Evaluating Canopy Growth (TSX:WEED) After Schedule III Reform Hopes Lift Cannabis Stocks

Reviewed by Simply Wall St

Reports that President Trump intends to move marijuana to Schedule III have jolted Canopy Growth (TSX:WEED) back into focus, with investors quickly repricing its prospects for U.S. banking access and expansion.

See our latest analysis for Canopy Growth.

That policy buzz comes on top of Canopy’s December rollout of high potency Claybourne Gassers vapes in Canada. Together these catalysts have powered a sharp 30 day share price return of 52.32%, even though the 1 year total shareholder return remains deeply negative. This suggests momentum is improving off a low base rather than fully reversing past losses.

If this kind of speculative rebound has your attention, it could be a good moment to scan other cannabis and pharmaceutical names and compare them with healthcare stocks.

With shares still down nearly 45% over the past year and trading at a sizable discount to analyst targets, is Canopy now a mispriced turnaround story, or has the market already baked in the upside from U.S. reform?

Most Popular Narrative: 30.3% Undervalued

With Canopy Growth last closing at CA$2.30 versus a narrative fair value near CA$3.30, the storyline leans toward meaningful upside if its roadmap delivers.

Advanced cost rationalization initiatives including automation, supply chain optimization, and targeted SG&A reductions are expected to meaningfully improve net margins and earnings in the coming quarters by aligning the cost base with core revenue drivers and reducing structural overhead.

Want to see how modest revenue growth, margin repair, and a punchy future earnings multiple combine to justify that higher value? The projections behind this fair value might surprise you. Curious which assumptions really move the needle for Canopy’s long term upside? Read on to unpack the full narrative.

Result: Fair Value of $3.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and ongoing operating losses, along with potential regulatory setbacks in Europe, could quickly undermine the bullish turnaround narrative.

Find out about the key risks to this Canopy Growth narrative.

Another Angle on Valuation

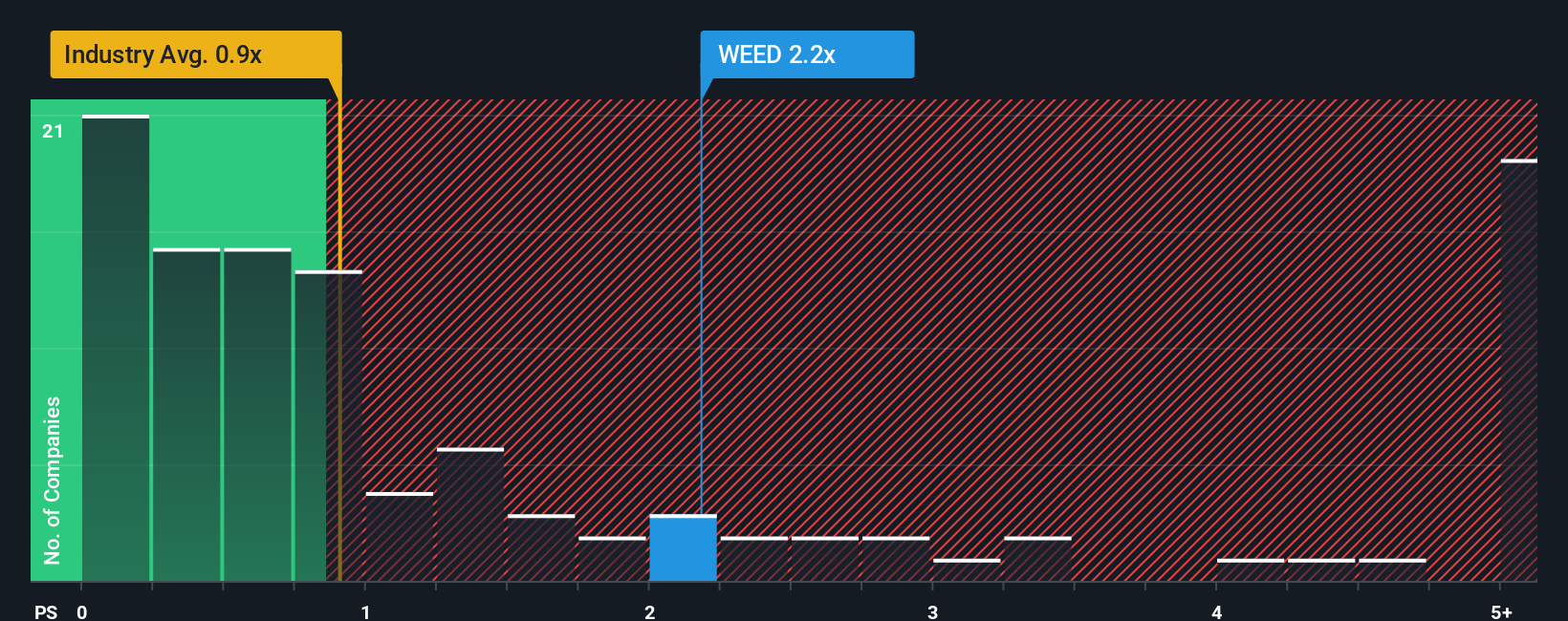

On a simple price to sales view, Canopy looks far less forgiving. The stock trades around 2.8 times sales compared with 1.1 times for the Canadian pharmaceuticals industry and 0.9 times for close peers, while our fair ratio also sits near 1.1 times. That premium hints at real downside risk if the optimistic turnaround narrative stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canopy Growth Narrative

If you see the story differently or want to test your own assumptions with fresh data, you can build a custom view in minutes with Do it your way.

A great starting point for your Canopy Growth research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, you can scan focused stock shortlists on Simply Wall St’s Screener so strong ideas never slip past you.

- Target income by checking out these 13 dividend stocks with yields > 3% that can potentially bolster your portfolio’s cash flow.

- Explore early stage innovation by reviewing these 26 AI penny stocks at the forefront of artificial intelligence and automation.

- Look for possible mispriced opportunities by filtering through these 906 undervalued stocks based on cash flows that may be trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WEED

Canopy Growth

Engages in the production, distribution, and sale of cannabis, hemp, and cannabis-related products in Canada, Germany, and Australia.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)