- Canada

- /

- Consumer Finance

- /

- TSX:GSY

TSX Growth Stocks With High Insider Ownership For June 2025

Reviewed by Simply Wall St

As we head into the second half of 2025, the Canadian market is navigating through a landscape shaped by evolving trade negotiations and potential tariff adjustments, which could influence inflation and economic growth. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Tenaz Energy (TSX:TNZ) | 10.5% | 151.2% |

| Stingray Group (TSX:RAY.A) | 25.7% | 30.8% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.3% |

| Propel Holdings (TSX:PRL) | 36.4% | 33% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Discovery Silver (TSX:DSV) | 17.5% | 39.4% |

| Burcon NutraScience (TSX:BU) | 15.1% | 152.2% |

| Aritzia (TSX:ATZ) | 17.4% | 24.7% |

| Almonty Industries (TSX:AII) | 11.9% | 55.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. offers non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands to Canadian consumers, with a market cap of CA$2.51 billion.

Operations: The company generates revenue from its Easyhome segment, contributing CA$150.86 million, and its Easyfinancial segment, which brings in CA$1.41 billion.

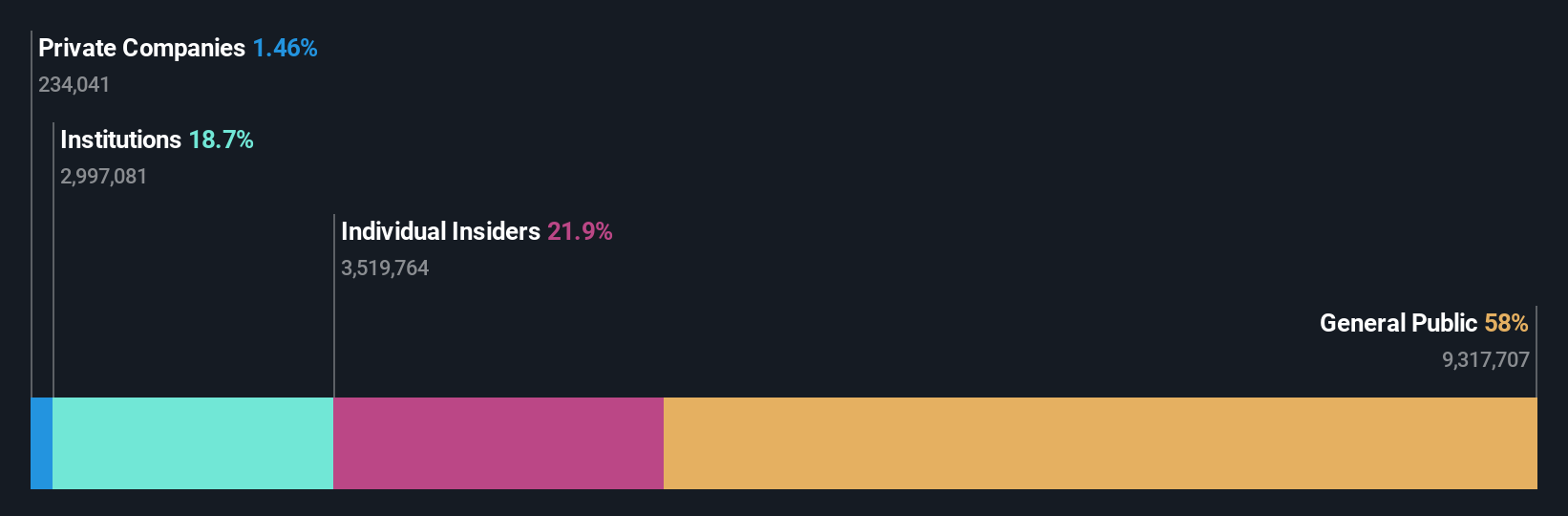

Insider Ownership: 21.9%

Return On Equity Forecast: 26% (2028 estimate)

