We Think BIGG Digital Assets (CSE:BIGG) Can Easily Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. By way of example, BIGG Digital Assets (CSE:BIGG) has seen its share price rise 104% over the last year, delighting many shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it's well worth asking whether BIGG Digital Assets' cash burn is too risky. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for BIGG Digital Assets

Does BIGG Digital Assets Have A Long Cash Runway?

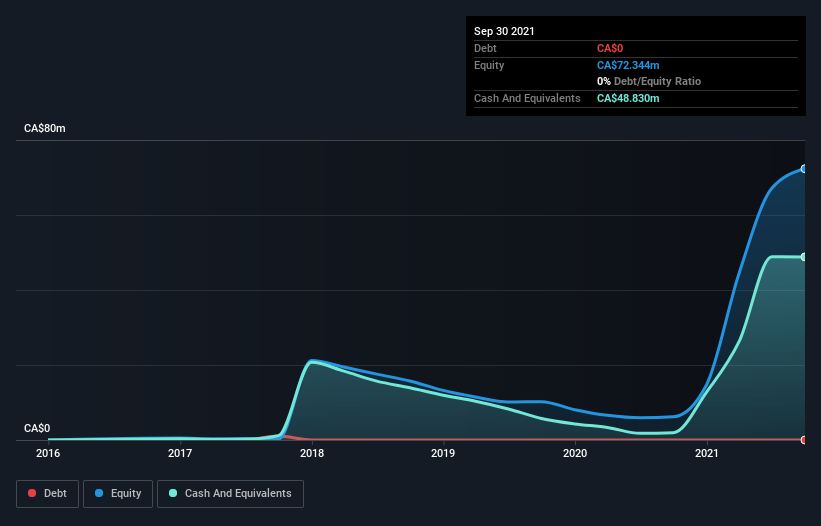

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2021, BIGG Digital Assets had CA$49m in cash, and was debt-free. Importantly, its cash burn was CA$10m over the trailing twelve months. That means it had a cash runway of about 4.8 years as of September 2021. Importantly, though, analysts think that BIGG Digital Assets will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. The image below shows how its cash balance has been changing over the last few years.

How Well Is BIGG Digital Assets Growing?

Notably, BIGG Digital Assets actually ramped up its cash burn very hard and fast in the last year, by 169%, signifying heavy investment in the business. But shareholders are no doubt taking some confidence from the rockstar revenue growth of 548% during that same year. Considering both these factors, we're not particularly excited by its growth profile. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can BIGG Digital Assets Raise Cash?

While BIGG Digital Assets seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

BIGG Digital Assets has a market capitalisation of CA$255m and burnt through CA$10m last year, which is 4.0% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is BIGG Digital Assets' Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way BIGG Digital Assets is burning through its cash. For example, we think its revenue growth suggests that the company is on a good path. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 2 warning signs for BIGG Digital Assets that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BIGG Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BIGG

BIGG Digital Assets

Owns, operates, and invests in businesses in the digital assets space industry in Canada, the United States of America, Europe, and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)