Avino Silver & Gold Mines Leads Our Trio Of TSX Penny Stock Picks

Reviewed by Simply Wall St

As the Canadian market navigates political shifts and economic uncertainties, investors are reminded of the importance of fundamentals over headlines. Amidst these conditions, penny stocks—often overlooked but still significant—offer intriguing opportunities for those seeking growth potential in smaller or newer companies. These stocks can present a mix of affordability and growth when backed by strong financials, leading to potential hidden value in quality investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$122.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$989.91M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.54M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$226.4M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$138.93M | ★★★★★☆ |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd., along with its subsidiaries, focuses on the acquisition, exploration, and development of mineral properties in Canada and has a market capitalization of CA$191.04 million.

Operations: The company generates revenue of $54.33 million from its Metals & Mining segment, specifically focusing on Gold and Other Precious Metals.

Market Cap: CA$191.04M

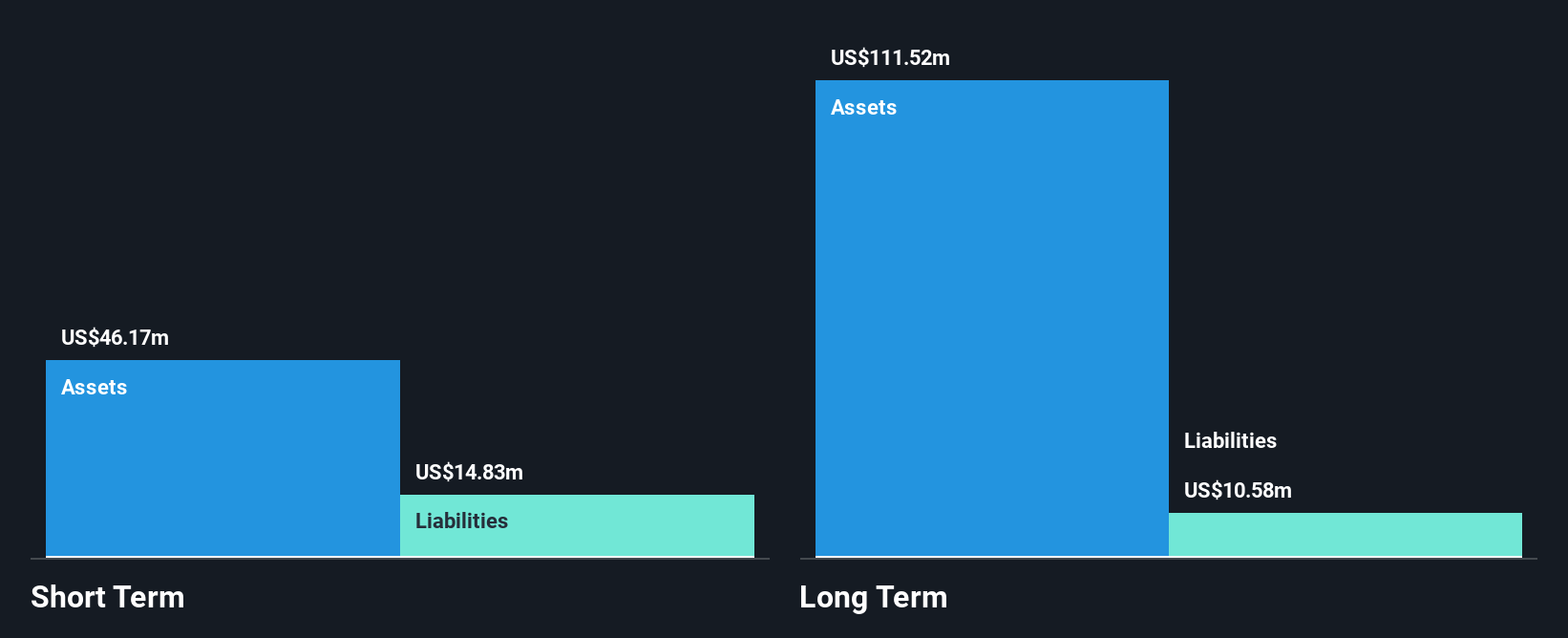

Avino Silver & Gold Mines has demonstrated significant financial improvement, reporting Q3 2024 sales of US$14.62 million and a net income of US$1.17 million, reversing from a loss the previous year. The company shows strong operational results with increased silver and copper production compared to last year. Its seasoned management team and board contribute to its strategic direction, while its financial health is robust with short-term assets exceeding liabilities and cash surpassing debt levels. However, shareholder dilution occurred recently, and the return on equity remains low at 3.1%, indicating room for growth in profitability metrics.

- Navigate through the intricacies of Avino Silver & Gold Mines with our comprehensive balance sheet health report here.

- Assess Avino Silver & Gold Mines' future earnings estimates with our detailed growth reports.

NorthWest Copper (TSXV:NWST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NorthWest Copper Corp. is involved in the acquisition and exploration of mineral properties in Canada, with a market cap of CA$60.13 million.

Operations: NorthWest Copper Corp. has not reported any revenue segments.

Market Cap: CA$60.13M

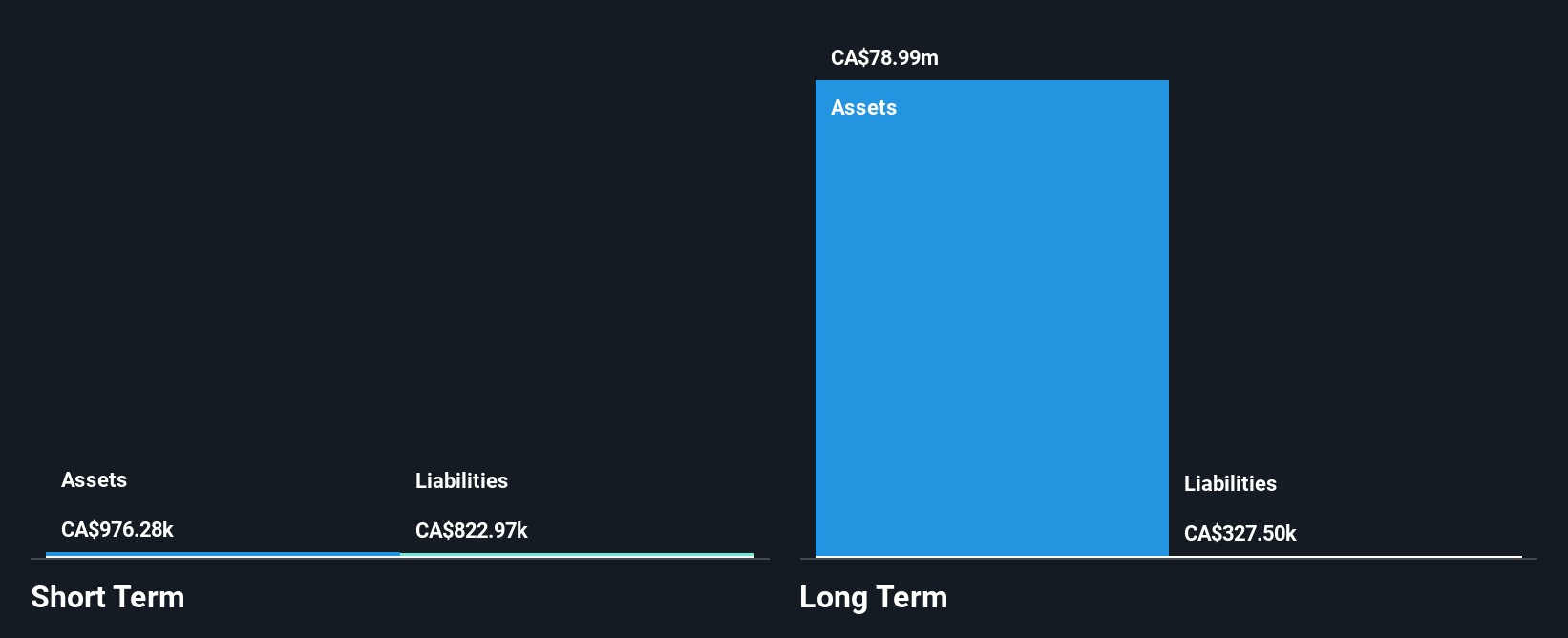

NorthWest Copper Corp., with a market cap of CA$60.13 million, remains pre-revenue and unprofitable, reporting a reduced net loss of CA$1.21 million for Q3 2024 compared to the previous year. The company is debt-free but faces shareholder dilution with an 8% increase in shares outstanding over the past year. Despite having less than a year of cash runway, recent leadership changes bring optimism; Paul Olmsted's appointment as CEO and board member adds extensive mining industry experience, potentially strengthening strategic initiatives to advance its copper and gold assets in British Columbia amidst high share price volatility.

- Take a closer look at NorthWest Copper's potential here in our financial health report.

- Assess NorthWest Copper's previous results with our detailed historical performance reports.

