- South Korea

- /

- Entertainment

- /

- KOSDAQ:A078340

High Growth Tech And 2 Other Stocks with Potential Expansion

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and fluctuating economic indicators, global markets have shown mixed performances with the S&P 500 experiencing a slight decline while European indices managed modest gains. In this dynamic environment, identifying stocks with high growth potential requires careful consideration of factors such as earnings performance and market resilience, particularly in sectors like technology that are poised for expansion despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1215 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Synopex (KOSDAQ:A025320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synopex Inc. manufactures and sells FPCB products and electronic components in South Korea and internationally, with a market capitalization of approximately ₩500.85 billion.

Operations: The company's primary revenue stream is its FPCB Business Division, generating ₩316.16 billion, while the Filter Business Division contributes ₩38.32 billion.

Synopex Inc. has demonstrated a robust growth trajectory, with its revenue forecast to increase by 16.3% annually, outpacing the Korean market's average of 9.1%. Despite recent earnings fluctuations—net income dropped to KRW 1.39 billion from KRW 2.91 billion year-over-year—the company's earnings are expected to surge by an impressive 27.5% per year. Notably, Synopex's R&D commitment is reflected in its innovation and product development, crucial for maintaining competitive advantage in the fast-evolving tech landscape. This focus on R&D aligns with industry trends where leading firms invest heavily to spearhead technological advancements and market adaptation.

- Click to explore a detailed breakdown of our findings in Synopex's health report.

Examine Synopex's past performance report to understand how it has performed in the past.

Com2uS (KOSDAQ:A078340)

