- Canada

- /

- Industrial REITs

- /

- TSX:DIR.UN

3 Stocks That May Be Undervalued In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are showing signs of optimism, with U.S. stocks rebounding due to cooling inflation and strong bank earnings, while European indices rise on hopes of continued interest rate cuts. In this environment, identifying undervalued stocks becomes crucial for investors aiming to capitalize on potential market opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩18390.00 | ₩36679.19 | 49.9% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.89 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.04 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.39 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩129300.00 | ₩257307.05 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.19 | NZ$6.18 | 48.4% |

Let's dive into some prime choices out of the screener.

Zhende Medical (SHSE:603301)

Overview: Zhende Medical Co., Ltd. focuses on the research, development, production, and sale of medical care and protective equipment in China with a market cap of CN¥5.69 billion.

Operations: Revenue Segments (in millions of CN¥):

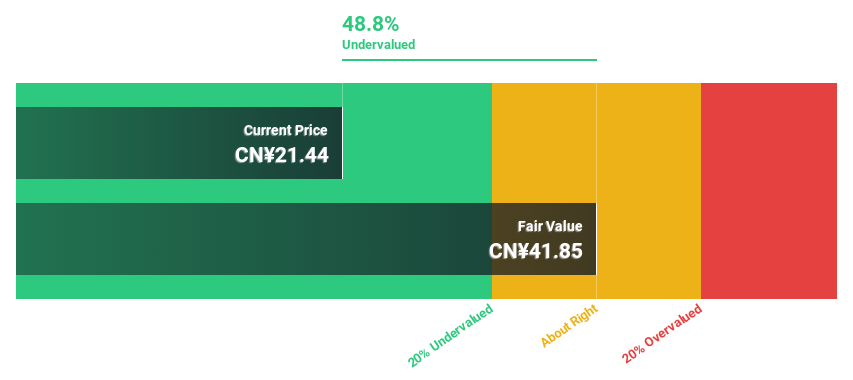

Estimated Discount To Fair Value: 48.9%

Zhende Medical is trading at CN¥21.38, significantly below its estimated fair value of CN¥41.84, indicating it may be undervalued based on cash flows. Despite a drop in sales to CN¥3.13 billion for the nine months ending September 2024, net income increased slightly to CN¥307.46 million from the previous year, suggesting resilience in profitability. However, profit margins have decreased from 10.2% to 5.1%, which could be a concern moving forward.

- Our expertly prepared growth report on Zhende Medical implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Zhende Medical here with our thorough financial health report.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, along with its subsidiaries, operates in the renewable energy sector both in Japan and internationally, with a market capitalization of approximately ¥74.32 billion.

Operations: West Holdings Corporation's revenue is primarily derived from its operations in the renewable energy sector, both domestically and internationally.

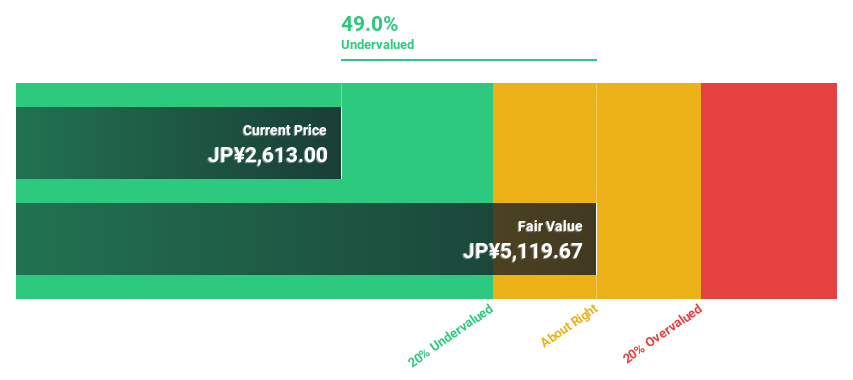

Estimated Discount To Fair Value: 38.4%

West Holdings is trading at ¥1874, well below its estimated fair value of ¥3040.43, highlighting potential undervaluation based on cash flows. Revenue and earnings are projected to grow faster than the Japanese market at 12.6% and 14.9% annually, respectively. However, concerns arise as dividends are not covered by free cash flows and debt coverage by operating cash flow is inadequate. The company will report Q1 2025 results on January 14, 2025.

- Our growth report here indicates West Holdings may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in West Holdings' balance sheet health report.

Dream Industrial Real Estate Investment Trust (TSX:DIR.UN)

Overview: Dream Industrial REIT is an owner, manager, and operator of a global portfolio of diversified industrial properties with a market cap of CA$3.39 billion.

Operations: The company generates revenue from its investment properties, amounting to CA$484.15 million.

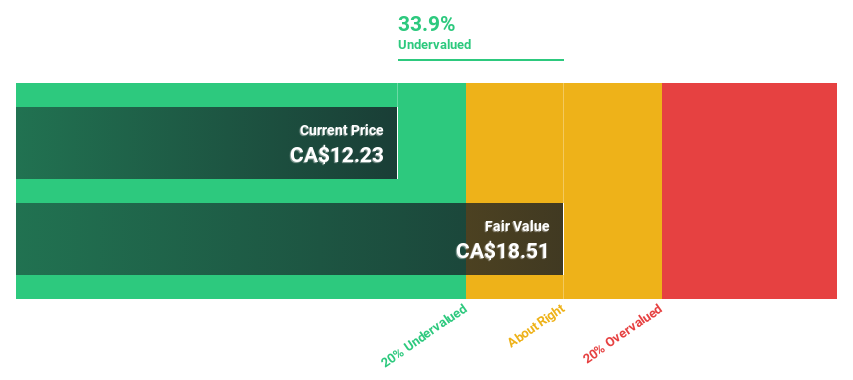

Estimated Discount To Fair Value: 35.2%

Dream Industrial Real Estate Investment Trust, trading at CA$11.81, is significantly undervalued compared to its estimated fair value of CA$18.22, suggesting potential based on cash flows. Earnings are expected to grow at 29.7% annually, outpacing the Canadian market's growth rate of 15.8%. However, debt coverage by operating cash flow is inadequate despite a reliable dividend yield of 5.93%. Recent acquisitions in Canada and Europe indicate strategic expansion plans supported by existing liquidity and retained cash flow.

- The growth report we've compiled suggests that Dream Industrial Real Estate Investment Trust's future prospects could be on the up.

- Navigate through the intricacies of Dream Industrial Real Estate Investment Trust with our comprehensive financial health report here.

Make It Happen

- Unlock our comprehensive list of 875 Undervalued Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DIR.UN

Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager and operator of a global portfolio of well-located, diversified industrial properties.

Reasonable growth potential with proven track record and pays a dividend.