Earnings Release: Here's Why Analysts Cut Their VIQ Solutions Inc. (TSE:VQS) Price Target To CA$7.90

Shareholders of VIQ Solutions Inc. (TSE:VQS) will be pleased this week, given that the stock price is up 12% to CA$6.57 following its latest quarterly results. Revenues of US$8.3m beat expectations by a respectable 2.1%, although statutory losses per share increased. VIQ Solutions lost US$0.43, which was 752% more than what the analysts had included in their models. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on VIQ Solutions after the latest results.

See our latest analysis for VIQ Solutions

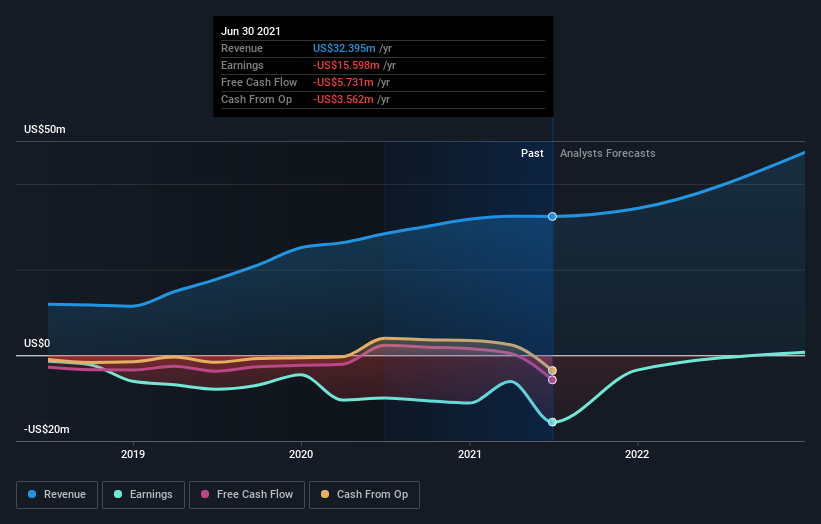

Taking into account the latest results, the current consensus from VIQ Solutions' four analysts is for revenues of US$34.2m in 2021, which would reflect a modest 5.7% increase on its sales over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 80% to US$0.14. Before this earnings announcement, the analysts had been modelling revenues of US$34.0m and losses of US$0.044 per share in 2021. While this year's revenue estimates held steady, there was also a very substantial increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

With the increase in forecast losses for next year, it's perhaps no surprise to see that the average price target dipped 11% to CA$7.90, with the analysts signalling that growing losses would be a definite concern. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic VIQ Solutions analyst has a price target of CA$9.75 per share, while the most pessimistic values it at CA$8.00. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that VIQ Solutions' revenue growth is expected to slow, with the forecast 12% annualised growth rate until the end of 2021 being well below the historical 31% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 16% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than VIQ Solutions.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at VIQ Solutions. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on VIQ Solutions. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for VIQ Solutions going out to 2022, and you can see them free on our platform here..

Plus, you should also learn about the 3 warning signs we've spotted with VIQ Solutions .

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:VQS

VIQ Solutions

Operates as a technology and service platform provider for digital evidence capture, retrieval, and content management in Australia, the United States, the United Kingdom, Canada, and internationally.

Good value with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026