Exploring Constellation Software And Two Other High Growth Canadian Tech Stocks

Reviewed by Simply Wall St

The Canadian market has experienced increased volatility recently, with concerns about a slowing economy and persistent inflation causing fluctuations. Despite these challenges, stocks have shown resilience and remain near record highs. In this environment, identifying high-growth tech stocks like Constellation Software can provide investors with opportunities to capitalize on innovation and market leadership in the tech sector.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.70% | 33.96% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.54% | 162.50% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.33% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

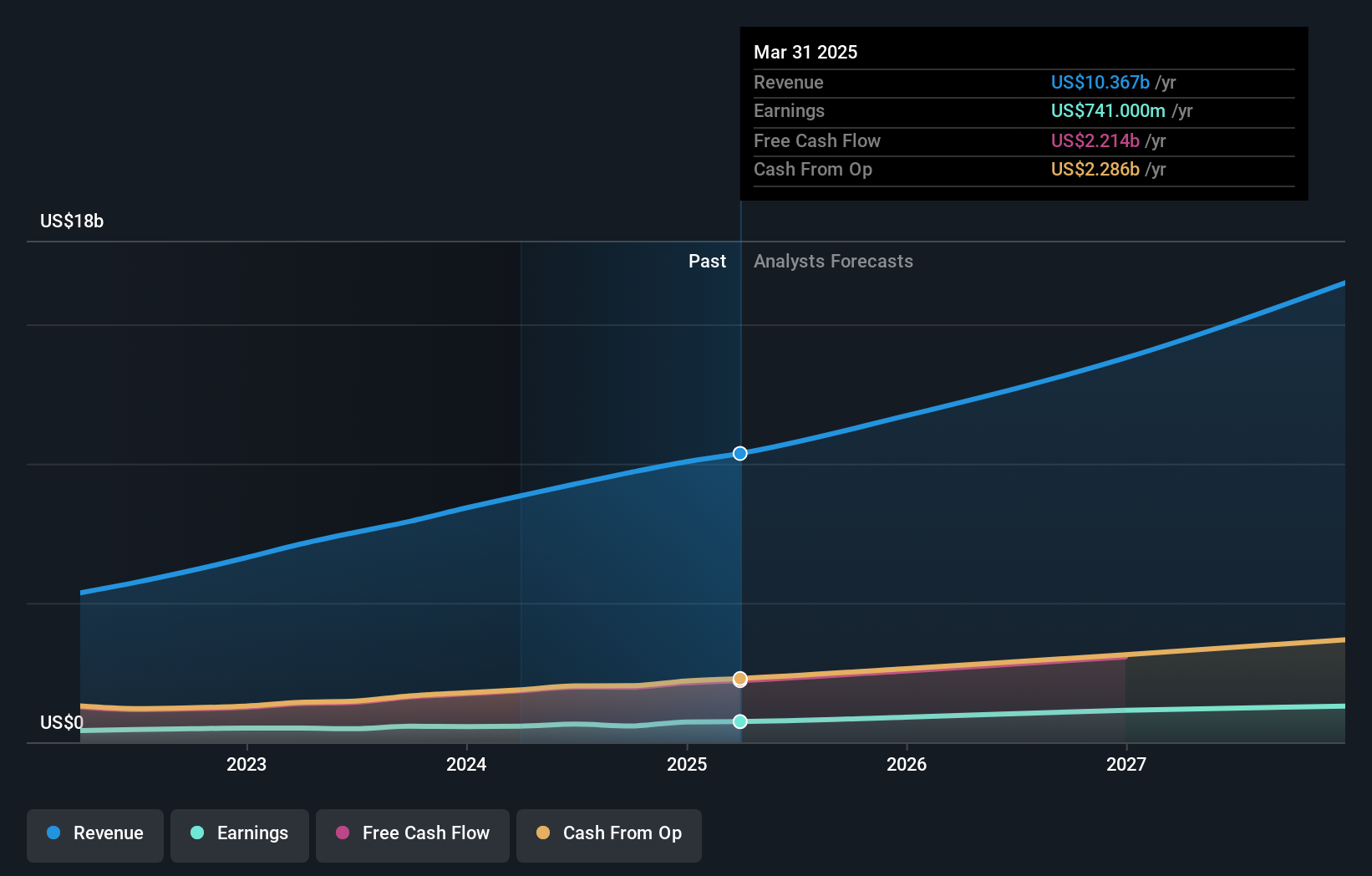

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally; it has a market cap of CA$90.84 billion.

Operations: Constellation Software generates revenue primarily from its software and programming segment, amounting to $9.27 billion. The company acquires, builds, and manages vertical market software businesses across multiple regions globally.

Constellation Software's revenue grew 16.2% annually, outpacing the Canadian market's 6.9%. Earnings surged by 33.5% last year, and are projected to grow at 23.6% per year over the next three years, significantly above the market average of 15.3%. The company reported Q2 revenue of $2.47 billion and net income of $177 million, reflecting strong operational performance. R&D expenses have been a key focus, underlining their commitment to innovation in diverse software segments like ERP & CRM through their new global entity Omegro.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. operates as a learning management software company that provides an AI-powered learning platform in North America and internationally, with a market cap of CA$1.74 billion.

Operations: Docebo generates revenue primarily from its educational software segment, which contributed $200.24 million. The company leverages AI technology to enhance its learning platform offerings across various regions.

