- Canada

- /

- Healthtech

- /

- TSX:VHI

Top TSX Growth Stocks With High Insider Ownership For October 2024

Reviewed by Simply Wall St

As the Canadian TSX navigates a volatile start to the fourth quarter, driven by uncertainties in global politics and economic indicators, investors are keenly watching for signs of stability amid strong fundamentals. In such an environment, growth companies with high insider ownership can be particularly appealing, as they often signal confidence from those closest to the business and may offer resilience against broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Amerigo Resources (TSX:ARG) | 12% | 36.8% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Allied Gold (TSX:AAUC) | 17.7% | 72.9% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Let's explore several standout options from the results in the screener.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, with a market cap of CA$990.62 million, explores for and produces mineral deposits in Africa through its subsidiaries.

Operations: The company's revenue is derived from its operations at the Agbaou Mine ($142.03 million), Bonikro Mine ($193.93 million), and Sadiola Mine ($391.07 million).

Insider Ownership: 17.7%

Allied Gold is forecast to achieve revenue growth of 21.8% annually, outpacing the Canadian market. Expected profitability within three years aligns with high growth potential, though recent shareholder dilution via a CAD 192.2 million equity offering could be a concern. The Sadiola Gold Mine expansion promises increased production and operational efficiency, potentially enhancing future earnings. Trading significantly below fair value estimates suggests attractive relative valuation compared to peers and industry standards.

- Dive into the specifics of Allied Gold here with our thorough growth forecast report.

- Our valuation report here indicates Allied Gold may be undervalued.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of approximately CA$5.71 billion.

Operations: The company's revenue primarily comes from its apparel segment, which generated CA$2.37 billion.

Insider Ownership: 18.9%

Aritzia's earnings are projected to grow significantly at 60.4% annually, outpacing the Canadian market. Despite recent insider selling and a decline in profit margins from 7.5% to 3.3%, the stock trades at a substantial discount to estimated fair value, suggesting potential undervaluation. Revenue is expected to rise by 12.1% per year, supported by fiscal guidance projecting net revenue between C$2.52 billion and C$2.62 billion for FY2025, indicating steady growth prospects despite shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of Aritzia stock in this growth report.

- According our valuation report, there's an indication that Aritzia's share price might be on the expensive side.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$459.38 million.

