- Canada

- /

- Healthtech

- /

- TSX:VHI

3 High Insider Owned TSX Growth Companies With Earnings Up To 66%

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 2.3%, yet it remains up 12% over the past year with earnings projected to grow by 15% annually in the coming years. In this context, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.5% | 70.7% |

| Allied Gold (TSX:AAUC) | 22.5% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| VersaBank (TSX:VBNK) | 13.3% | 28.2% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

Underneath we present a selection of stocks filtered out by our screen.

Knight Therapeutics (TSX:GUD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knight Therapeutics Inc. develops, manufactures, acquires, licenses, markets, and distributes pharmaceutical and consumer health products as well as medical devices globally; it has a market cap of CA$570.85 million.

Operations: The company's revenue segments include CA$337.87 million from pharmaceuticals.

Insider Ownership: 22.3%

Earnings Growth Forecast: 66.2% p.a.

Knight Therapeutics, a Canadian growth company with high insider ownership, is forecasted to achieve revenue growth of 6.8% annually, outpacing the market slightly. Despite recent net losses (CAD 1.94 million in Q2 2024), the company has raised its revenue guidance for 2024 to CAD 355-365 million and completed significant share buybacks, enhancing shareholder value. Analysts project earnings growth at an impressive rate of over 66% per year as Knight aims for profitability within three years.

- Unlock comprehensive insights into our analysis of Knight Therapeutics stock in this growth report.

- Our expertly prepared valuation report Knight Therapeutics implies its share price may be lower than expected.

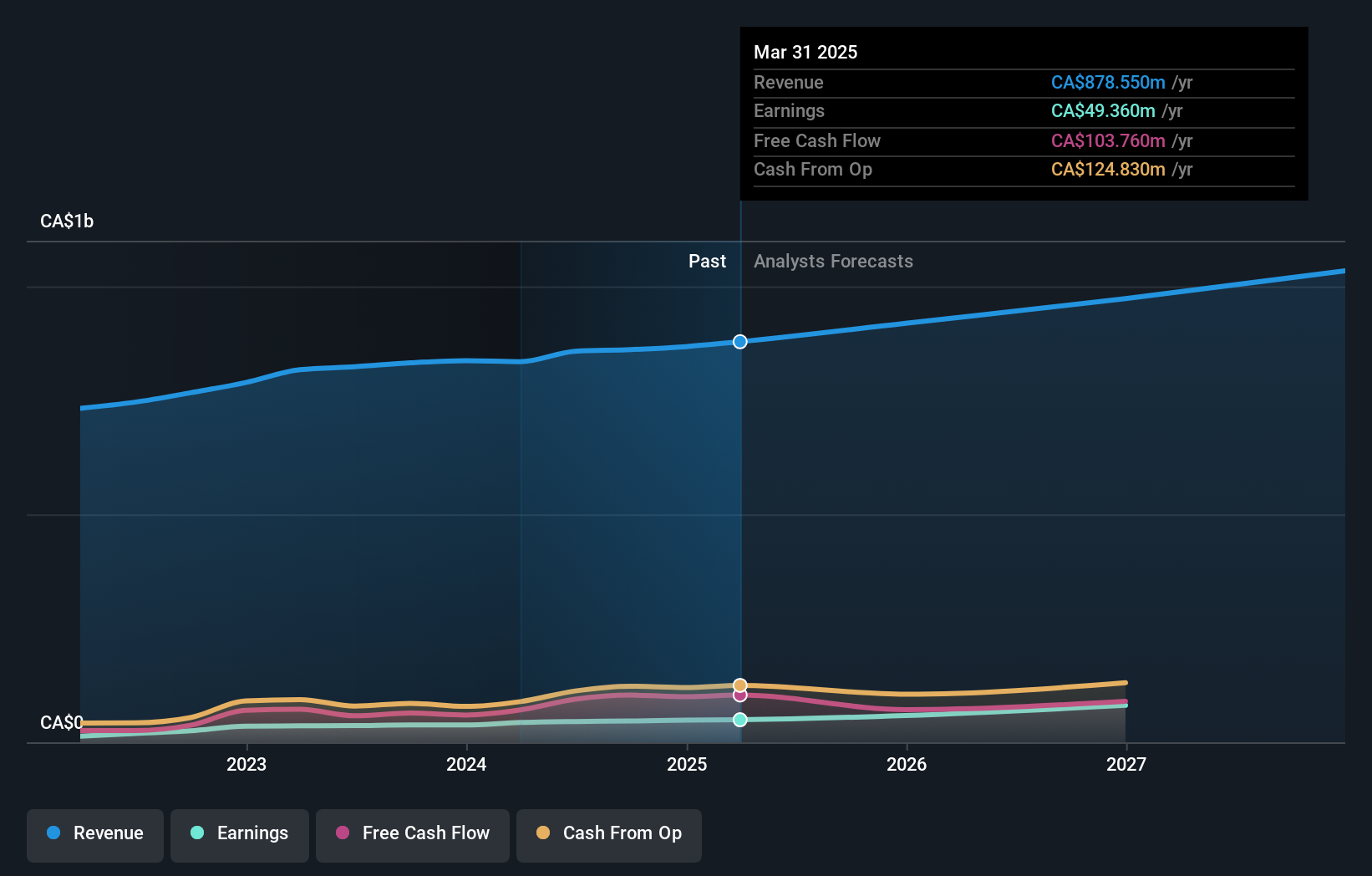

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged individuals across Canada, the United States, Europe, and internationally, with a market cap of CA$1.43 billion.

