- Canada

- /

- Paper and Forestry Products

- /

- TSX:WEF

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

With Canada's election now behind it, one source of uncertainty has been removed, allowing policymakers to focus on trade and the economy. As the Canadian market navigates these changes, investors may find opportunities in smaller or newer companies. Penny stocks, despite their somewhat outdated name, continue to offer potential value for those seeking growth opportunities with solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.74 | CA$74.85M | ✅ 4 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.73 | CA$73.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.83 | CA$1.05B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.10 | CA$576.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$280.6M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$503.51M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.53 | CA$128.51M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.15 | CA$84.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.50 | CA$116.3M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Microbix Biosystems (TSX:MBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Microbix Biosystems Inc. is a life science company that develops and commercializes proprietary biological and technological solutions for human health and wellbeing across North America, Europe, and internationally, with a market cap of CA$54.92 million.

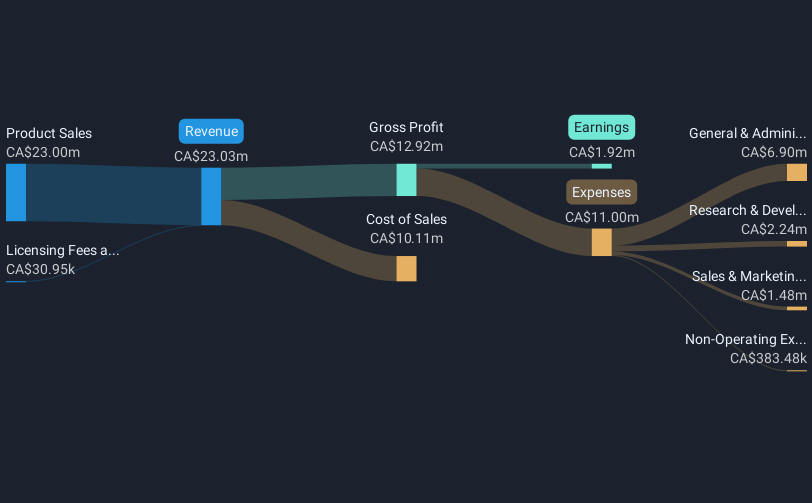

Operations: The company's revenue is primarily derived from product sales amounting to CA$23.00 million, supplemented by licensing fees and royalties totaling CA$0.03 million.