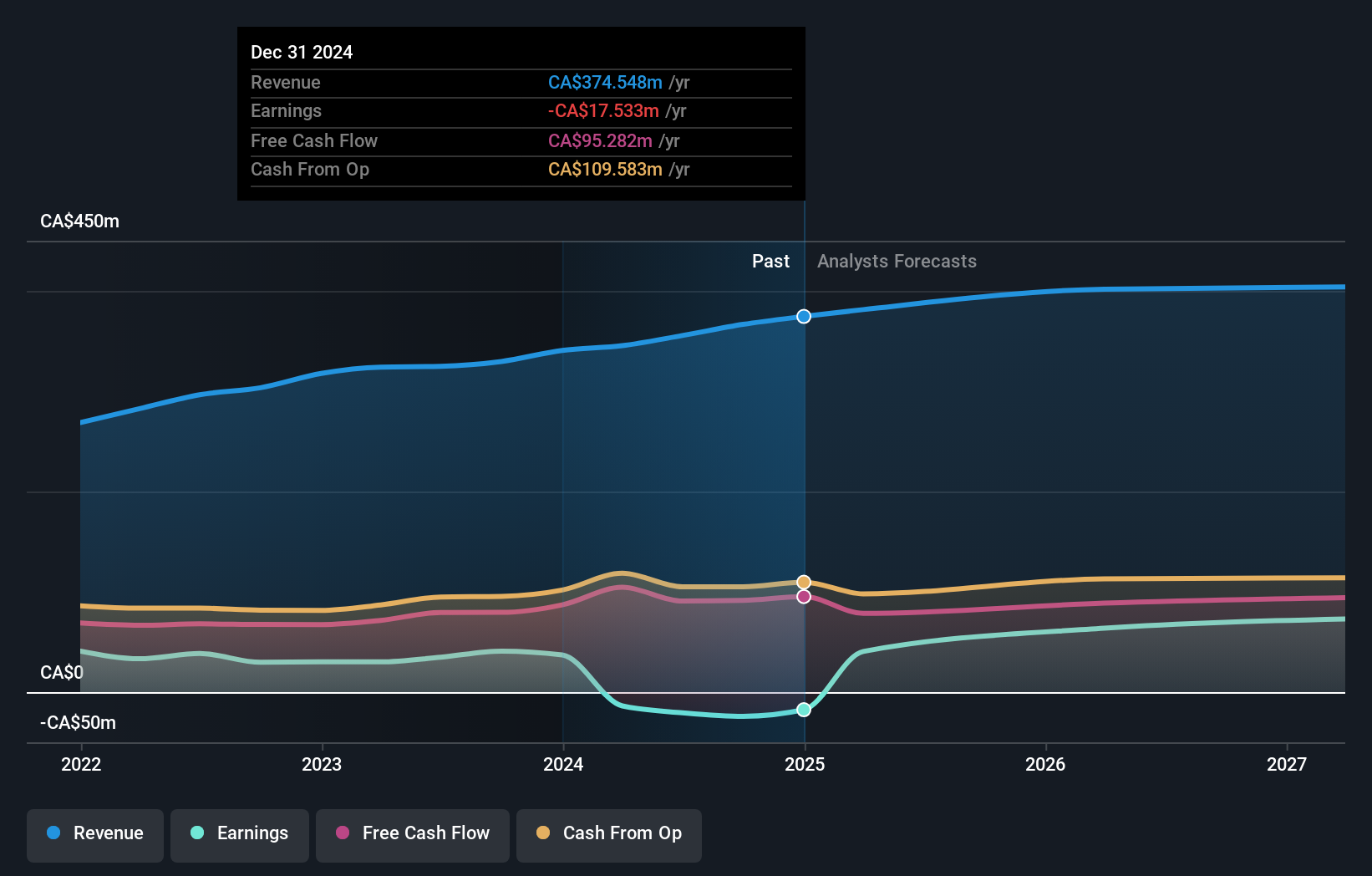

goeasy Ltd. showcases strong growth potential with forecasted earnings and revenue growth rates of 18.2% and 29.5% per year, respectively, outpacing the Canadian market averages. Despite recent net income decline to C$39.4 million for Q1 2025, insider ownership remains high with more shares bought than sold in the past three months without substantial volumes. However, debt coverage by operating cash flow is a concern and dividends are not well covered by free cash flows.

- Click to explore a detailed breakdown of our findings in goeasy's earnings growth report.

- Our comprehensive valuation report raises the possibility that goeasy is priced lower than what may be justified by its financials.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stingray Group Inc. is a music, media, and technology company operating in Canada, the United States, and internationally with a market cap of CA$677.59 million.

Operations: The company's revenue is derived from two main segments: Radio, contributing CA$132.35 million, and Broadcasting and Commercial Music, generating CA$254.54 million.

Insider Ownership: 25.7%

Return On Equity Forecast: 25% (2028 estimate)

