- Canada

- /

- Retail REITs

- /

- TSX:CRR.UN

Crombie Real Estate Investment Trust (TSX:CRR.UN): Assessing Valuation After a Year of Steady Total Return Gains

Reviewed by Simply Wall St

Crombie Real Estate Investment Trust (TSX:CRR.UN) has quietly delivered a steady climb this year, with the unit price up about 15% year to date and roughly 18% over the past year.

See our latest analysis for Crombie Real Estate Investment Trust.

That climb has come as investors steadily warm to Crombie’s mix of grocery anchored and mixed use properties, with the share price now at $15.34 and a solid one year total shareholder return, suggesting momentum is gradually building rather than fading.

If Crombie’s steady gains have you thinking about where else defensive income and growth might be hiding, it could be worth exploring these 13 dividend stocks with yields > 3% as a starting shortlist.

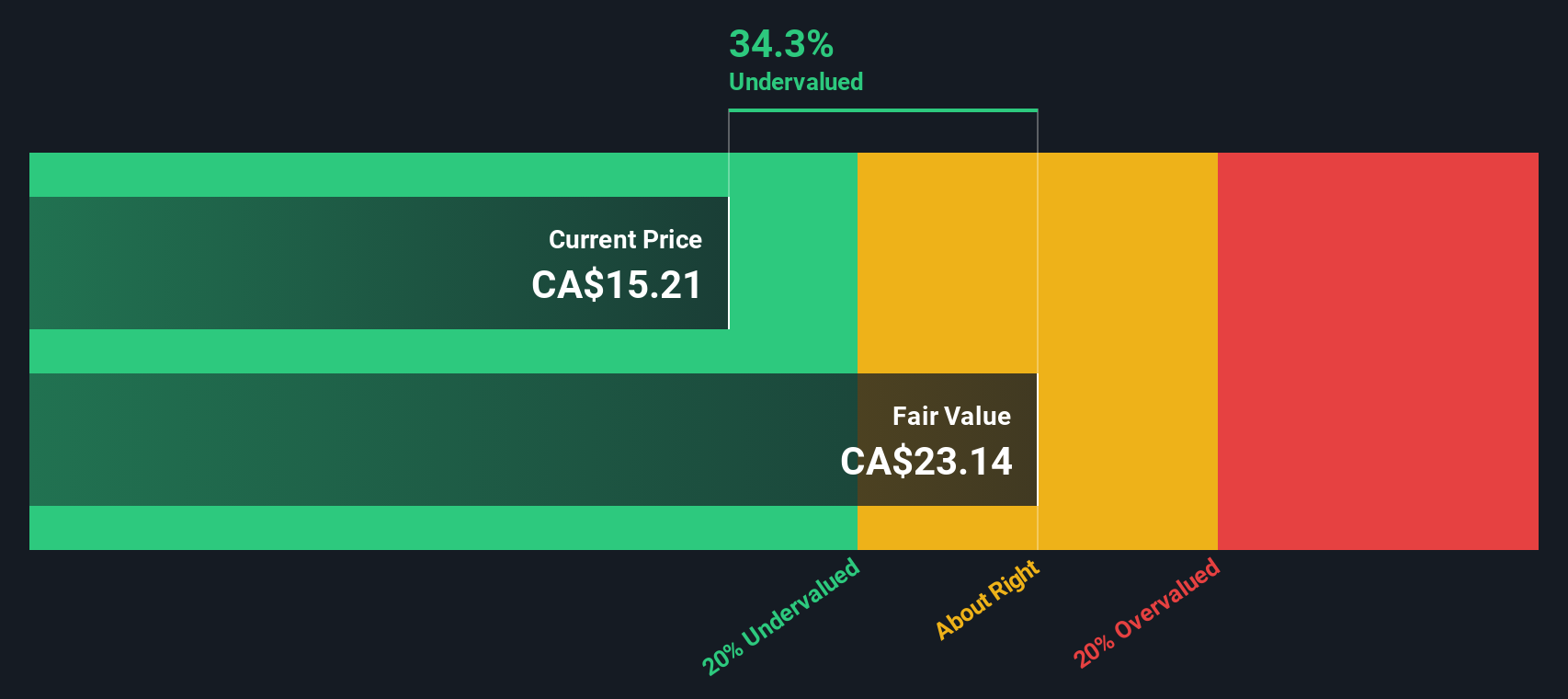

With a near 18% one year total return, modest revenue growth, and analysts still seeing some upside, is Crombie trading at an attractive discount to its intrinsic value, or is the market already pricing in its future development pipeline?

Price to earnings of 17.1x: Is it justified?

Crombie is currently trading on a price to earnings ratio of 17.1 times, which frames the CA$15.34 unit price as modestly valued relative to its earnings.

The price to earnings multiple compares what investors pay for each dollar of current earnings, a key yardstick for income oriented, mature REITs like Crombie. For a trust with slow but steady revenue growth and a focus on stable, grocery anchored assets, this multiple reflects how much the market is willing to pay for dependable cash flows today.

Against the broader North American Retail REITs industry, Crombie’s 17.1 times price to earnings ratio looks conservative given the sector average of 24 times, which suggests the market is not awarding it a premium relative to that group. However, when lined up against closer peers, that same multiple appears more expensive than the 15.3 times peer average, which suggests investors may already be paying somewhat more for Crombie’s reliability and development pipeline.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to earnings of 17.1x (ABOUT RIGHT)

However, investors should still weigh risks like higher interest costs pressuring development returns and softer consumer spending potentially impacting Crombie’s grocery anchored tenants.

Find out about the key risks to this Crombie Real Estate Investment Trust narrative.

Another view: DCF points to a deeper discount

While a 17.1 times earnings multiple suggests Crombie is roughly fairly priced, our DCF model paints a different picture, indicating fair value around CA$25.41, roughly 40% above today’s CA$15.34 unit price. Is the market underestimating long term cash flows or simply demanding a higher risk premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crombie Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crombie Real Estate Investment Trust Narrative

If you see things differently, or simply want to dig into the numbers yourself, you can easily build a personal view in minutes: Do it your way.

A great starting point for your Crombie Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop with a single REIT. Use the Simply Wall Street Screener to explore income, growth, and thematic opportunities before the market catches on.

- Identify potential high growth at lower prices by scanning these 3613 penny stocks with strong financials that already show financial strength instead of relying only on hype.

- Explore structural change in medicine by targeting these 30 healthcare AI stocks that are involved in transforming diagnosis, treatment, and hospital efficiency.

- Review these 13 dividend stocks with yields > 3% with yields above 3 percent that are supported by solid fundamentals to help strengthen your income stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRR.UN

Crombie Real Estate Investment Trust

Crombie invests in real estate with a vision of enriching communities together by building spaces and value today that leave a positive impact on tomorrow.

Established dividend payer with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)