Insiders at Taal Distributed Information Technologies Inc. (CSE:TAAL) made a tidy sum after selling stock currently priced at CA$2.35 at a price of CA$4.24

Even though Taal Distributed Information Technologies Inc. (CSE:TAAL) stock gained 24% last week, insiders who sold CA$129k worth of stock over the past year are probably better off. Selling at an average price of CA$4.24, which is higher than the current price might have been the right call as holding on to stock would have meant their investment would be worth less now than it was at the time of sale.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for Taal Distributed Information Technologies

Taal Distributed Information Technologies Insider Transactions Over The Last Year

While there weren't any large insider transactions in the last twelve months, it's still worth looking at the trading.

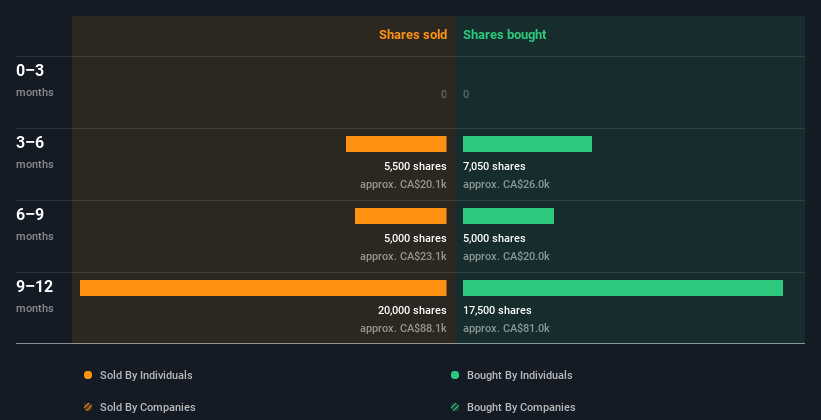

Over the last year, we can see that insiders have bought 29.55k shares worth CA$127k. On the other hand they divested 30.50k shares, for CA$129k. In total, Taal Distributed Information Technologies insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that Taal Distributed Information Technologies insiders own 47% of the company, worth about CA$40m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Taal Distributed Information Technologies Tell Us?

The fact that there have been no Taal Distributed Information Technologies insider transactions recently certainly doesn't bother us. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Taal Distributed Information Technologies insider transactions don't fill us with confidence. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Taal Distributed Information Technologies. At Simply Wall St, we've found that Taal Distributed Information Technologies has 3 warning signs (1 makes us a bit uncomfortable!) that deserve your attention before going any further with your analysis.

Of course Taal Distributed Information Technologies may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taal Distributed Information Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:TAAL

Taal Distributed Information Technologies

TAAL Distributed Information Technologies Inc.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)