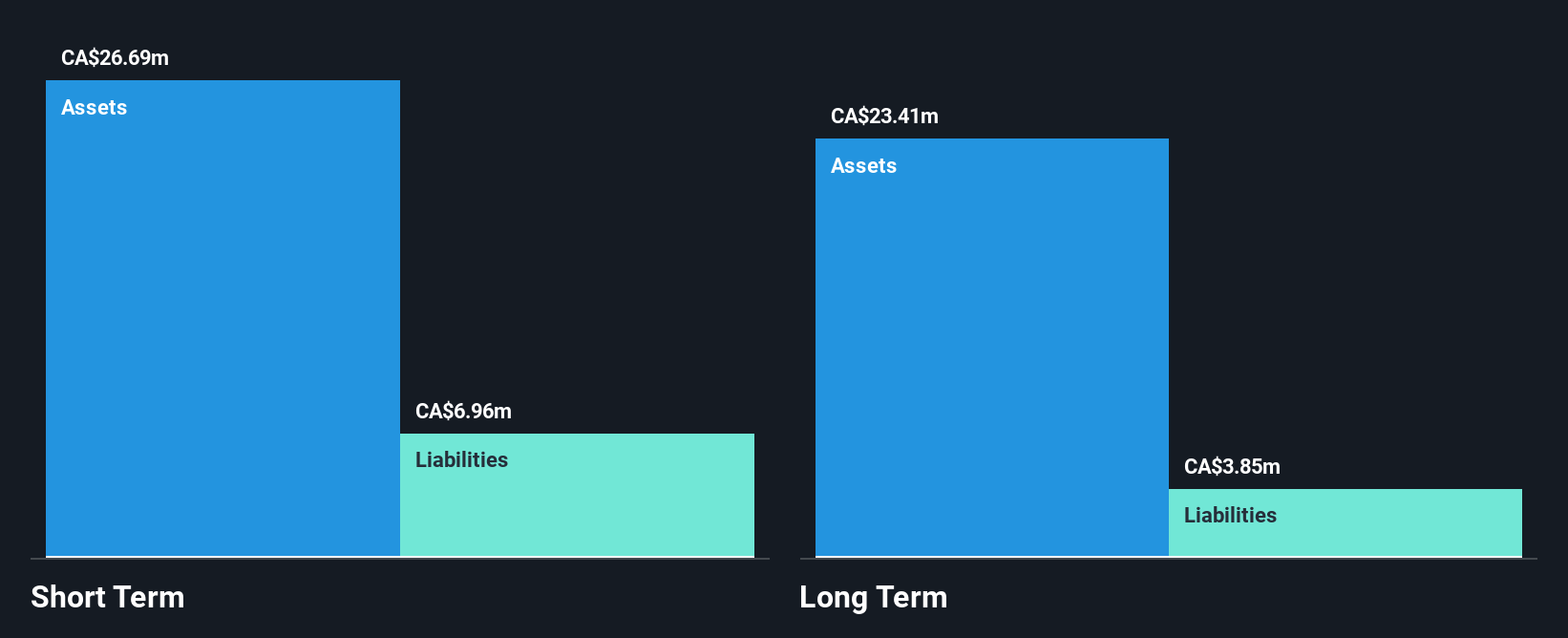

Pivotree Inc., with a market cap of CA$46.07 million, has recently transitioned to profitability, reporting a net income of CA$0.94 million in Q3 2025 compared to a loss the previous year. The company's revenue streams from Professional Services and Managed Solutions totaled CA$70.16 million for the nine months ending September 30, 2025, though sales declined from the prior year. Pivotree benefits from being debt-free with strong short-term asset coverage over liabilities and an experienced management team averaging 2.8 years tenure. However, its Return on Equity remains low at 6.9%, indicating room for improvement in generating shareholder value.

- Dive into the specifics of Pivotree here with our thorough balance sheet health report.

- Gain insights into Pivotree's future direction by reviewing our growth report.

Summing It All Up

- Get an in-depth perspective on all 391 TSX Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CEMX

CEMATRIX

Through its subsidiaries, engages in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets in North America.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)