Simply Wall St Growth Rating: ★★★★☆☆

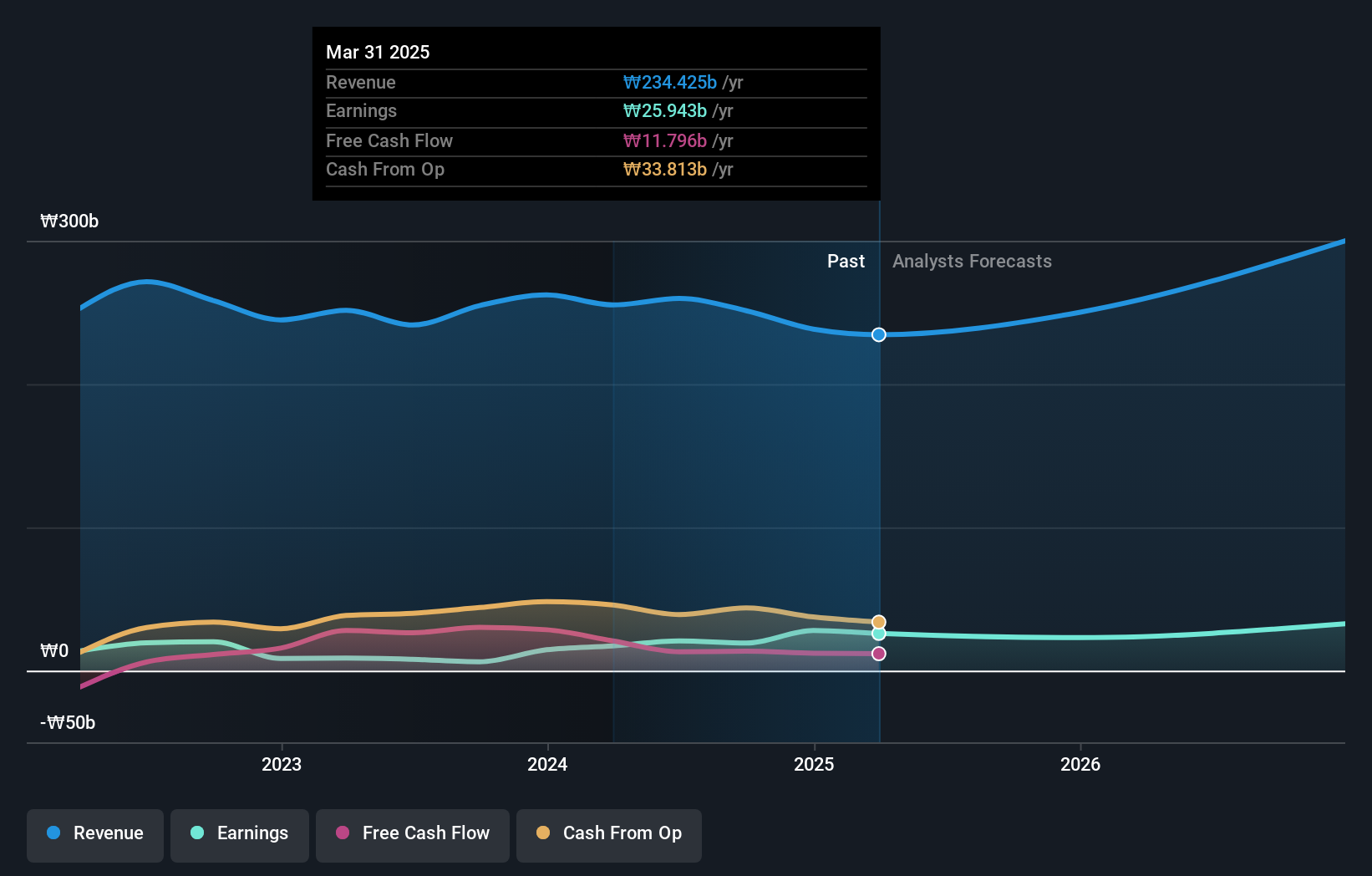

Overview: Com2uS Corporation is a global developer and publisher of mobile games, operating in regions including South Korea, the United States, and Europe, with a market cap of ₩532.83 billion.

Operations: Com2uS generates revenue primarily from its mobile gaming segment, which accounts for ₩549.09 billion, supplemented by contributions from VFX and New Media, Exhibition Events, and Broadcast Content Production. The company's diverse portfolio extends across various international markets.

Com2uS is navigating a transformative phase, with an expected revenue growth of 12% annually, outstripping the broader Korean market's average of 9.1%. This growth is underpinned by strategic expansions and innovations, particularly noted during their recent presentation at NH Corporate Day. Despite current unprofitability, forecasts suggest a promising turnaround with earnings projected to surge by approximately 81.8% annually over the next three years. However, challenges persist as its Return on Equity (RoE) is anticipated to remain modest at 4.8%, reflecting underlying efficiency issues that could dampen profitability gains.

- Navigate through the intricacies of Com2uS with our comprehensive health report here.

Review our historical performance report to gain insights into Com2uS''s past performance.

WildBrain (TSX:WILD)

Simply Wall St Growth Rating: ★★★★☆☆

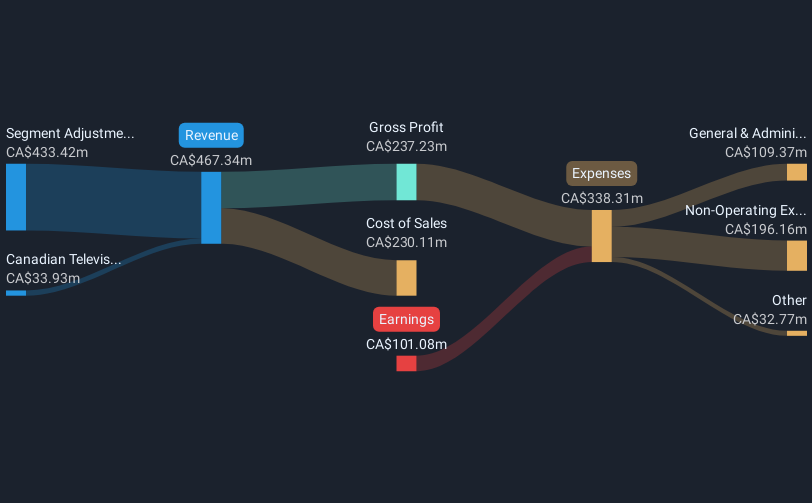

Overview: WildBrain Ltd. is involved in the development, production, and distribution of films and television programs across Canada, the United States, the United Kingdom, and internationally with a market cap of approximately CA$359.81 million.

Operations: The company generates revenue primarily through Canadian television broadcasting, contributing CA$33.93 million. It operates in the film and TV production and distribution sectors across multiple regions, including Canada, the U.S., and the UK.

WildBrain's trajectory in the entertainment sector is marked by a notable forecast of 7.2% annual revenue growth, outpacing the Canadian market average of 5.9%. This growth is complemented by an impressive projected earnings surge of 117.9% annually, positioning the company for profitability within three years. Recent strategic moves include a significant private placement and leadership changes at its shareholders' meeting, signaling a dynamic approach to governance and capital management. These developments underscore WildBrain's potential to reshape its financial landscape and stake a larger claim in its industry.

- Take a closer look at WildBrain's potential here in our health report.

Evaluate WildBrain's historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 1215 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078340

Com2uS

Develops and publishes mobile games in South Korea, the United States, China, Japan, Taiwan, Southeast Asia, Europe, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)