The Canadian market has shown resilience, bolstered by strong consumer spending and positive real wage gains that have supported economic stability. In the context of these robust economic conditions, investors may find opportunities in penny stocks, a term that often refers to smaller or newer companies with potential for growth. While the concept of penny stocks might seem outdated, they continue to offer a mix of affordability and growth potential when backed by solid financials; we explore three such stocks on the TSX that stand out for their financial strength.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$180.6M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.34 | CA$387.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$119.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$228.37M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$31.7M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.52 | CA$994.26M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.18M | ★★★★★★ |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Boat Rocker Media (TSX:BRMI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Boat Rocker Media Inc. is an entertainment company that creates, produces, and distributes television and film content in Canada, the United States, and internationally with a market cap of CA$34.03 million.

Operations: The company's revenue is primarily derived from its Television segment, which accounts for CA$134.89 million, and the Kids and Family segment, contributing CA$50.67 million.

Market Cap: CA$34.03M

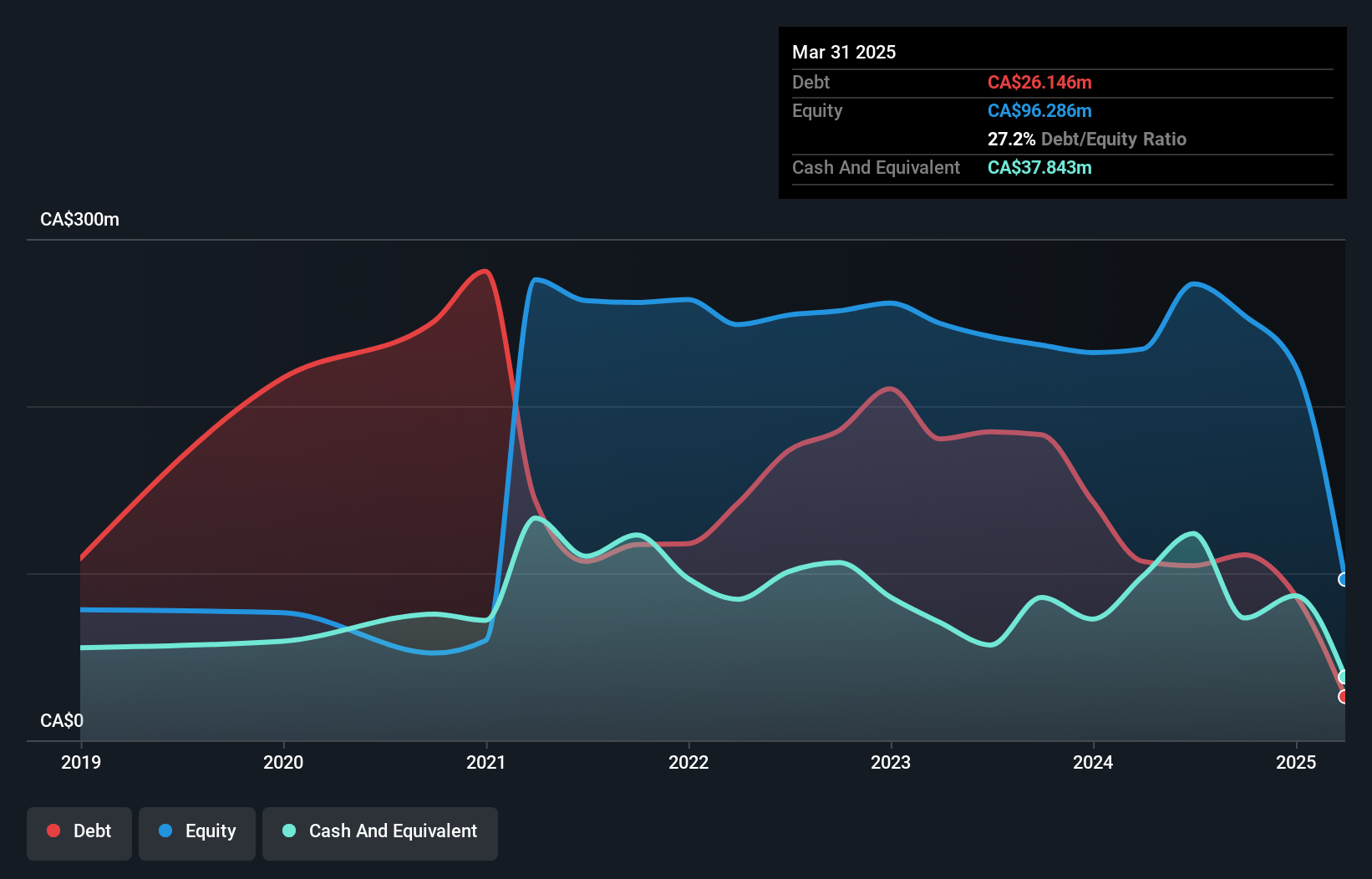

Boat Rocker Media Inc., with a market cap of CA$34.03 million, faces challenges typical of penny stocks, such as unprofitability and negative return on equity (-14.99%). Despite these hurdles, the company has reduced its debt-to-equity ratio significantly over five years and maintains a satisfactory net debt level (14.9%). While recent earnings showed a decline in sales to CA$36.83 million for Q3 2024 from the previous year's CA$196.36 million, Boat Rocker has improved its cash runway due to positive free cash flow growth by 40% annually, ensuring operational stability for over three years.

- Navigate through the intricacies of Boat Rocker Media with our comprehensive balance sheet health report here.

- Gain insights into Boat Rocker Media's outlook and expected performance with our report on the company's earnings estimates.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies to replace synthetic, petrochemical-based adhesives and related products globally, with a market cap of CA$232.10 million.

Operations: The company's revenue is primarily derived from its Biopolymer Nanosphere Technology Platform, generating $15.95 million.

