- Canada

- /

- Electrical

- /

- TSXV:FCLI

Top Penny Stocks On The TSX To Monitor In January 2025

Reviewed by Simply Wall St

As 2025 begins, the Canadian market is navigating a landscape marked by fluctuating bond yields and evolving interest rate expectations. Despite these challenges, the potential for growth remains strong, especially as investors adjust their outlooks in light of recent economic data. Penny stocks—often smaller or newer companies—continue to offer intriguing opportunities for those seeking affordability and growth potential when supported by robust financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.44 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$123.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.75 | CA$687.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$218.52M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.64M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AnorTech (TSXV:ANOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AnorTech Inc. is involved in the acquisition, exploration, development, and mining of mineral resources in Greenland with a market cap of CA$5.45 million.

Operations: AnorTech Inc. has not reported any specific revenue segments.

Market Cap: CA$5.45M

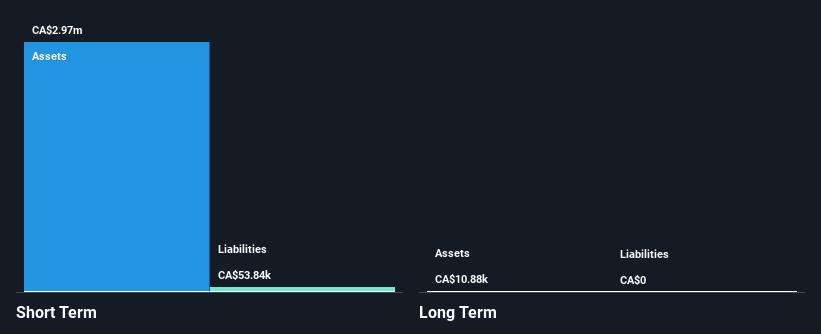

AnorTech Inc., with a market cap of CA$5.45 million, operates in the mineral exploration sector and remains pre-revenue, generating less than US$1 million. Despite its unprofitability, AnorTech has reduced losses at a notable rate over the past five years and maintains a strong cash runway exceeding three years without debt concerns. The company's share price has been highly volatile recently, though its weekly volatility has improved over the past year. Recent earnings reports indicated increased net losses compared to previous periods, highlighting ongoing challenges in achieving profitability. Short-term assets comfortably cover liabilities with no significant shareholder dilution observed recently.

- Dive into the specifics of AnorTech here with our thorough balance sheet health report.

- Assess AnorTech's previous results with our detailed historical performance reports.

Full Circle Lithium (TSXV:FCLI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Full Circle Lithium Corp. is a specialty chemical recycling and processing company operating in the United States and Canada, with a market cap of CA$20.14 million.

Operations: Currently, there are no reported revenue segments for Full Circle Lithium Corp.