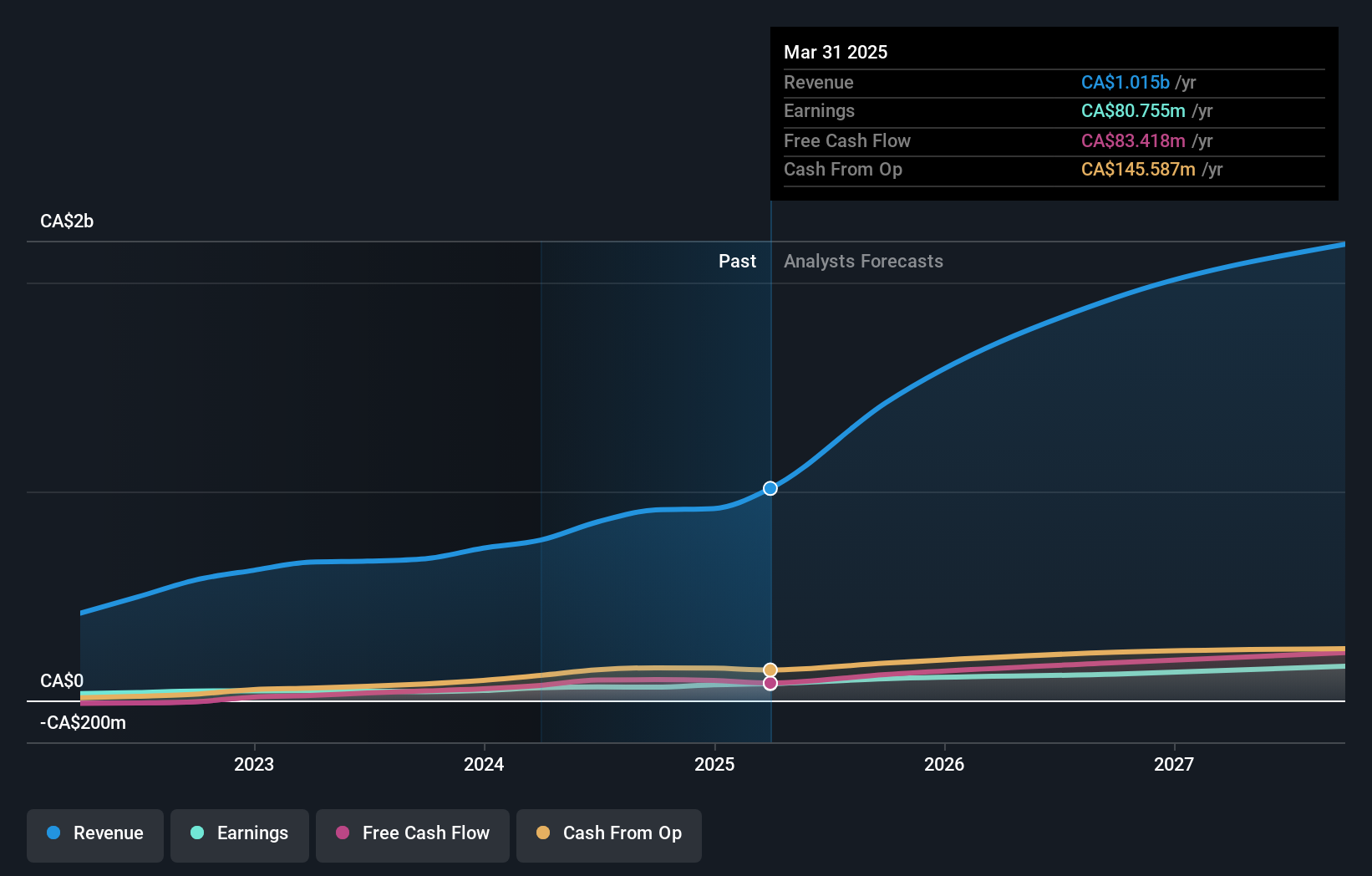

Stingray Group demonstrates promising growth potential with forecasted earnings and revenue growth rates of 30.8% and 5.7% per year, respectively, surpassing Canadian market averages. The company recently achieved profitability with a net income of C$36.44 million for the fiscal year ended March 31, 2025. Despite carrying a high level of debt, Stingray maintains a reliable dividend yield of 3.03%. Recent strategic partnerships highlight its commitment to integrating advanced technology in customer experiences.

- Click here and access our complete growth analysis report to understand the dynamics of Stingray Group.

- Our valuation report here indicates Stingray Group may be undervalued.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$3.64 billion.

Operations: TerraVest Industries Inc. generates revenue from several segments, including CA$216.52 million from Service, CA$104.18 million from Processing Equipment, CA$336.15 million from Compressed Gas Equipment, and CA$363 million from HVAC and Containment Equipment.

Insider Ownership: 19.1%

Return On Equity Forecast: N/A (2028 estimate)

TerraVest Industries exhibits strong growth potential with earnings and revenue projected to grow significantly at 26.8% and 28.5% per year, respectively, outpacing the Canadian market averages. Recent financials show a substantial increase in revenue to C$311.45 million for Q2 2025 compared to the previous year. Despite recent significant insider selling, TerraVest trades at a notable discount of 42.3% below its estimated fair value, enhancing its appeal among growth-focused investors in Canada.

- Take a closer look at TerraVest Industries' potential here in our earnings growth report.

- According our valuation report, there's an indication that TerraVest Industries' share price might be on the expensive side.

Summing It All Up

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 46 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion