Undiscovered Gems In Canada Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

In recent weeks, Canadian equities have reached new record highs, buoyed by dovish signals from the Bank of Canada and supportive measures from the Federal Reserve. This positive market sentiment has particularly benefited small-cap stocks, which are often more sensitive to interest rate changes and economic shifts. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and growth potential that can capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Flint | 46.67% | 13.46% | 21.87% | ★★★★★☆ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Hemlo Mining | NA | 26.48% | 134.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cronos Group (TSX:CRON)

Simply Wall St Value Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and international markets with a market cap of CA$1.60 billion.

Operations: Cronos Group generates revenue primarily from the cultivation, manufacture, and marketing of cannabis and cannabis-derived products, amounting to $132.36 million. Their financial performance is characterized by a focus on managing costs associated with these operations.

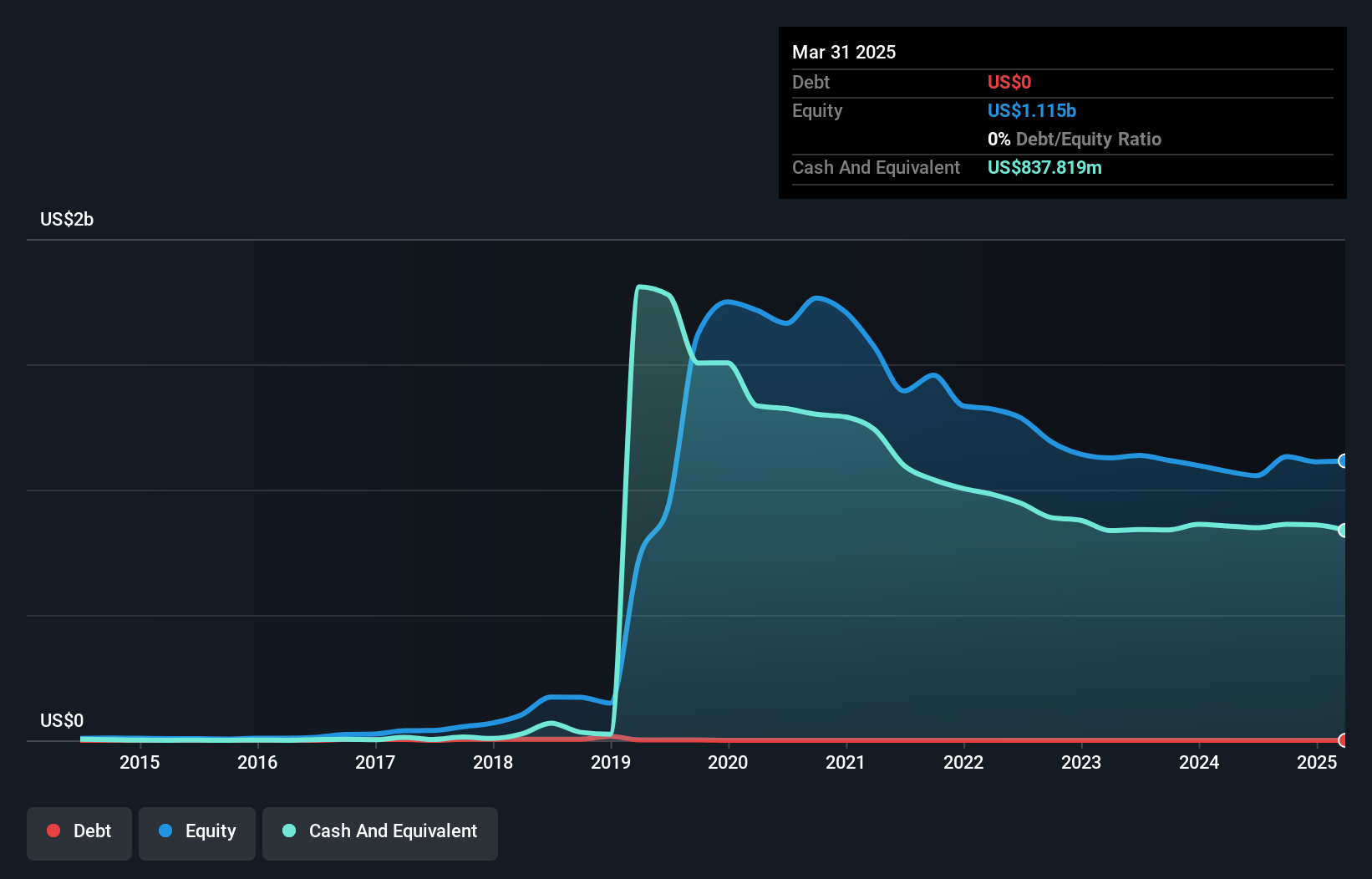

Cronos Group, a notable player in the cannabis sector, recently reported impressive financial results with third-quarter sales reaching US$48.83 million, up from US$46.59 million last year. Net income soared to US$25.96 million compared to US$8.35 million previously, reflecting its high-quality earnings and profitability achieved this year. The company is debt-free and has repurchased 2,792,813 shares for US$5.46 million under its buyback program since May 2025. With innovative product launches like Lord Jones Live Resin Fusions™ pre-rolls and seasonal SOURZ by Spinach edibles expanding across Canada, Cronos demonstrates strong growth potential within the industry.

Magellan Aerospace (TSX:MAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Magellan Aerospace Corporation, with a market cap of CA$1.03 billion, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe through its subsidiaries.

Operations: Magellan generates revenue primarily from its aerospace segment, which amounted to CA$1.01 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

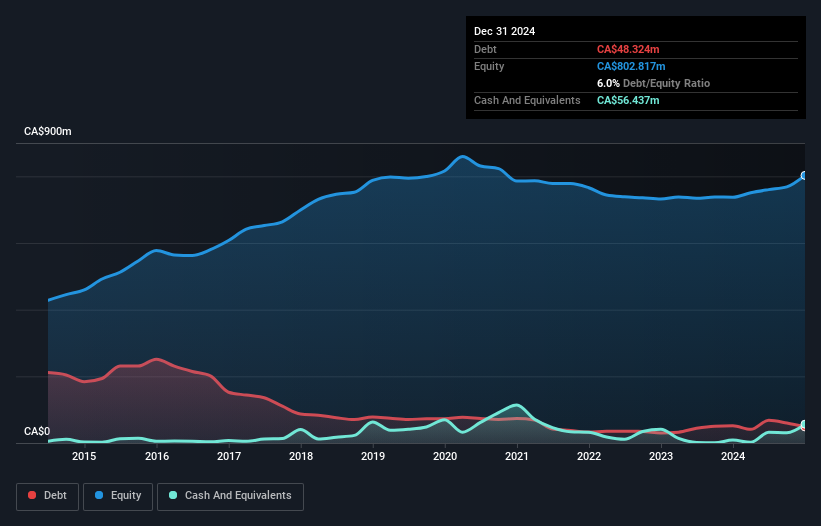

Magellan Aerospace, a small player in Canada's aerospace sector, is showing promising signs with earnings growth of 131% over the past year, significantly outpacing the industry's 34%. The company boasts high-quality earnings and trades at a compelling value, estimated to be 62.9% below its fair value. Recent financials highlight a net income rise to CAD 12.67 million for Q3 from CAD 5.85 million last year, alongside sales of CAD 255.67 million up from CAD 223.51 million. Additionally, Magellan's debt-to-equity ratio has improved from 8.6% to 7.9% over five years, reflecting prudent financial management.

- Navigate through the intricacies of Magellan Aerospace with our comprehensive health report here.

Evaluate Magellan Aerospace's historical performance by accessing our past performance report.

Hemlo Mining (TSXV:HMMC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hemlo Mining Corp. is involved in gold mining operations with a market capitalization of CA$1.78 billion.

