What You Need To Know About The VIQ Solutions Inc. (TSE:VQS) Analyst Downgrade Today

One thing we could say about the analysts on VIQ Solutions Inc. (TSE:VQS) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

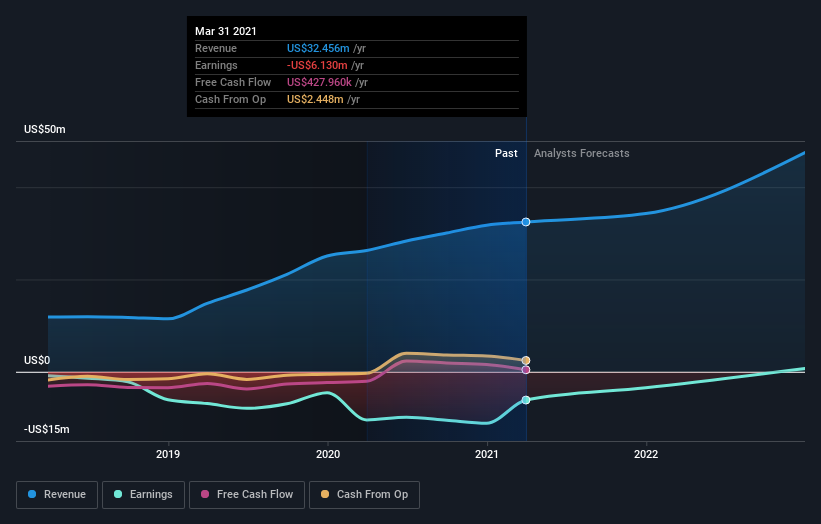

After this downgrade, VIQ Solutions' four analysts are now forecasting revenues of US$34m in 2021. This would be a satisfactory 5.6% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 54% to US$0.14. Yet before this consensus update, the analysts had been forecasting revenues of US$40m and losses of US$0.044 per share in 2021. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for VIQ Solutions

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that VIQ Solutions' revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 7.6% growth on an annualised basis. This is compared to a historical growth rate of 31% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 12% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than VIQ Solutions.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that VIQ Solutions' revenues are expected to grow slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on VIQ Solutions after today.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple VIQ Solutions analysts - going out to 2022, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:VQS

VIQ Solutions

Operates as a technology and service platform provider for digital evidence capture, retrieval, and content management in Australia, the United States, the United Kingdom, Canada, and internationally.

Good value with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)