Docebo's revenue is forecast to grow at 14.7% annually, outpacing the Canadian market's 6.9%. Notably, earnings are expected to surge by 34% per year, significantly above the market average of 15.3%. The company reported Q2 revenue of $53.05 million and net income of $4.7 million compared to a net loss last year, reflecting strong operational performance. R&D expenses highlight their commitment to innovation in learning platforms, with an emphasis on SaaS models ensuring recurring revenue from subscriptions.

- Get an in-depth perspective on Docebo's performance by reading our health report here.

Evaluate Docebo's historical performance by accessing our past performance report.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

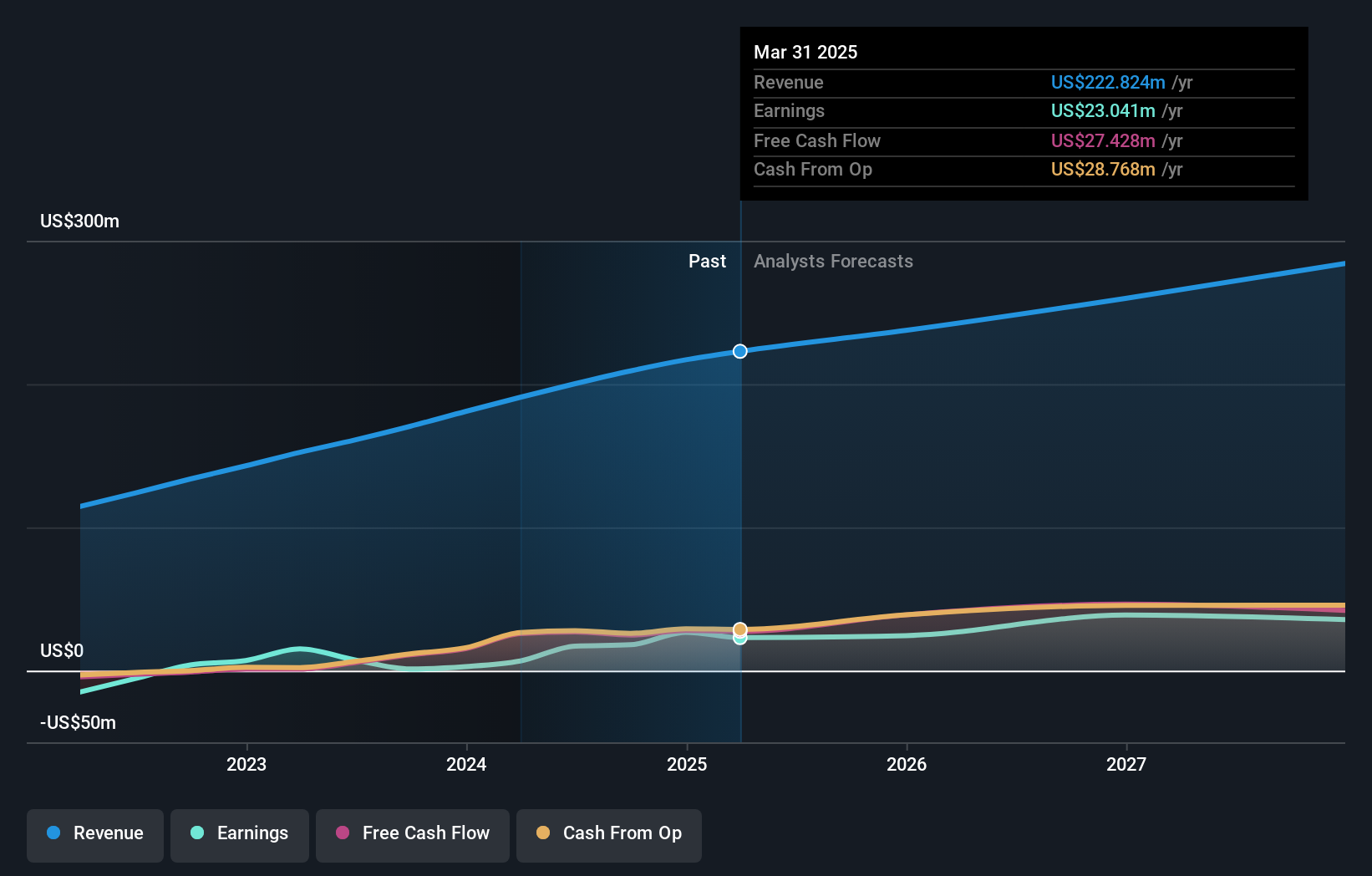

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.39 billion.

Operations: Kinaxis Inc. generates revenue primarily from its software and programming segment, amounting to CA$457.72 million. The company focuses on providing cloud-based subscription software for supply chain operations across multiple regions, including the United States, Europe, Asia, and Canada.

Kinaxis, with its AI-powered supply chain solutions, is forecasted to achieve annual earnings growth of 48.9%, significantly outpacing the Canadian market's 15.3%. The company reported Q2 revenue of $118.28 million and net income of $3.43 million, a notable turnaround from a net loss last year. With R&D expenses comprising approximately 14% of revenue, Kinaxis continues to innovate in supply chain orchestration through its Maestro platform, enhancing agility and predictive capabilities for clients like Brother and Syensqo.

- Delve into the full analysis health report here for a deeper understanding of Kinaxis.

Explore historical data to track Kinaxis' performance over time in our Past section.

Key Takeaways

- Dive into all 24 of the TSX High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KXS

Kinaxis

Provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.