- Canada

- /

- Retail REITs

- /

- TSX:CHP.UN

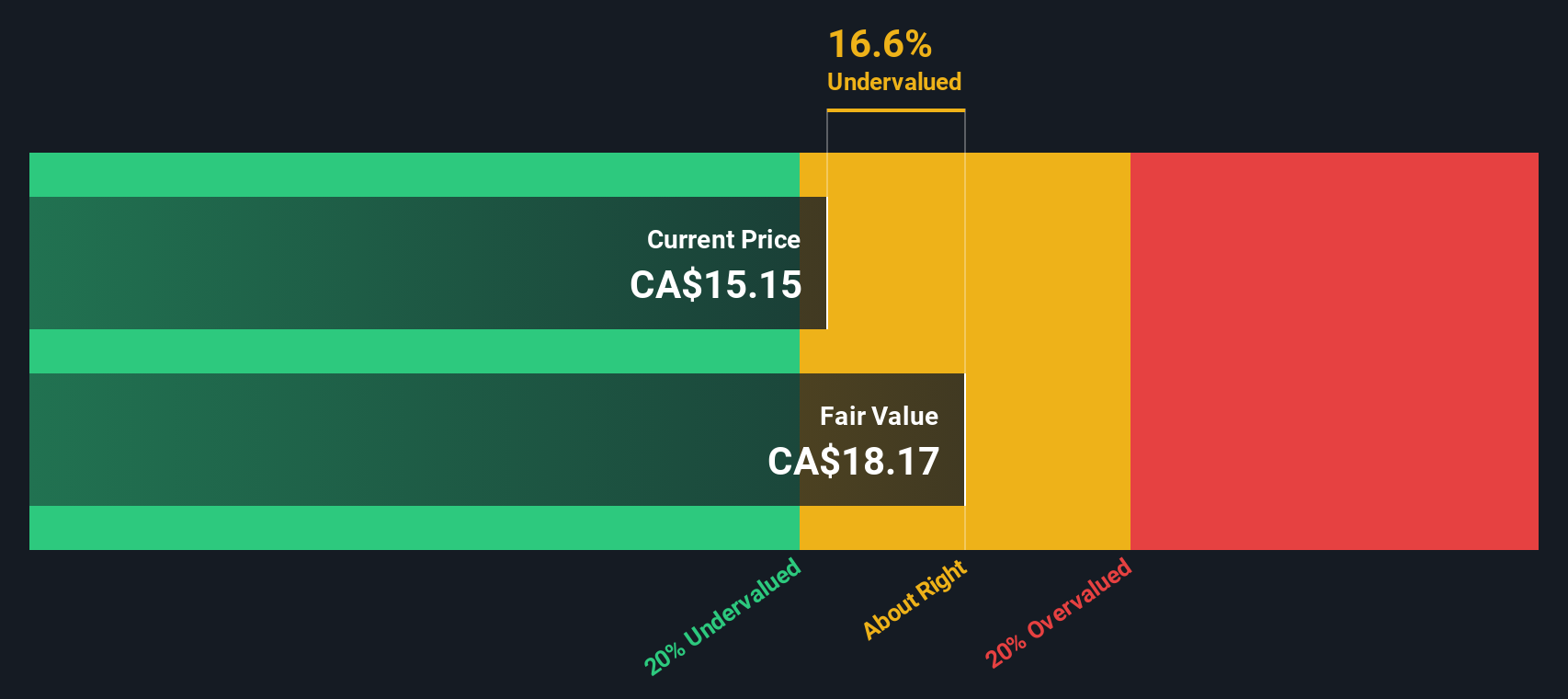

Assessing Choice Properties REIT (TSX:CHP.UN)’s Valuation After Its Recent 10% Year-to-Date Share Price Gain

Reviewed by Simply Wall St

Choice Properties Real Estate Investment Trust (TSX:CHP.UN) has quietly outpaced the broader Canadian REIT space over the past year, and that steady climb has investors revisiting its income profile and valuation.

See our latest analysis for Choice Properties Real Estate Investment Trust.

With the share price now at CA$14.76, Choice Properties has given investors a solid year to date share price return of just over 10 percent, and a 12 month total shareholder return of around 13 percent suggests momentum is quietly building rather than fading.

If this steady REIT performance has you thinking about portfolio balance, it could also be worth exploring fast growing stocks with high insider ownership as a way to uncover more ambitious growth ideas alongside your income names.

With analysts still seeing upside to their price targets and the units trading at a noticeable discount to some intrinsic estimates, investors now face a pivotal question: is there still a buying opportunity here, or is the market already pricing in future growth?

Price to earnings of 6.2x: Is it justified?

Choice Properties looks inexpensive at first glance, with its last close of CA$14.76 implying a price to earnings multiple of just 6.2 times, well below peers that trade on far richer earnings valuations.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, which is particularly useful for REITs where recurring income is a core part of the investment case. For Choice Properties, a low multiple like this can suggest the market is sceptical about how sustainable or repeatable current profits are, especially given the impact of recent one off items.

Against that backdrop, the units appear to be priced as if earnings quality and growth prospects are modest, even though the trust has delivered steady 3.9 percent annual earnings growth over the past five years and is trading at a 19.8 percent discount to the SWS DCF fair value estimate of CA$18.41. If market confidence in those earnings improves, there is room for the multiple to expand toward more typical REIT levels.

The contrast with the wider sector is stark. Choice Properties trades on 6.2 times earnings compared with about 24 times for the broader North American retail REIT industry and 32.4 times for its more direct peers. This underscores how deeply the units are discounted relative to similar income focused names.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 6.2x (UNDERVALUED)

However, risks remain, including a growth slowdown from softer tenant demand and any reversal in valuation multiples if interest rate expectations shift higher.

Find out about the key risks to this Choice Properties Real Estate Investment Trust narrative.

Another way to look at value

Our DCF model also points to upside, with Choice Properties trading at CA$14.76 versus an estimated fair value of CA$18.41. That 19.8 percent gap reinforces the low earnings multiple. However, it also raises a key question: how long might investors wait for value to be recognised?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Choice Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Choice Properties Real Estate Investment Trust Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Choice Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Choice Properties?

Do not leave your next move to chance. Use the Simply Wall Street screener to uncover high conviction opportunities that match your strategy before others notice.

- Capture potential market mispricings by targeting companies trading below their intrinsic worth with these 913 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Ride structural tailwinds in next generation technology by zeroing in on businesses at the forefront of artificial intelligence through these 25 AI penny stocks and support tomorrow's potential leaders today.

- Strengthen your income stream by focusing on reliable payers using these 13 dividend stocks with yields > 3% and avoid missing out on attractive yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CHP.UN

Choice Properties Real Estate Investment Trust

Choice Properties is a leading Real Estate Investment Trust that creates enduring value through places where people thrive.

Established dividend payer and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)