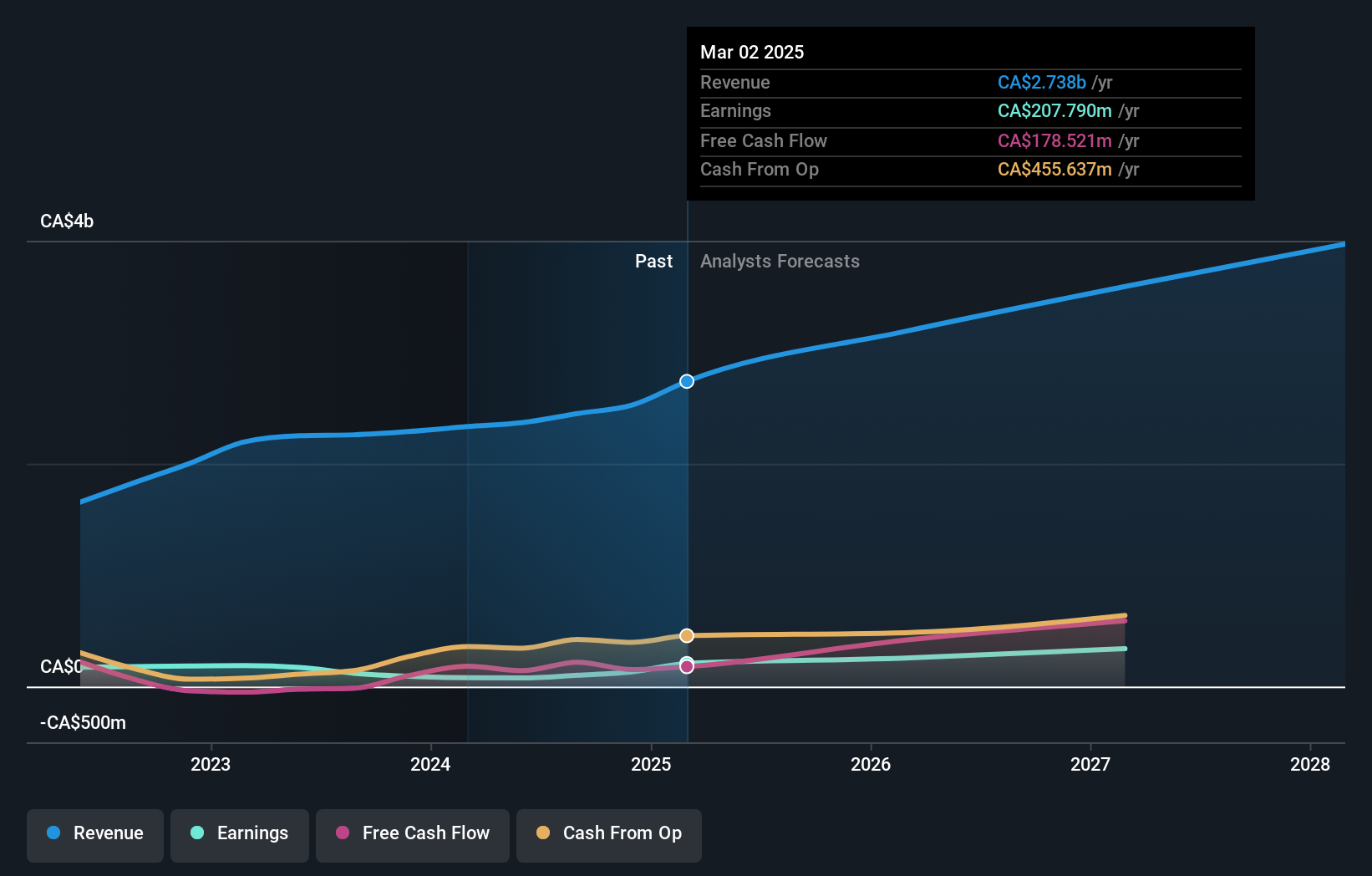

Operations: The company generates revenue from its Healthcare Software segment, amounting to CA$58.32 million.

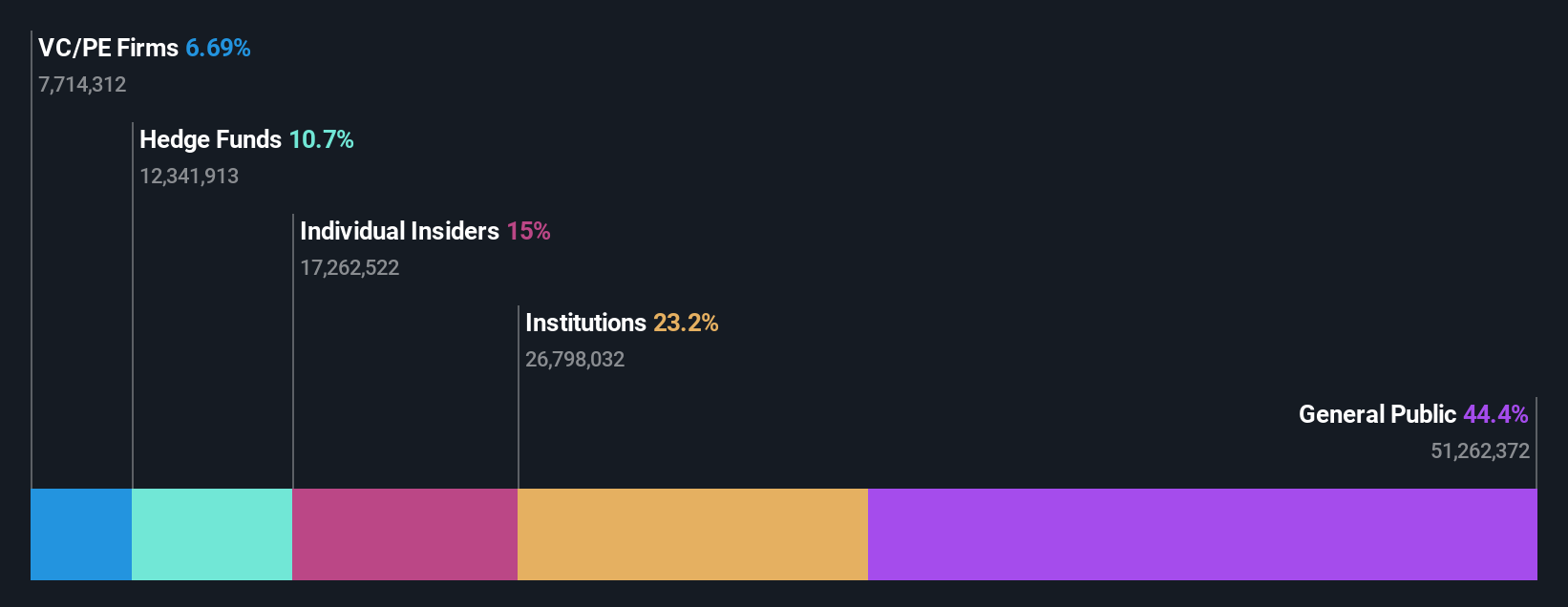

Insider Ownership: 15.1%

Vitalhub's earnings are forecast to grow significantly at 65.9% annually, surpassing the Canadian market average. Despite recent shareholder dilution and large one-off items affecting financial results, the company trades at a substantial discount to its estimated fair value. Revenue is expected to increase by 13.5% per year, outpacing the market's growth rate. Recent inclusion in the S&P Global BMI Index highlights its expanding market presence amidst mixed profitability trends in recent quarters.

- Click here and access our complete growth analysis report to understand the dynamics of Vitalhub.

- Our valuation report here indicates Vitalhub may be overvalued.

Taking Advantage

- Click through to start exploring the rest of the 32 Fast Growing TSX Companies With High Insider Ownership now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)