As the Canadian market navigates a landscape of fluctuating interest rates and economic resilience, investors are closely watching how these factors influence stock valuations. Amidst this backdrop, penny stocks—often smaller or younger companies—remain an intriguing investment area for those seeking growth opportunities at lower price points. These stocks can offer unique potential when backed by strong financials and solid fundamentals, making them worthy of attention despite their somewhat outdated label.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.49 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.28 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$123.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$687.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.26 | CA$218.52M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$178.64M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.00 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Clean Air Metals (TSXV:AIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clean Air Metals Inc. is a Canadian exploration company focused on the identification, acquisition, exploration, and development of mineral properties with a market cap of CA$12.78 million.

Operations: Clean Air Metals Inc. currently does not report any revenue segments.

Market Cap: CA$12.78M

Clean Air Metals Inc., with a market cap of CA$12.78 million, is currently pre-revenue and focused on its Thunder Bay North Critical Minerals project. Recent developments include the commencement of a 2000-metre drilling program targeting high-grade zones at the Current deposit, following positive results from earlier exploration efforts. Despite being debt-free, Clean Air Metals faces challenges such as limited cash runway and an inexperienced management team. The company recently raised CA$1.10 million through a private placement to support ongoing exploration activities, which are crucial for advancing its strategy of delineating high-grade mineral resources for potential future extraction.

- Unlock comprehensive insights into our analysis of Clean Air Metals stock in this financial health report.

- Review our historical performance report to gain insights into Clean Air Metals' track record.

Blockmint Technologies (TSXV:BKMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Blockmint Technologies Inc. develops distributed systems and networks for decentralized blockchain applications, with a market cap of CA$7.72 million.

Operations: Blockmint Technologies Inc. has not reported any revenue segments.

