The harsh reality for 1933 Industries Inc. (CSE:TGIF) shareholders is that its auditors, Meyers Norris Penny LLP - MNP LLP, expressed doubts about its ability to continue as a going concern, in its reported results to July 2021. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

See our latest analysis for 1933 Industries

What Is 1933 Industries's Net Debt?

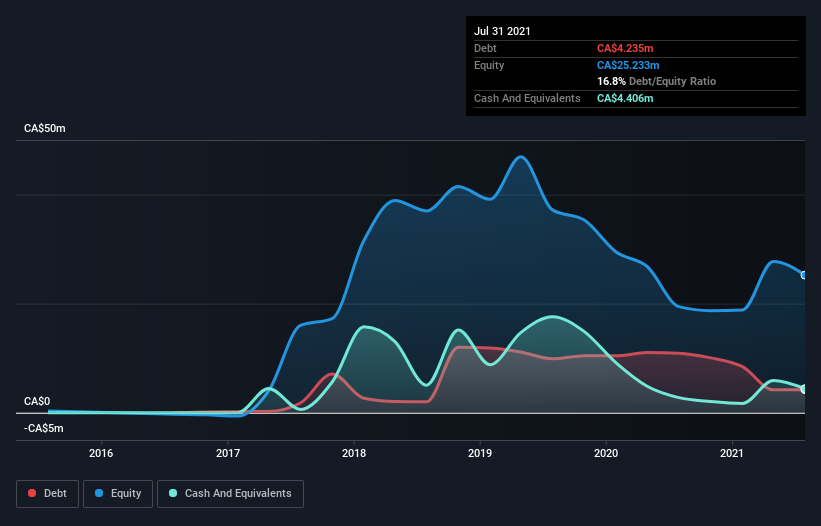

As you can see below, 1933 Industries had CA$4.23m of debt at July 2021, down from CA$10.9m a year prior. But it also has CA$4.41m in cash to offset that, meaning it has CA$171.0k net cash.

How Healthy Is 1933 Industries' Balance Sheet?

We can see from the most recent balance sheet that 1933 Industries had liabilities of CA$2.71m falling due within a year, and liabilities of CA$17.4m due beyond that. On the other hand, it had cash of CA$4.41m and CA$934.1k worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$14.8m.

1933 Industries has a market capitalization of CA$24.8m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, 1933 Industries also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is 1933 Industries's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year 1933 Industries's revenue was pretty flat, and it made a negative EBIT. While that hardly impresses, its not too bad either.

So How Risky Is 1933 Industries?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year 1933 Industries had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of CA$5.1m and booked a CA$6.5m accounting loss. With only CA$171.0k on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with 1933 Industries (including 2 which are significant) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:TGIF

1933 Industries

Engages in the cultivation, extraction, and production of cannabis products in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives