The early days of 2025 have been marked by significant market activity, with bond yields experiencing a surprising rise, particularly in the U.S., which has influenced stock valuations. Amidst these shifts, investors are increasingly attentive to smaller and newer companies that offer growth potential at lower price points. Despite being considered an outdated term, penny stocks continue to present opportunities for those seeking affordable investments with strong financial fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.44 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$123.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.75 | CA$687.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$218.52M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.64M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Chakana Copper (TSXV:PERU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chakana Copper Corp. is involved in the exploration and development of mineral properties, with a market cap of CA$6.68 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$6.68M

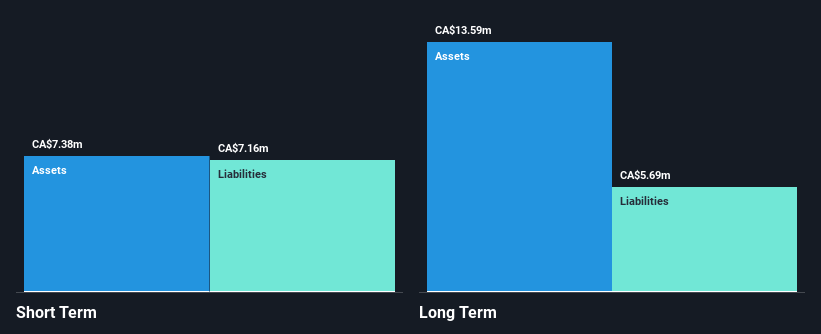

Chakana Copper Corp., with a market cap of CA$6.68 million, is a pre-revenue company focused on mineral exploration. Despite reducing losses by 12.7% annually over the past five years, it remains unprofitable with a recent net loss of CA$6.51 million for Q1 2024. The company has no debt and its short-term assets exceed both short and long-term liabilities, providing some financial stability despite having less than one year of cash runway based on current free cash flow. Share price volatility has increased recently, reflecting potential risks for investors in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Chakana Copper.

- Gain insights into Chakana Copper's past trends and performance with our report on the company's historical track record.

SATO Technologies (TSXV:SATO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SATO Technologies Corp. is a Canadian blockchain company focused on cryptocurrency mining, with a market cap of CA$15.75 million.

Operations: The company generates revenue of CA$18.17 million from its compute power dedicated to Bitcoin mining.

Market Cap: CA$15.75M

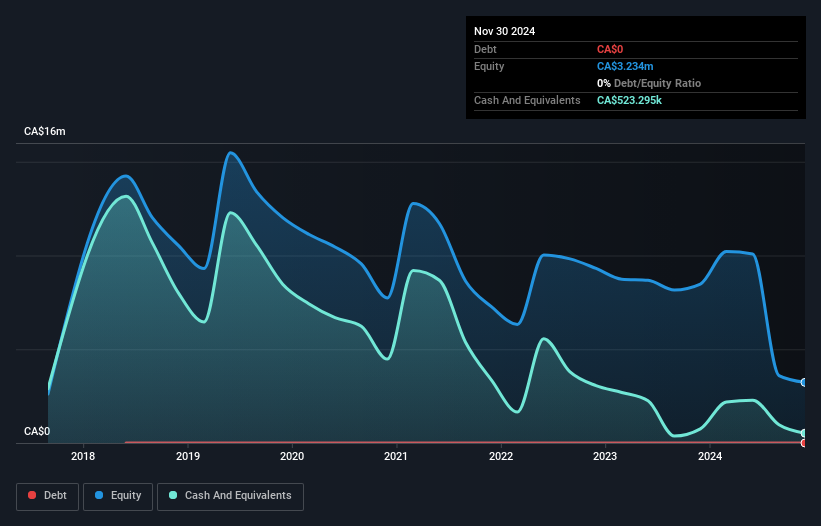

SATO Technologies Corp., with a market cap of CA$15.75 million, has become profitable this year, generating revenue of CA$18.17 million from Bitcoin mining. Despite recent volatility and a high net debt to equity ratio of 82.6%, the company maintains well-covered interest payments and short-term liabilities exceeded by assets. SATO's strategic expansion into AI and high-performance computing leverages its expertise in energy-efficient blockchain technology, utilizing 20 MW of hydro-electricity from Québec for new data centers. Recent earnings show mixed results with increased nine-month sales but a third-quarter net loss, highlighting both growth potential and financial challenges ahead.

- Unlock comprehensive insights into our analysis of SATO Technologies stock in this financial health report.

