Organigram (TSX:OGI) One‑Off Gain‑Driven Profitability Tests Bullish Narratives on Earnings Durability

Reviewed by Simply Wall St

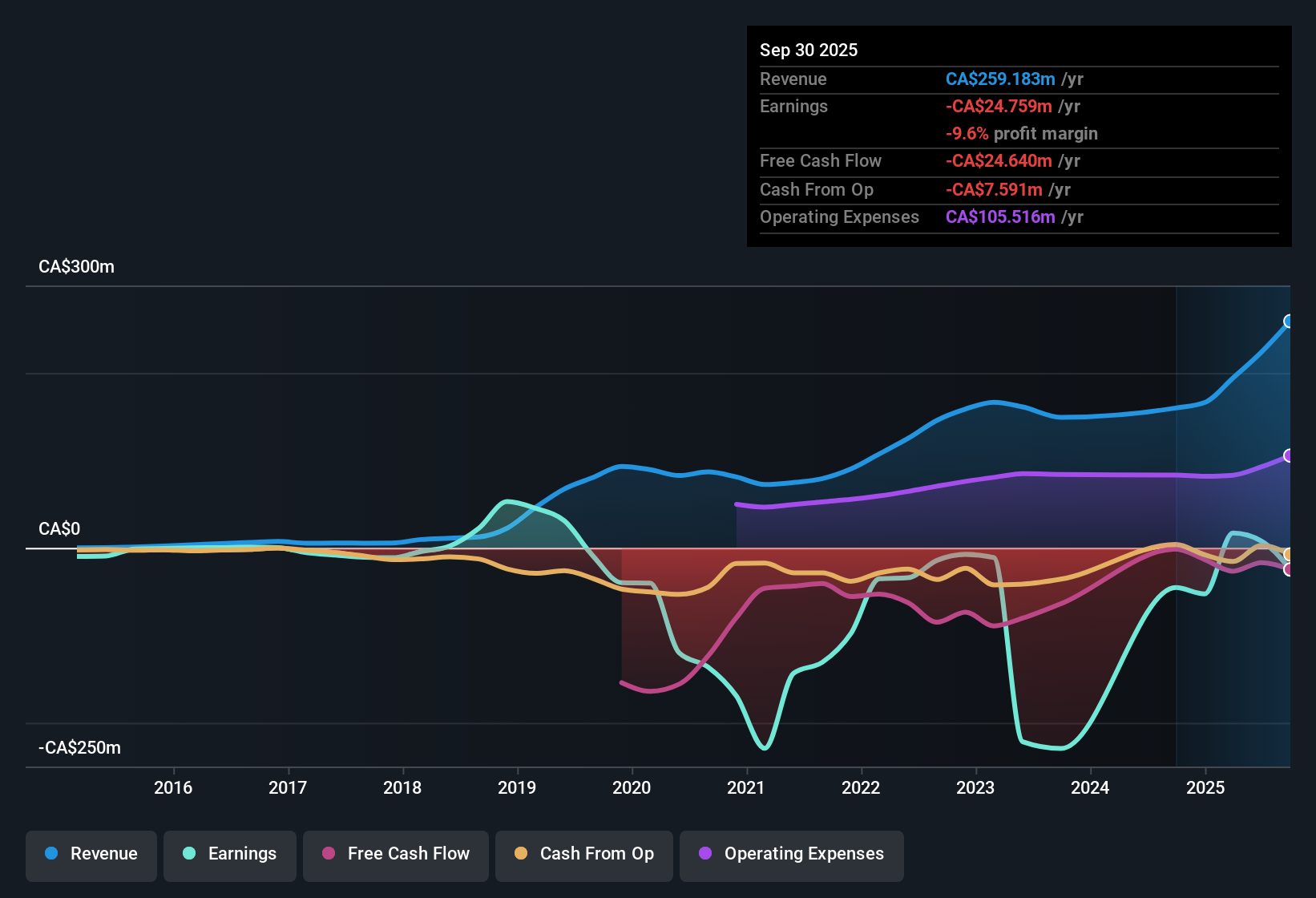

Organigram Global (TSX:OGI) has just posted its FY 2025 numbers, with fourth quarter revenue at about CA$80.1 million and basic EPS of roughly ‑CA$0.28. This caps a volatile year that saw both sharp profit and loss swings. Over the last six quarters, revenue has moved from CA$44.7 million in Q4 2024 to CA$80.1 million in Q4 2025, while quarterly basic EPS has ranged from ‑CA$0.20 to CA$0.33. This highlights how sensitive margins remain to one off items and shifting demand. Overall, the latest print points to a business that is scaling its top line but still wrestling with choppy profitability and margin stability.

See our full analysis for Organigram Global.With the headline figures on the table, the next step is to compare these results with the dominant market narratives around Organigram to see which stories the numbers actually support and which ones start to look shaky.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Up, Profit Still Uneven

- On a trailing 12 month basis, revenue rose from CA$159.8 million in 2024 Q4 to CA$259.2 million by 2025 Q4, while net income excluding extra items improved from a loss of CA$45.4 million to a smaller loss of CA$24.8 million over the same span.

- Bulls often point to this mix of higher revenue and narrowing losses as evidence of a business maturing. However, the swing from a CA$42.5 million profit in 2025 Q2 to a CA$38.0 million loss in 2025 Q4 shows that profitability is still highly sensitive to quarter specific factors and not yet consistently backing a straightforward bullish story.

One Off Gain Skews Profit Picture

- Over the last 12 months, reported earnings were boosted by a CA$25.9 million one off gain, which helped push trailing EPS to CA$0.07 in 2025 Q3 before slipping back to a loss of CA$0.19 per share by 2025 Q4.

- What stands out for a bearish narrative is that analysts forecast earnings to decline about 103.9 percent per year over the next three years. When you strip out the CA$25.9 million gain, the trailing 12 month net result is still a CA$24.8 million loss, reinforcing concerns that the recent move toward profitability may not yet be durable without unusual items.

High Multiple Despite Forecast Earnings Drop

- Organigram is trading around CA$2.61 per share on a trailing P/E of 42.5 times, well above the 15.7 times industry average and 12.6 times peer average, even though forecasts call for earnings to fall sharply at about 103.9 percent per year over the next three years.

- From a bullish angle, some investors may focus on revenue expected to grow roughly 10.8 percent annually and note that the DCF fair value of CA$4.47 sits meaningfully above the current share price. However, the combination of a premium P/E multiple and projected earnings declines challenges the idea that the stock already offers a straightforward value opportunity based solely on growth and discounted cash flow upside.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Organigram Global's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Organigram’s volatile earnings, reliance on one off gains, and premium valuation versus peers suggest its profit story is still fragile and hard to trust.

If you would rather focus on companies where valuation better matches reliable earnings power and downside feels more limited, use our these 909 undervalued stocks based on cash flows to quickly narrow in on ideas that look cheaper against cash flows and may offer a more compelling risk reward profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OGI

Organigram Global

Engages in the production and sale of cannabis and cannabis-derived products in Canada.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)