Tornado Infrastructure Equipment (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tornado Infrastructure Equipment Ltd., with a market cap of CA$138.93 million, designs, fabricates, manufactures, and sells hydrovac trucks through its subsidiaries in North America and China.

Operations: The company generates revenue of CA$34.37 million from Canada and CA$97.71 million from the United States through its operations in North America and China.

Market Cap: CA$138.93M

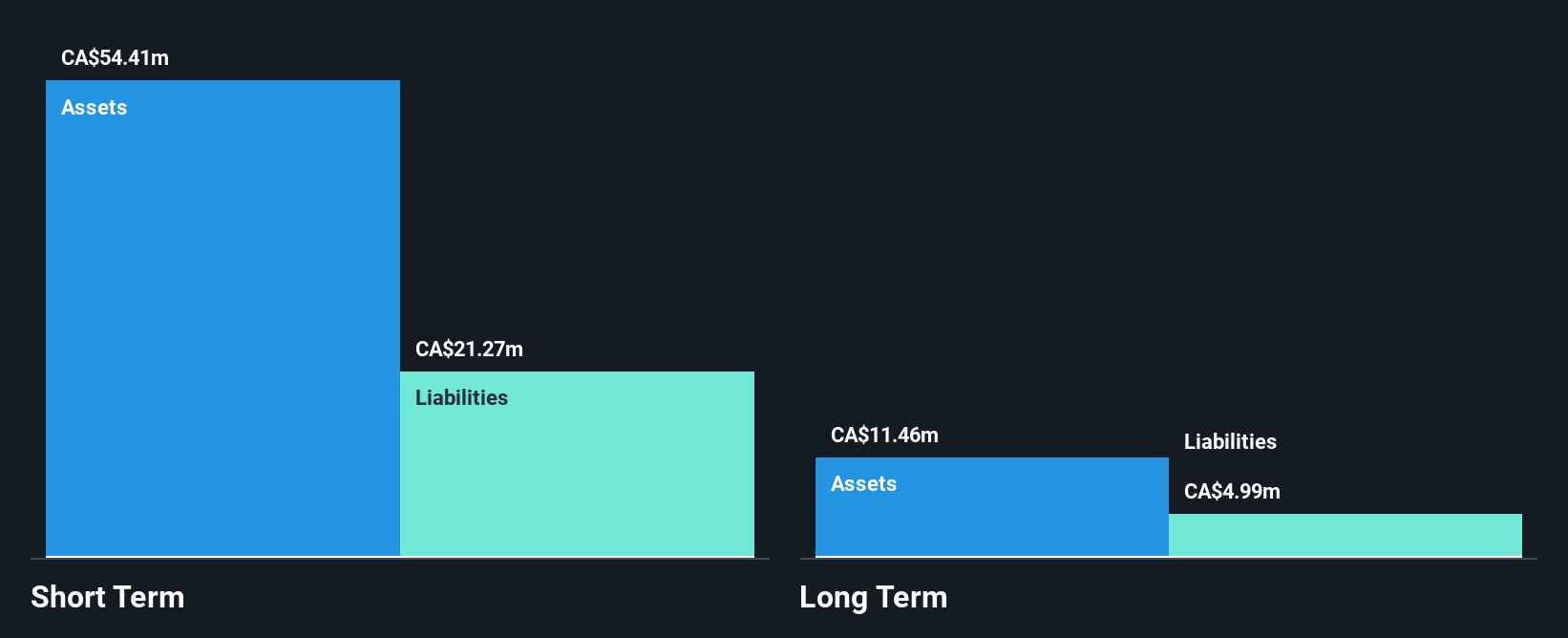

Tornado Infrastructure Equipment Ltd., with a market cap of CA$138.93 million, has shown strong financial performance and strategic growth initiatives. The company's earnings grew significantly by 242.1% over the past year, supported by high-quality earnings and improved profit margins from 3.6% to 8.7%. With a seasoned management team and board, Tornado maintains a satisfactory net debt to equity ratio of 4.4%, with short-term assets exceeding both short- and long-term liabilities. Recent U.S.-focused expansions include new subsidiaries and the construction of its first hydrovac truck in Texas, enhancing its ability to meet rising demand in North America.

- Click here and access our complete financial health analysis report to understand the dynamics of Tornado Infrastructure Equipment.

- Gain insights into Tornado Infrastructure Equipment's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Unlock our comprehensive list of 928 TSX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tornado Infrastructure Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TGH

Tornado Infrastructure Equipment

Through its subsidiaries, designs, fabricates, manufactures, and sells hydrovac trucks in North America and China.

Outstanding track record with excellent balance sheet.