- Understand SATO Technologies' earnings outlook by examining our growth report.

Sokoman Minerals (TSXV:SIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sokoman Minerals Corp. is an exploration-stage company focused on acquiring and exploring mineral properties in Canada, with a market cap of CA$12.91 million.

Operations: Currently, there are no reported revenue segments for this exploration-stage company.

Market Cap: CA$12.91M

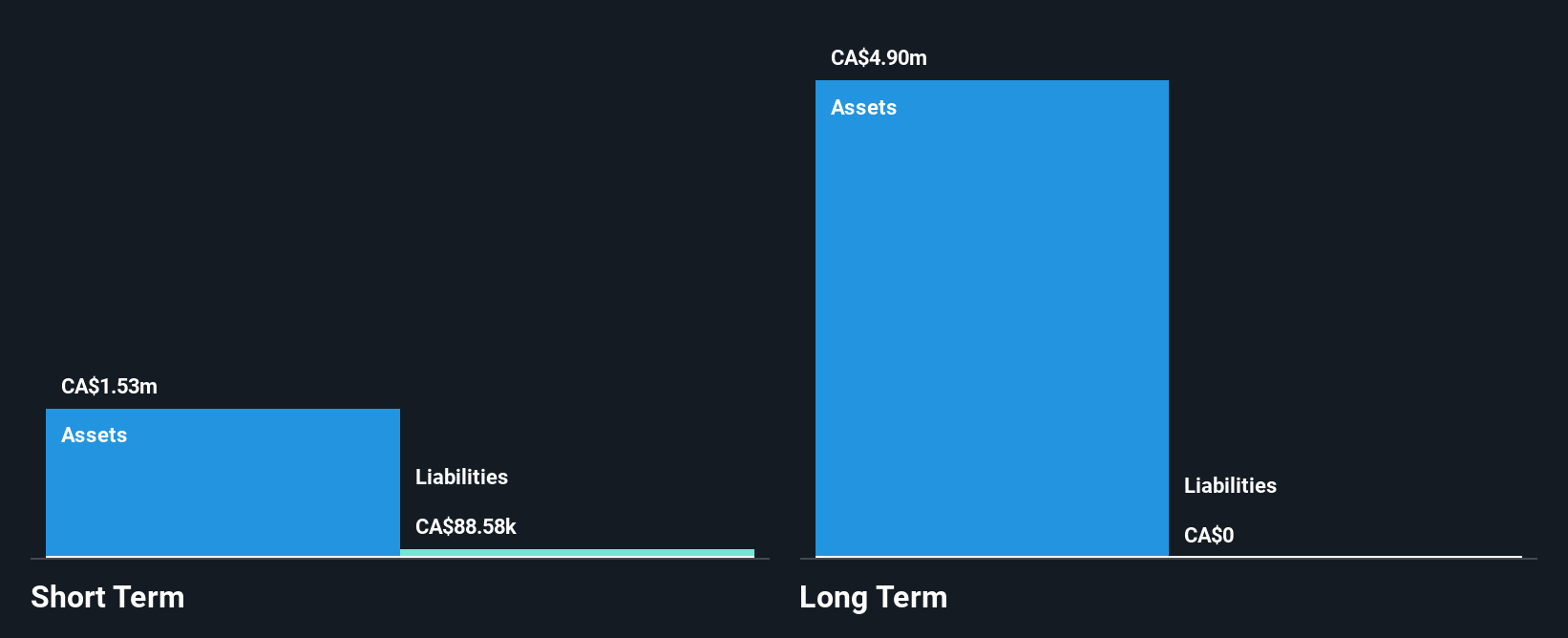

Sokoman Minerals Corp., with a market cap of CA$12.91 million, remains pre-revenue, focusing on exploration projects such as the Moosehead and Fleur de Lys. Recent drilling at Moosehead revealed promising gold-bearing quartz veins, with assays pending. The company completed its Phase 1 drill program at Fleur de Lys, intersecting gold mineralization in several holes. Despite no current revenue streams and recent net losses, Sokoman's debt-free status and experienced management provide some stability. A private placement aims to raise up to CA$1.5 million for further exploration efforts, though auditors have expressed going concern doubts about the company's financial viability.

- Click to explore a detailed breakdown of our findings in Sokoman Minerals' financial health report.

- Gain insights into Sokoman Minerals' historical outcomes by reviewing our past performance report.

Where To Now?

- Click here to access our complete index of 933 TSX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SATO

SATO Technologies

Engages in the cryptocurrency mining business in Canada.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)