- Canada

- /

- Industrial REITs

- /

- TSX:NXR.UN

Exploring Hammond Power Solutions And 2 Other Undervalued Small Caps With Insider Action On TSX

Reviewed by Simply Wall St

In the wake of President Trump's inauguration and his flurry of executive orders, the Canadian market has experienced a notable uptick, with the TSX index climbing higher amid economic uncertainties surrounding potential U.S. tariff plans. As investors navigate this evolving landscape, identifying opportunities in small-cap stocks on the TSX can be particularly appealing due to their potential for growth and resilience in fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 11.9x | 3.2x | 45.88% | ★★★★★★ |

| Nexus Industrial REIT | 12.3x | 3.1x | 18.77% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -33954.21% | ★★★★☆☆ |

| Bragg Gaming Group | NA | 1.1x | -82.13% | ★★★★☆☆ |

| Savaria | 31.5x | 1.7x | 26.33% | ★★★☆☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -111.81% | ★★★☆☆☆ |

| Calfrac Well Services | 11.9x | 0.2x | 48.63% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.0x | 0.6x | -75.64% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.4x | 21.14% | ★★★☆☆☆ |

| StorageVault Canada | NA | 4.7x | -664.04% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

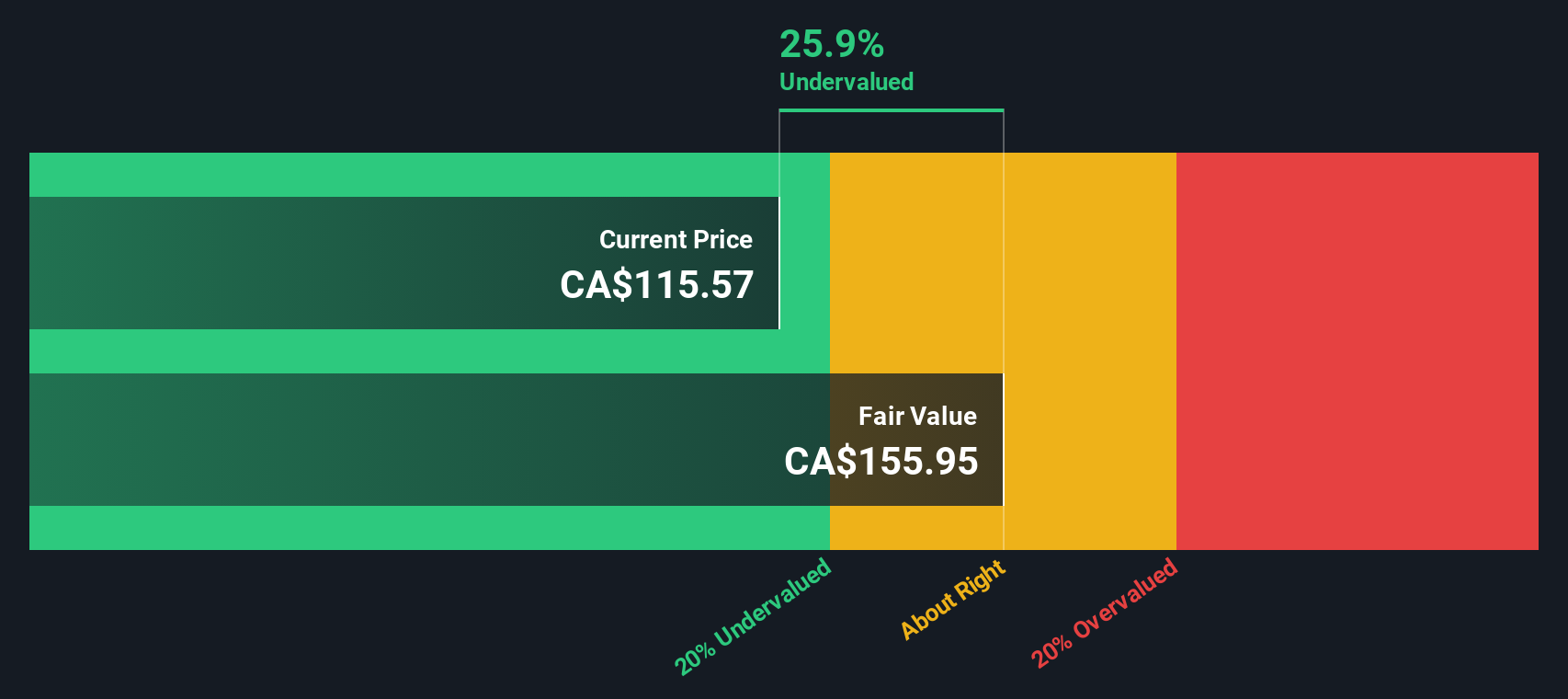

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, with a market capitalization of CA$0.54 billion.

Operations: The company's revenue largely stems from the manufacture and sale of transformers, with recent figures reaching CA$766.82 million. A significant aspect of its financial profile is the gross profit margin, which has recently been noted at 33.46%. Operating expenses have been substantial, with sales and marketing expenses being a notable component.

