Cronos Group (TSX:CRON): Exploring Valuation as Investor Interest Picks Up

Reviewed by Kshitija Bhandaru

Cronos Group (TSX:CRON) shares have captured interest lately, driven by a noticeable uptick in performance over the past month. The cannabis-focused company has seen its stock climb by 5% in the last month, sparking fresh attention from investors.

See our latest analysis for Cronos Group.

Looking at the broader picture, Cronos Group's recent 30-day share price return of 4.9% adds to a steady build in momentum this year. However, the one-year total shareholder return remains modest at just 0.2%. While the headline numbers may seem quiet, the stock’s positive movement signals cautious optimism and suggests that investors are warming up to the company’s improving fundamentals after several challenging years.

If the renewed enthusiasm in Cronos caught your attention, it might be a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares still trading below analyst price targets, even after double-digit gains this year, investors are left to wonder if Cronos Group represents an appealing value opportunity or if future growth has already been factored in by the market.

Most Popular Narrative: 8.4% Undervalued

Cronos Group’s fair value according to the most popular narrative stands above the last closing price, hinting at meaningful further upside if expectations hold. This narrative draws from forecasts and business shifts that analysts believe will re-energize revenue, margins, and global expansion, which are key ingredients for the valuation premium.

Cronos is poised to significantly increase revenue as additional cultivation capacity at GrowCo comes online in Fall 2025, enabling the company to address persistent supply constraints and meet robust consumer demand in Canada and key international markets.

Want to know what’s behind this optimism? The full narrative reveals the crucial mix of future revenue acceleration, margin expansion, and a profit multiple typically reserved for industry leaders. The key financial levers may surprise you. Discover which bold projections are driving this target now.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential delays at GrowCo and ongoing regulatory uncertainty in key international markets. These factors could quickly shift the outlook.

Find out about the key risks to this Cronos Group narrative.

Another View: What Multiples Say

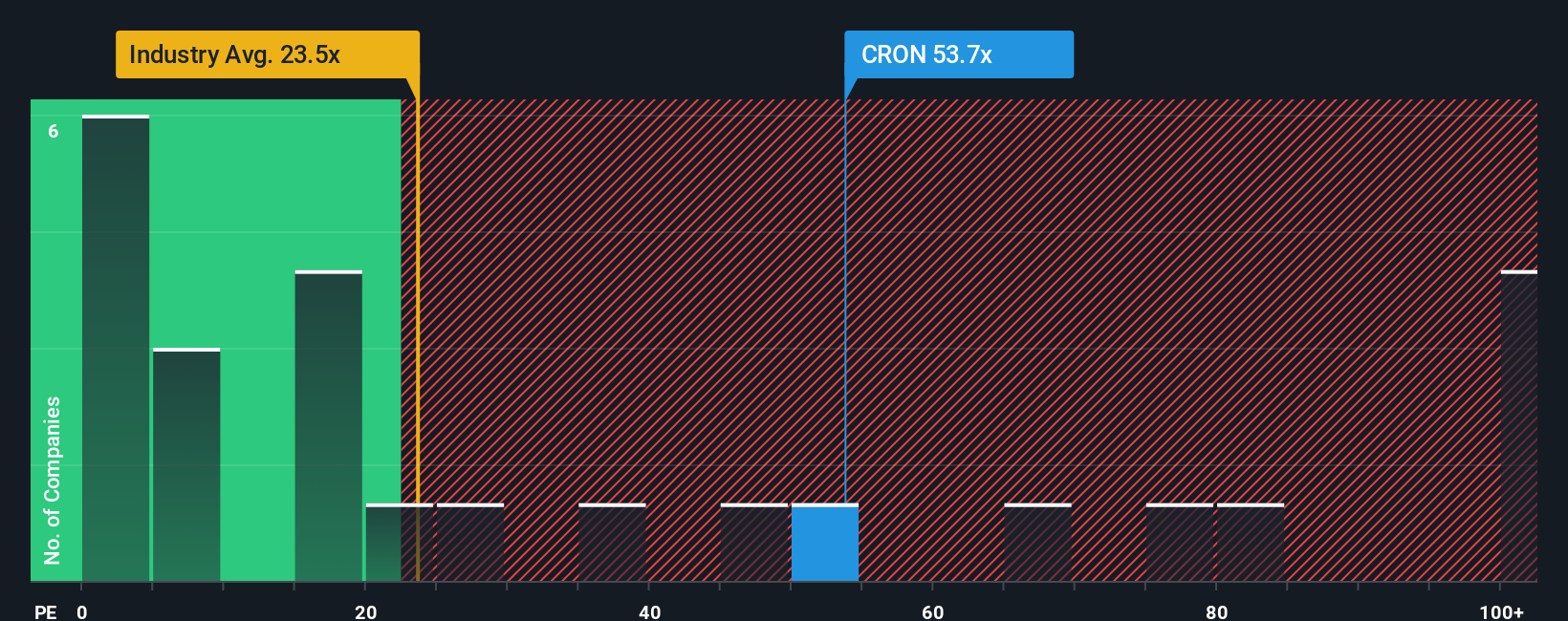

Taking a different angle, Cronos Group trades at a price-to-earnings ratio of 53.7x, which is well above both the North American Pharmaceuticals industry average of 23.6x and the fair ratio of 47.7x. This premium suggests the market is pricing in significant future growth, leaving less margin for error if expectations are missed. Is the optimism fully justified, or are today’s levels setting a high bar for future results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cronos Group Narrative

If you see things differently or want to dig into the details with your own analysis, you can build your personal view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cronos Group.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one opportunity. Take charge now and access fresh stock picks filtered by growth, value, and tomorrow’s biggest themes, before everyone else catches on.

- Maximize your long-term returns with steady income by reviewing these 19 dividend stocks with yields > 3% offering yields above 3% and reliable payout histories.

- Capitalize on the AI revolution by analyzing these 24 AI penny stocks at the forefront of automation, machine learning, and next-gen computing.

- Spot undervalued opportunities ready for re-rating with these 910 undervalued stocks based on cash flows based on robust cash flow analysis and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)