Market Cap: CA$232.1M

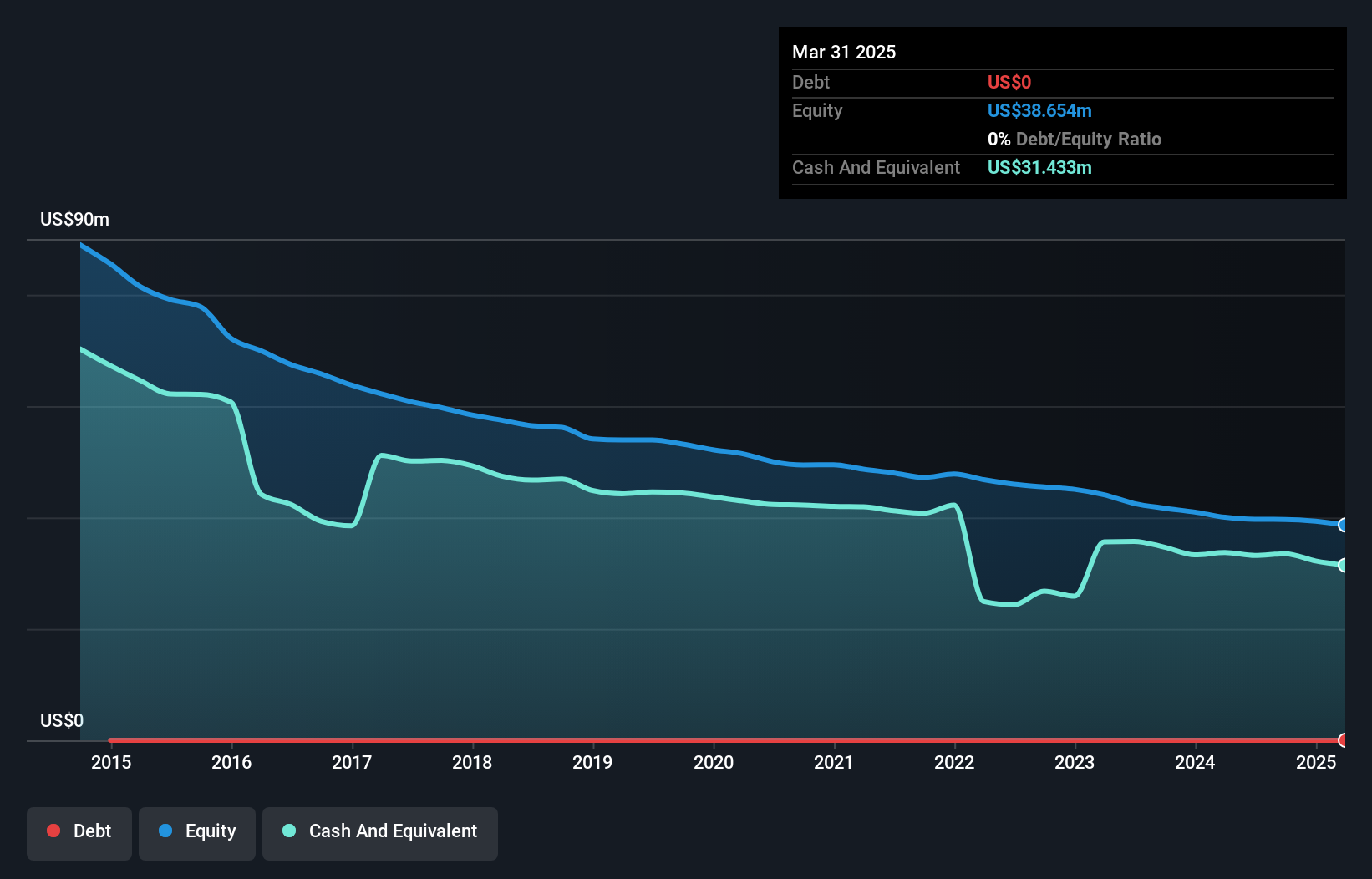

EcoSynthetix Inc., with a market cap of CA$232.10 million, demonstrates characteristics common to penny stocks, including unprofitability and negative return on equity (-4.4%). However, the company is debt-free and maintains a robust cash position with short-term assets of $38.1 million exceeding liabilities of $2.7 million, ensuring a cash runway for over three years based on current free cash flow levels. Recent earnings show growth in sales to US$5.23 million for Q3 2024 from US$3.8 million the previous year, alongside reduced net losses, indicating some progress towards financial stability amidst its challenges.

- Click here to discover the nuances of EcoSynthetix with our detailed analytical financial health report.

- Explore historical data to track EcoSynthetix's performance over time in our past results report.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally with a market cap of CA$82.11 million.

Operations: The company's revenue is primarily derived from its Direct-To-Consumer segment, which generated CA$217.78 million, complemented by CA$39.20 million from Partners and Other activities.