Operations: The company's revenue segments include Patient Care, which generated CA$183.98 million, and Segment Adjustment, which accounted for CA$673.74 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 21.5% p.a.

Savaria Corporation, a Canadian growth company with high insider ownership, reported Q2 2024 earnings of CAD 10.96 million on sales of CAD 221.34 million, showing year-over-year growth. Despite shareholder dilution over the past year and revenue forecasted to grow slower than 20% annually, analysts expect significant earnings growth at around 21.5% per year over the next three years. Savaria maintains a reliable monthly dividend policy and trades at a considerable discount to its estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Savaria.

- The valuation report we've compiled suggests that Savaria's current price could be quite moderate.

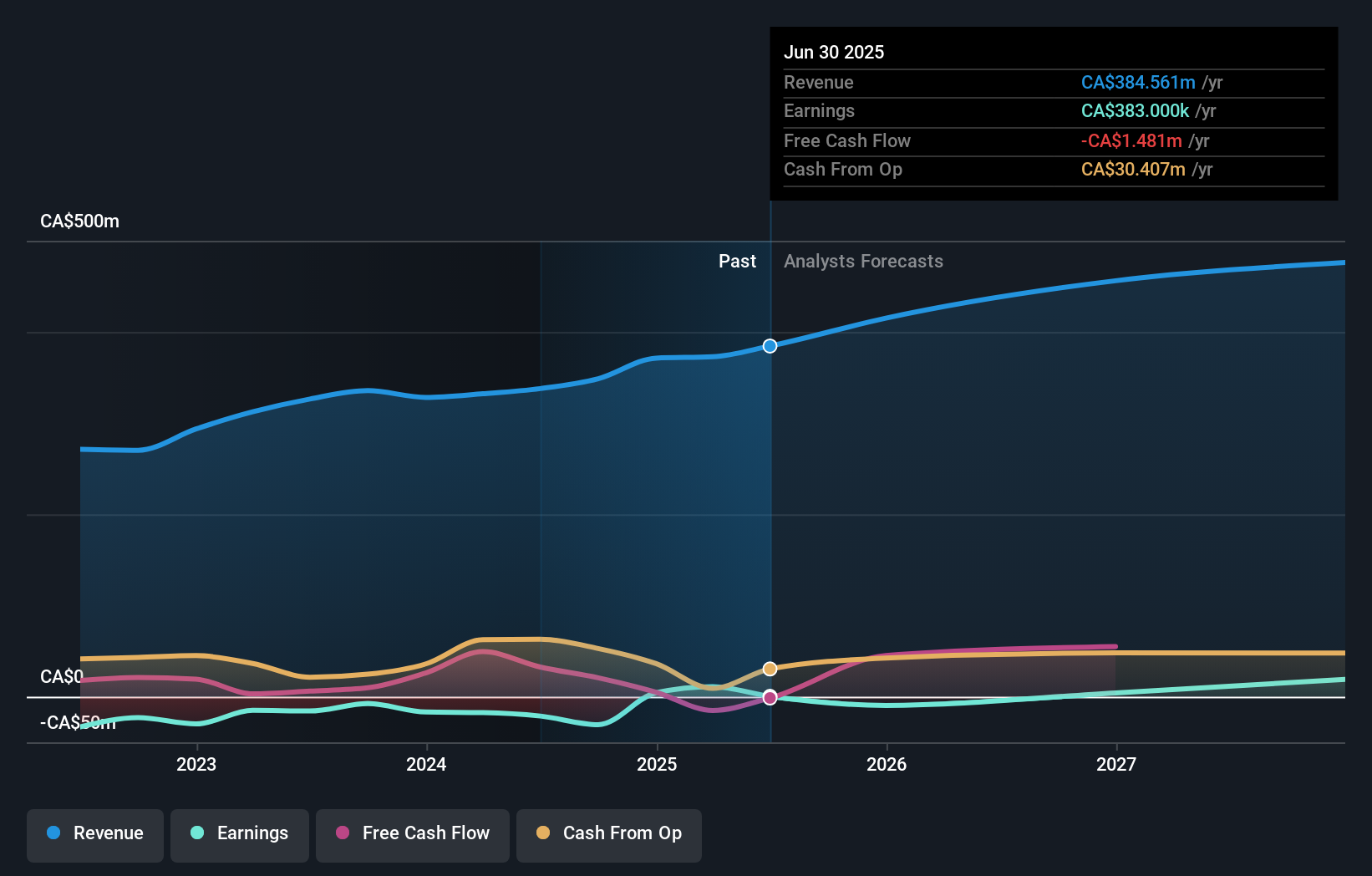

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. provides technology solutions for health and human service providers across several regions, including Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally, with a market cap of CA$391.57 million.

Operations: Vitalhub's revenue from healthcare software amounts to CA$58.32 million.

Insider Ownership: 15.1%

Earnings Growth Forecast: 65.9% p.a.

Vitalhub, a Canadian growth company with high insider ownership, has shown robust revenue growth but mixed profitability. For Q2 2024, revenue increased to C$16.24 million from C$13.09 million a year ago, though it posted a net loss of C$0.34 million compared to net income of C$0.62 million previously. Despite this, earnings are forecasted to grow significantly by 65.93% annually over the next three years and are expected to outpace the Canadian market's growth rate substantially.

- Click to explore a detailed breakdown of our findings in Vitalhub's earnings growth report.

- Our comprehensive valuation report raises the possibility that Vitalhub is priced lower than what may be justified by its financials.

Make It Happen

- Navigate through the entire inventory of 39 Fast Growing TSX Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet with reasonable growth potential.