PE: 22.1x

Hammond Power Solutions, a small Canadian company, shows potential in the undervalued stock space with insider confidence indicated by Dahra Granovsky's purchase of 1,500 shares valued at C$175,538. Their recent earnings report highlights growth with third-quarter sales reaching C$191.97 million and net income at C$16.31 million. Despite relying entirely on external borrowing for liabilities, the projected annual earnings growth of 11.48% suggests promising future prospects in their industry niche.

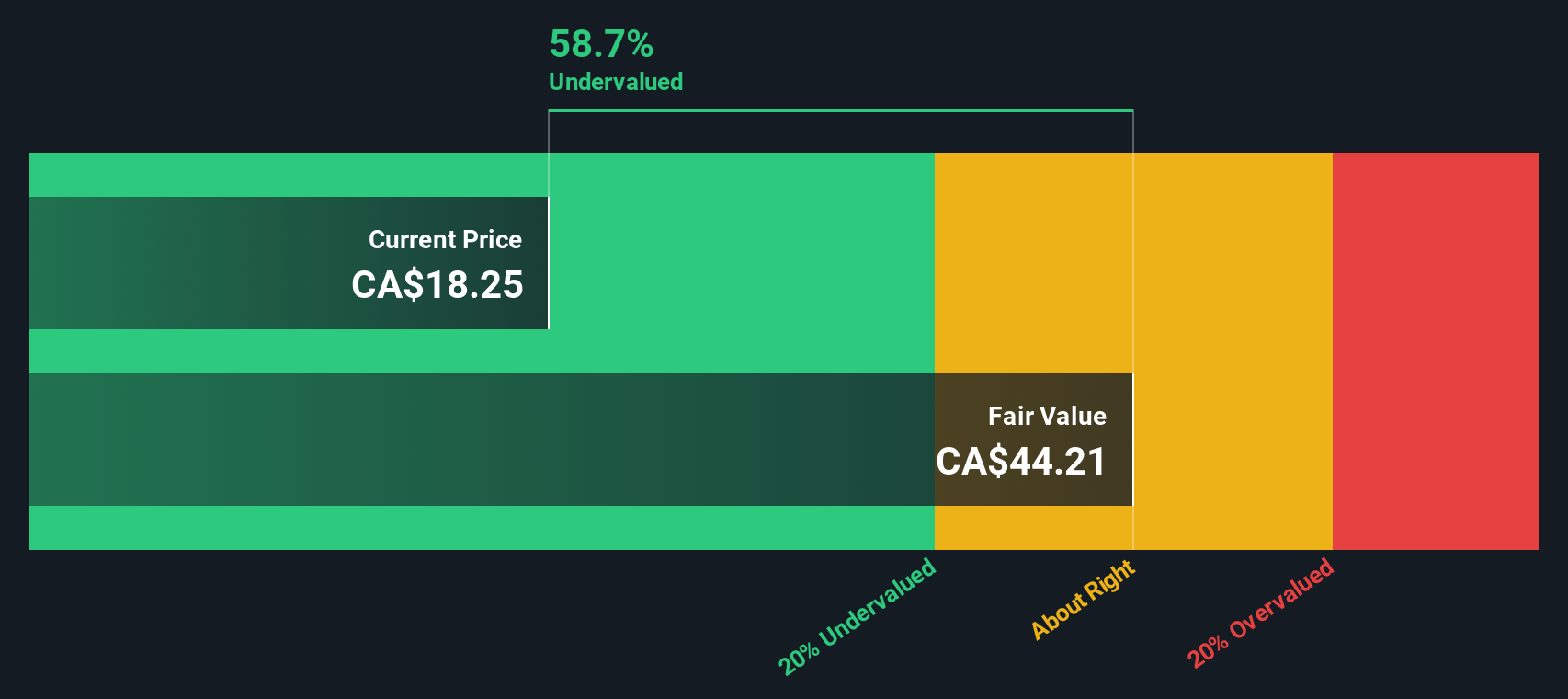

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector, focusing on manufactured housing communities, with a market cap of approximately $0.52 billion.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily through its residential real estate investments, with the latest reported revenue at $83.14 million. The company incurs costs of goods sold (COGS) amounting to $28.20 million, resulting in a gross profit margin of 66.08%. Operating expenses are recorded at $10.75 million, impacting overall profitability alongside non-operating expenses and depreciation & amortization costs.

PE: 3.7x

Flagship Communities Real Estate Investment Trust, a Canadian small-cap player, is currently navigating financial challenges with earnings forecasted to decline by 46% annually over the next three years. Despite this, revenue is expected to grow at 8.94% per year. Recent board appointments of experienced leaders like Candace McGraw and Jonathan Li signal strategic shifts aimed at future growth. The REIT maintains regular cash distributions of US$0.0517 monthly per unit, reflecting consistent shareholder returns amidst its evolving strategy.