Market Cap: CA$82.11M

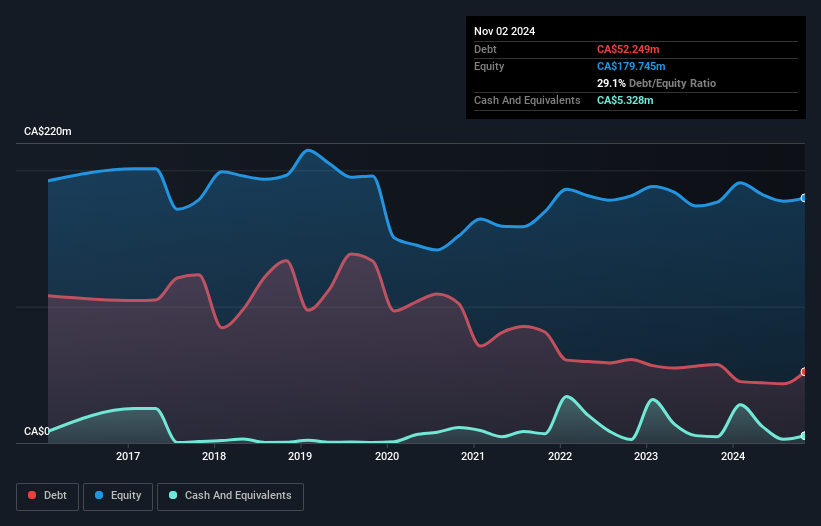

Roots Corporation, with a market cap of CA$82.11 million, exhibits typical penny stock traits such as low profit margins and modest growth prospects. Despite a reduction in its debt-to-equity ratio over five years to 24.5%, short-term assets (CA$65.3M) do not cover long-term liabilities (CA$114.8M). Recent earnings show improvement, with Q3 sales rising to CA$66.91 million from CA$63.53 million the previous year and net income increasing to CA$2.39 million from CA$0.519 million, though challenges remain with negative earnings growth (-43.8%) over the past year compared to industry averages.

- Unlock comprehensive insights into our analysis of Roots stock in this financial health report.

- Learn about Roots' future growth trajectory here.

Taking Advantage

- Embark on your investment journey to our 926 TSX Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based adhesives, and other related products worldwide.

Excellent balance sheet and overvalued.