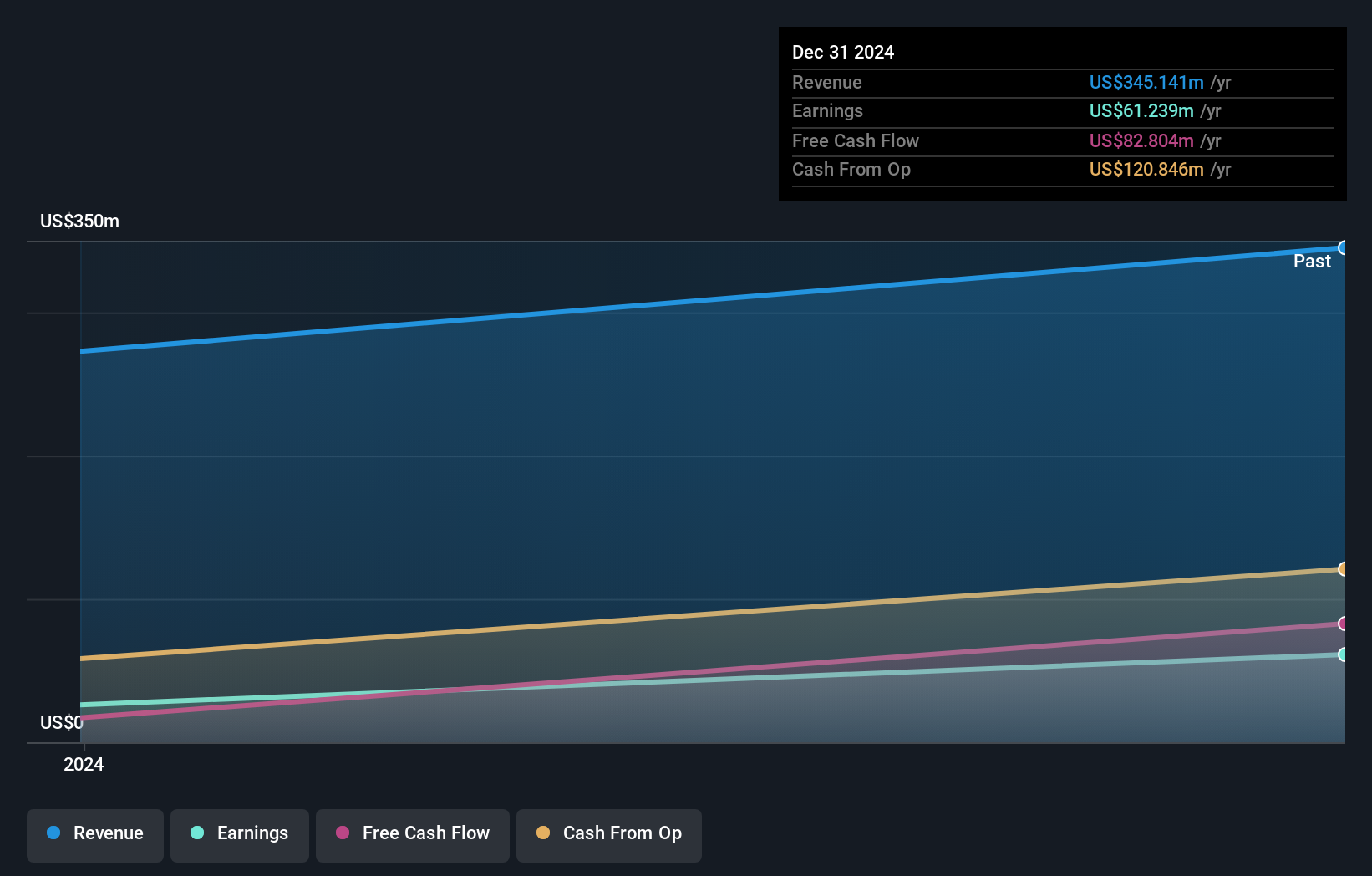

Operations: Hemlo Mining Corp. generates revenue primarily from its gold and other precious metals segment, amounting to CA$345.14 million.

Hemlo Mining, a small player in the mining sector, has shown impressive earnings growth of 134.5% over the past year, outpacing the Oil and Gas industry. Despite being debt-free for five years and trading at 88.8% below its estimated fair value, concerns about its ability to continue as a going concern were highlighted by auditors recently. The company's levered free cash flow increased significantly from C$17 million in 2023 to C$82 million in 2024, suggesting operational improvements or strategic adjustments. Notably illiquid shares and recent leadership changes with Carl DeLuca joining as General Counsel may influence future dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Hemlo Mining.

Review our historical performance report to gain insights into Hemlo Mining's's past performance.

Key Takeaways

- Reveal the 45 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)