Market Cap: CA$54.92M

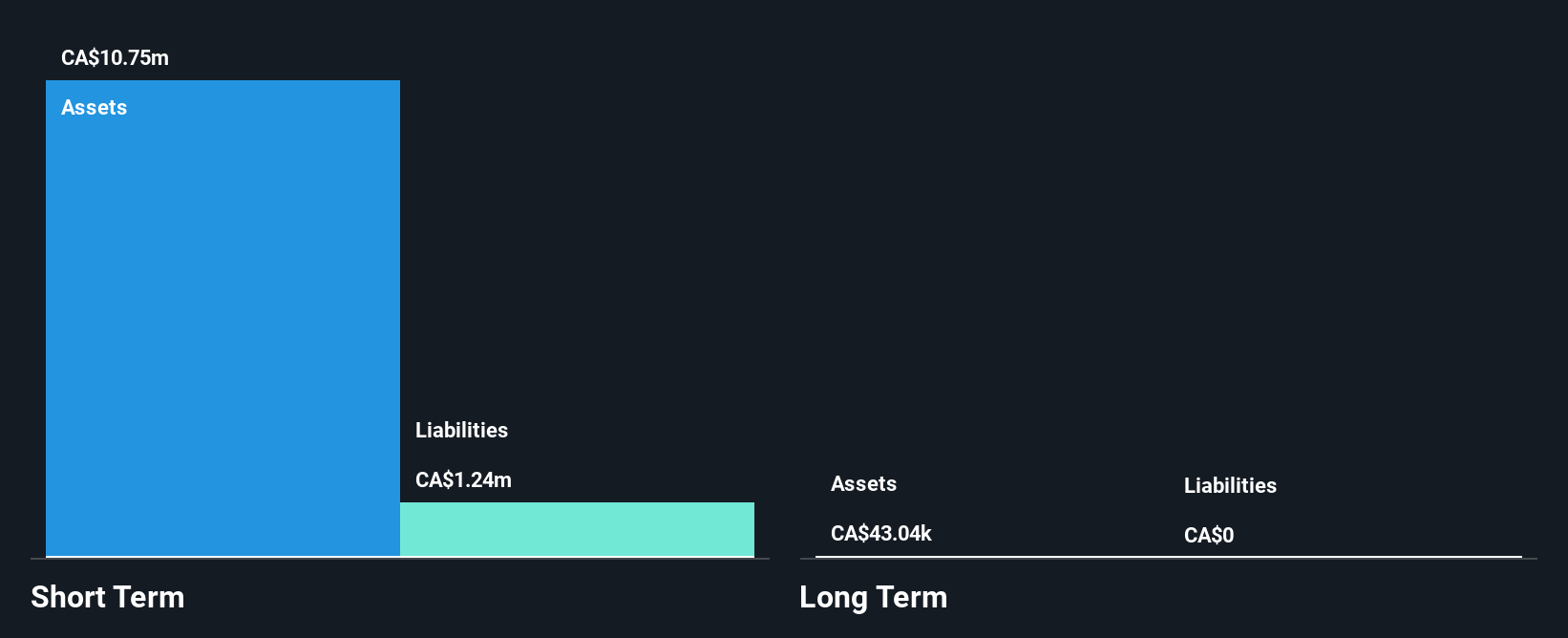

Microbix Biosystems Inc. has demonstrated financial resilience with short-term assets of CA$25.7 million surpassing both its short and long-term liabilities, while maintaining a cash position that exceeds its total debt. Despite a decline in net profit margins from 16.6% to 8.3%, the company remains profitable with high-quality earnings and well-covered interest payments by EBIT at 9.9 times coverage. Recent developments include an MOU with the Australian Centre for the Prevention of Cervical Cancer to supply quality assessment products, potentially enhancing market presence in Asia-Pacific regions through humanitarian initiatives like EPICC aimed at combating cervical cancer.

- Get an in-depth perspective on Microbix Biosystems' performance by reading our balance sheet health report here.

- Examine Microbix Biosystems' earnings growth report to understand how analysts expect it to perform.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing to the banking and merchant industries in North America, with a market cap of CA$40.03 million.

Operations: The company's revenue comes entirely from software-related sales and services, amounting to CA$7.20 million.

Market Cap: CA$40.03M

NamSys Inc. showcases a robust financial profile with no debt and high-quality earnings, supported by a substantial net profit margin of 32.9%, an improvement from last year. Recent earnings growth of 42.4% outpaces the industry average, indicating strong operational performance. The company is trading at a significant discount to its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in the software sector. NamSys's share repurchase program reflects confidence in its financial health and commitment to enhancing shareholder value, while its experienced board provides strategic stability amidst ongoing growth initiatives.

- Dive into the specifics of NamSys here with our thorough balance sheet health report.

- Explore historical data to track NamSys' performance over time in our past results report.

Western Forest Products (TSX:WEF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Forest Products Inc. is an integrated softwoods forest products company operating in Canada, the United States, Japan, China, Europe, and internationally with a market cap of CA$123.53 million.

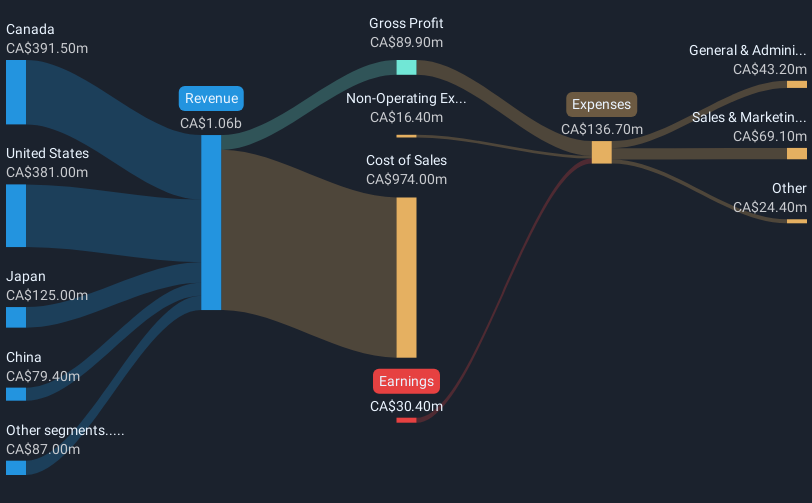

Operations: The company's revenue is primarily derived from its Paper & Lumber segment, totaling CA$1.06 billion.

Market Cap: CA$123.53M

Western Forest Products Inc. operates with a market cap of CA$123.53 million and reported revenues of CA$1.06 billion, though it remains unprofitable with losses increasing at 18.5% annually over five years. The company's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management despite ongoing profitability challenges. Its debt-to-equity ratio has improved to 15.1%, and a recent extension of its $250 million credit facility to 2028 underscores financial flexibility amid these challenges. While trading at good value compared to peers, the company faces hurdles in achieving profitability and covering interest payments through EBIT remains uncertain.

- Unlock comprehensive insights into our analysis of Western Forest Products stock in this financial health report.

- Gain insights into Western Forest Products' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Gain an insight into the universe of 928 TSX Penny Stocks by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Western Forest Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WEF

Western Forest Products

Operates as an integrated softwoods forest products company in Canada, the United States, Japan, China, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)