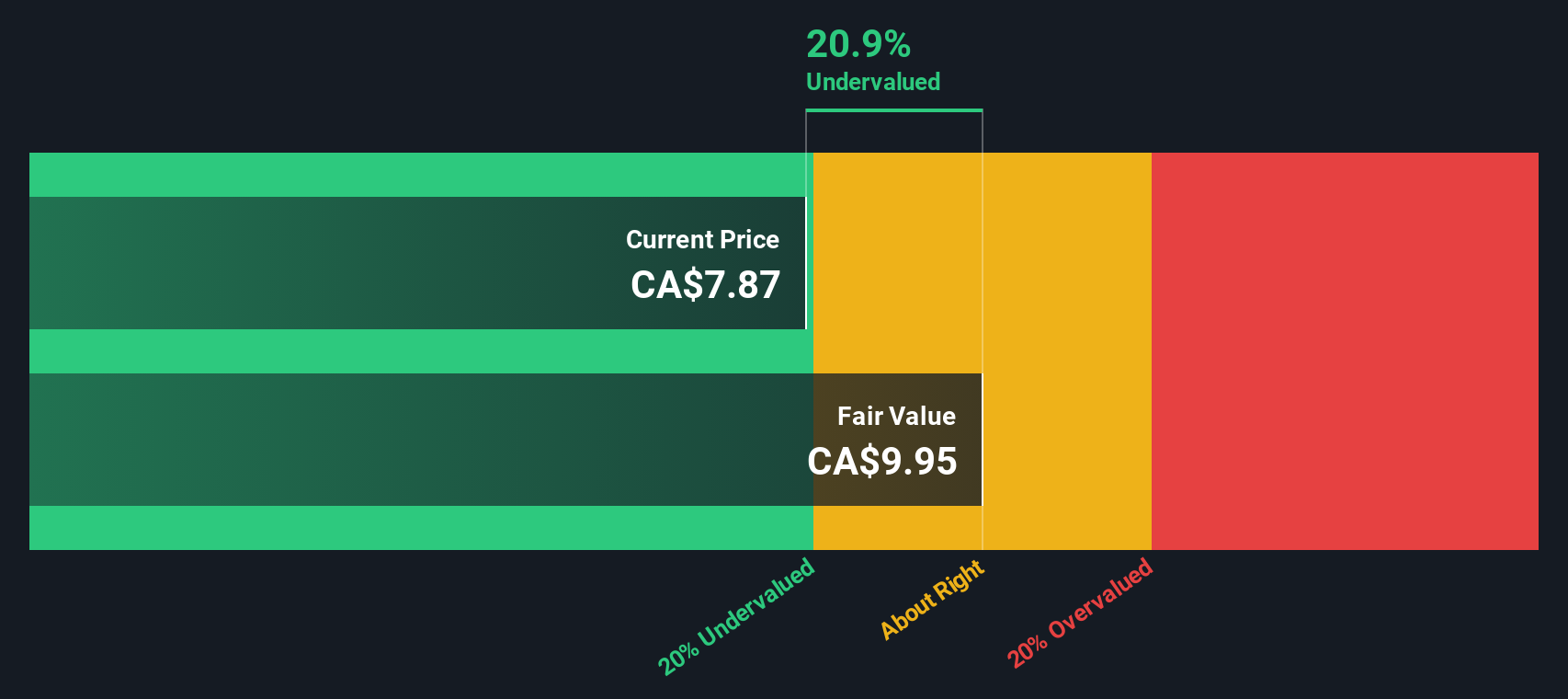

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust focused on owning and managing industrial properties, with a market capitalization of CA$1.15 billion.

Operations: The company generates revenue primarily from investment properties, with recent figures showing CA$172.86 million. The gross profit margin has shown a consistent trend around 71.02% recently, indicating the efficiency in managing cost of goods sold relative to revenue. Operating expenses have been relatively stable, with the latest recorded at CA$9.60 million, impacting net income outcomes significantly when combined with fluctuating non-operating expenses.

PE: 12.3x

Nexus Industrial REIT, a smaller player in Canada's market, recently announced dividends of C$0.05333 per unit for February and March 2025. Despite reporting a net loss of C$45.99 million in Q3 2024, sales rose to C$45.53 million from the previous year. The forecasted 12% annual earnings growth suggests potential, but reliance on external borrowing poses a risk. Insider confidence is evident with recent share purchases, hinting at optimism for future performance despite current challenges with profit margins and interest coverage.

- Unlock comprehensive insights into our analysis of Nexus Industrial REIT stock in this valuation report.

Evaluate Nexus Industrial REIT's historical performance by accessing our past performance report.

Where To Now?

- Navigate through the entire inventory of 30 Undervalued TSX Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexus Industrial REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NXR.UN

Nexus Industrial REIT

A growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition of industrial properties located in primary and secondary markets in Canada, and the ownership and management of its portfolio of properties.

Established dividend payer and good value.

Market Insights

Community Narratives