Market Cap: CA$20.14M

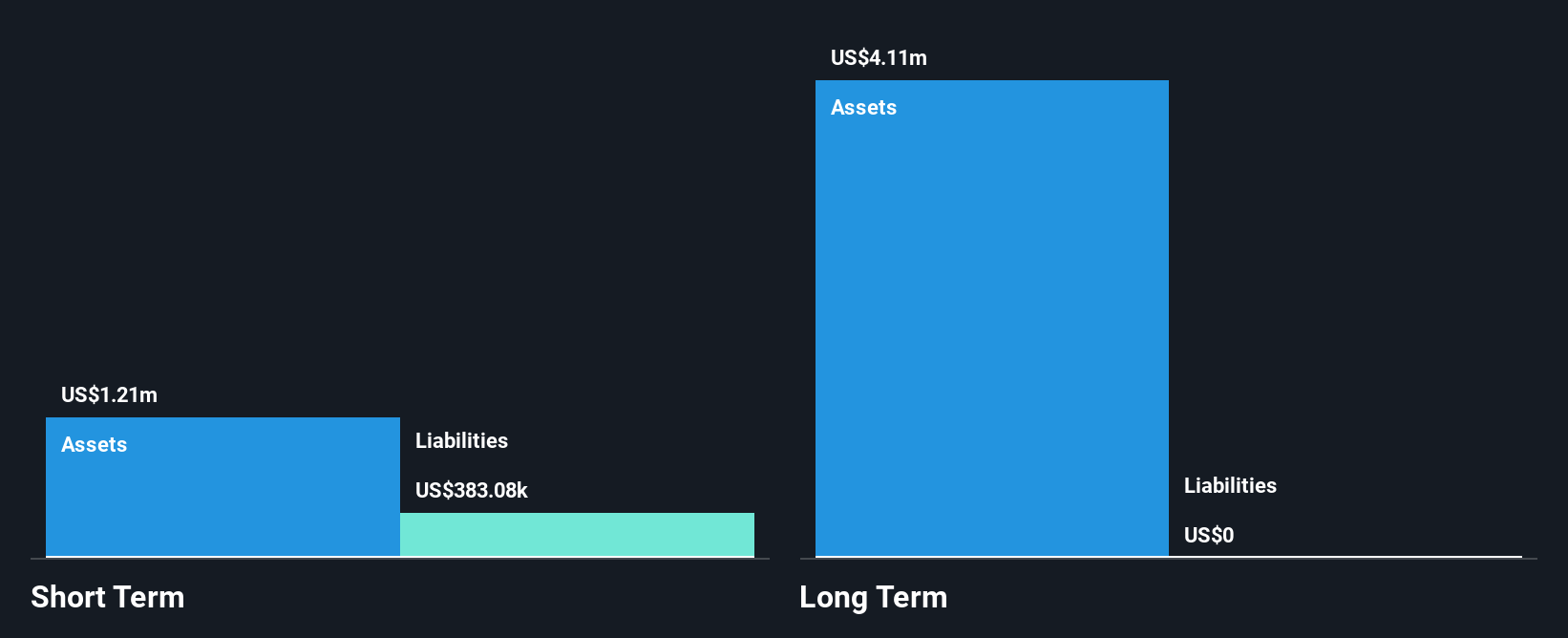

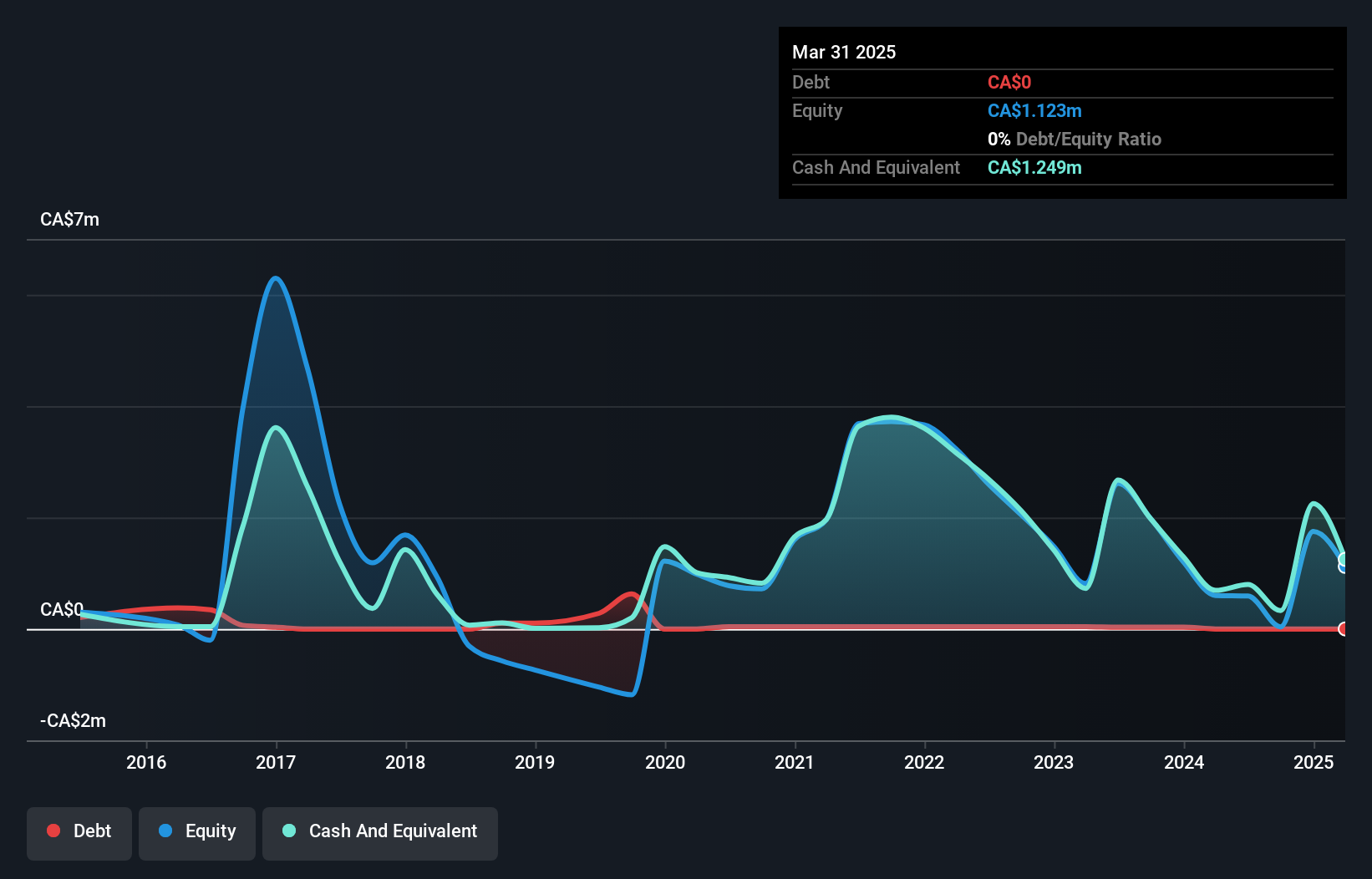

Full Circle Lithium Corp., with a market cap of CA$20.14 million, is pre-revenue and debt-free, but faces financial challenges with less than a year of cash runway if current cash flow trends persist. The company has made strides in commercializing its lithium-ion battery firefighting agent, FCL-X™, through distribution agreements with US Fire Pump Company and AEST Fire & Safety. These partnerships aim to expand the product's reach across various settings globally. Despite management changes and high share price volatility, Full Circle remains focused on leveraging its innovative solutions in the growing electric vehicle safety market.

- Jump into the full analysis health report here for a deeper understanding of Full Circle Lithium.

- Understand Full Circle Lithium's earnings outlook by examining our growth report.

Telo Genomics (TSXV:TELO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Telo Genomics Corp. is a molecular diagnostics company focused on developing and commercializing predictive technological products to personalize treatment plans for patients with specific conditions, primarily in Canada, with a market cap of CA$10.07 million.

Operations: No revenue segments have been reported.

Market Cap: CA$10.07M

Telo Genomics Corp., with a market cap of CA$10.07 million, is pre-revenue and faces financial constraints, having only two months of cash runway based on previous free cash flow reports. However, recent capital raises through private placements have bolstered its financial position slightly. The company's collaboration with Mayo Clinic has advanced the TeloViewSMM prognostic test for smoldering multiple myeloma (SMM), showing promising results in stratifying patient risk levels. Despite ongoing losses and high share price volatility, Telo Genomics continues to develop its diagnostic technologies amidst auditor concerns about its ability to continue as a going concern.

- Click here to discover the nuances of Telo Genomics with our detailed analytical financial health report.

- Learn about Telo Genomics' historical performance here.

Where To Now?

- Dive into all 933 of the TSX Penny Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FCLI

Full Circle Lithium

Manufactures and sells lithium-ion battery fire extinguishing agents primarily in the United States.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)