Market Cap: CA$7.72M

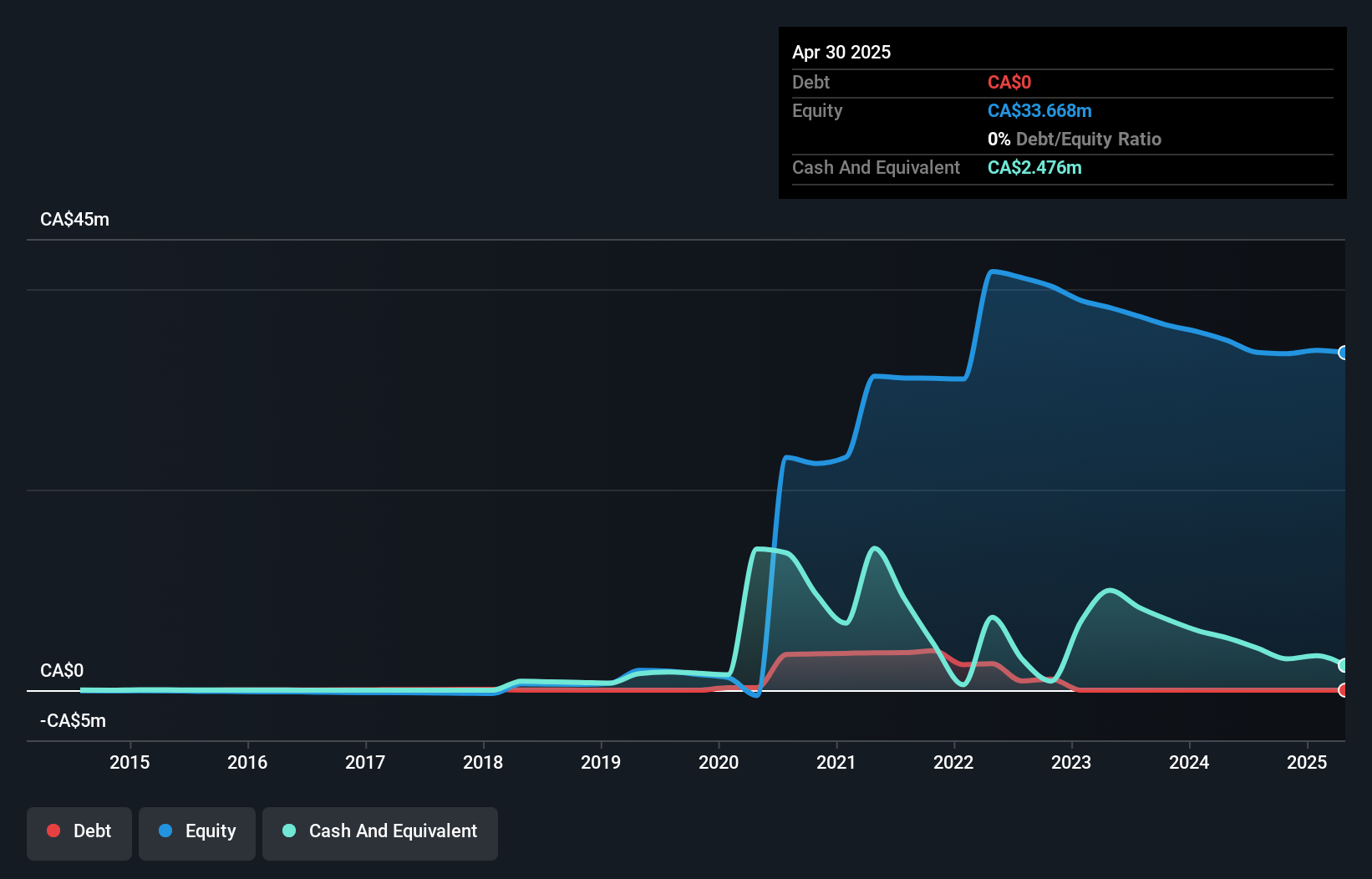

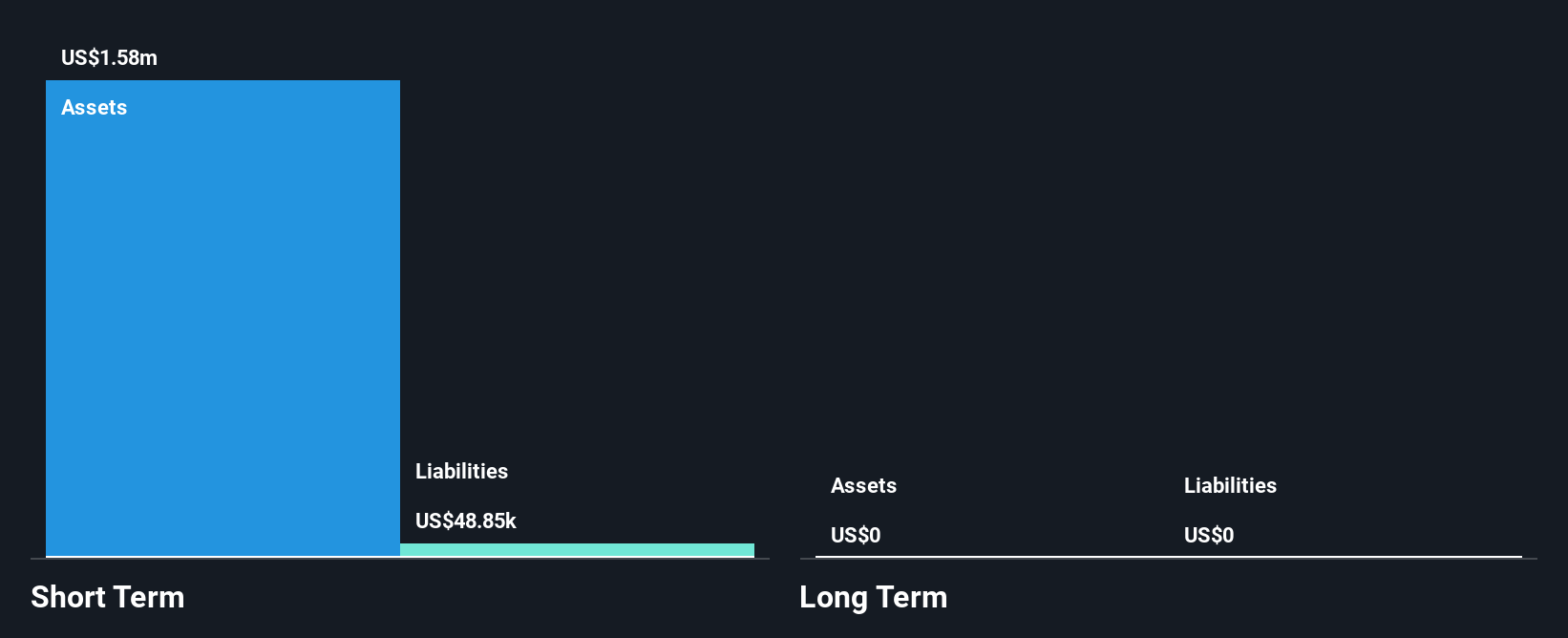

Blockmint Technologies Inc., with a market cap of CA$7.72 million, is pre-revenue and focuses on decentralized blockchain applications. The company reported a reduced net loss for the third quarter of 2024 compared to the previous year, indicating some progress in managing expenses. Despite its unprofitability, Blockmint has consistently decreased losses over five years by a significant rate annually. It remains debt-free with short-term assets significantly exceeding liabilities, providing financial stability in the short term. However, its share price has been highly volatile recently and it lacks revenue streams above US$1 million as of now.

- Jump into the full analysis health report here for a deeper understanding of Blockmint Technologies.

- Gain insights into Blockmint Technologies' historical outcomes by reviewing our past performance report.

Nova Leap Health (TSXV:NLH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nova Leap Health Corp. operates in the United States and Canada, offering home and home health care services, with a market cap of CA$25.01 million.

Operations: The company's revenue is derived from $3.78 million in Canada and $21.94 million in the United States, with a minor contribution of $0.01 million from the Group Head Office.

Market Cap: CA$25M

Nova Leap Health Corp., with a market cap of CA$25.01 million, operates in the home health care sector across Canada and the U.S. The company is unprofitable but maintains a positive free cash flow, ensuring a cash runway exceeding three years. Recent earnings showed mixed results, with a net income increase over nine months but losses in Q3 2024. Nova Leap's debt to equity ratio has significantly improved over five years, and its short-term assets surpass both short- and long-term liabilities. The recent credit agreement amendment provides additional financial flexibility for strategic acquisitions.

- Get an in-depth perspective on Nova Leap Health's performance by reading our balance sheet health report here.

- Understand Nova Leap Health's track record by examining our performance history report.

Key Takeaways

- Navigate through the entire inventory of 933 TSX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blockmint Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BKMT

Blockmint Technologies

Develops distributed systems and networks that enables decentralized deployment of blockchain based applications.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives