- Canada

- /

- Metals and Mining

- /

- TSXV:RBX

TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst ongoing uncertainties in the Canadian market, influenced by potential tariffs and political shifts, investors are adopting a more cautious stance. While the TSX has shown slight gains, the focus on growth companies with high insider ownership becomes particularly relevant as these firms often demonstrate strong alignment between management and shareholder interests, potentially offering resilience in volatile times.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 36.2% |

| Robex Resources (TSXV:RBX) | 25.7% | 141.5% |

| Vox Royalty (TSX:VOXR) | 12% | 83.3% |

| Allied Gold (TSX:AAUC) | 17.7% | 85.1% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.5% | 76.8% |

| NTG Clarity Networks (TSXV:NCI) | 38.2% | 27.6% |

| Aritzia (TSX:ATZ) | 17.6% | 41.1% |

| Enterprise Group (TSX:E) | 32.2% | 26.7% |

| Burcon NutraScience (TSX:BU) | 16.4% | 152.2% |

| CHAR Technologies (TSXV:YES) | 10.8% | 63% |

Let's uncover some gems from our specialized screener.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market capitalization of approximately CA$5.96 billion.

Operations: The company generates revenue primarily from its apparel segment, which accounted for CA$2.52 billion.

Insider Ownership: 17.6%

Earnings Growth Forecast: 41.1% p.a.

Aritzia demonstrates strong growth potential with earnings forecasted to grow significantly at 41.1% annually, outpacing the Canadian market. Despite a recent CAD 66.36 million equity offering, insider ownership remains substantial with more shares bought than sold over three months. The company reported robust Q3 results, with net income rising to CAD 74.07 million from CAD 43.09 million year-over-year, reflecting its effective growth strategy amidst trading below fair value estimates and analyst expectations for price appreciation.

- Dive into the specifics of Aritzia here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Aritzia is trading behind its estimated value.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market cap of CA$563.84 million.

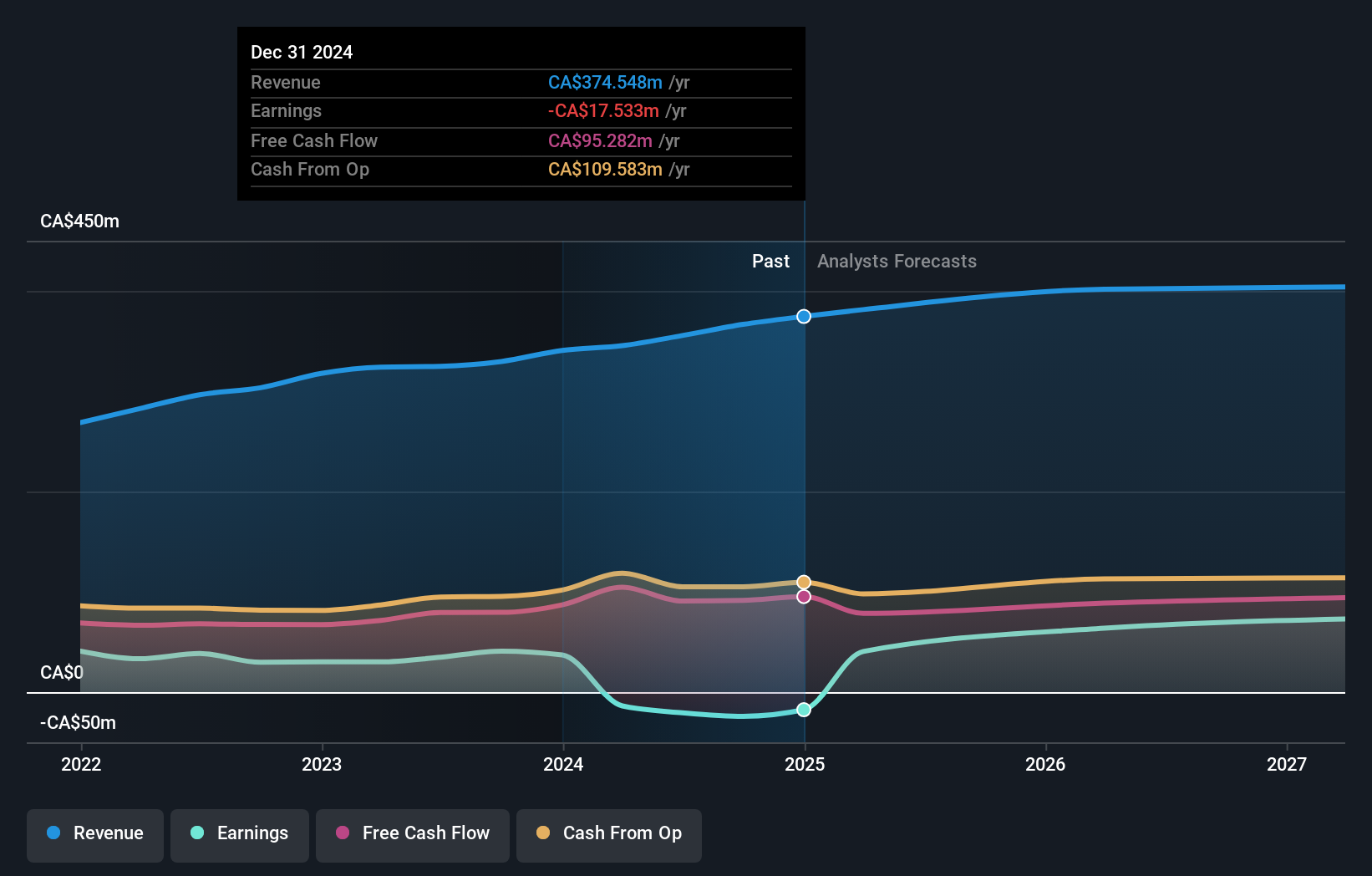

Operations: The company generates revenue from two primary segments: Radio, contributing CA$131.18 million, and Broadcasting and Commercial Music, accounting for CA$243.37 million.

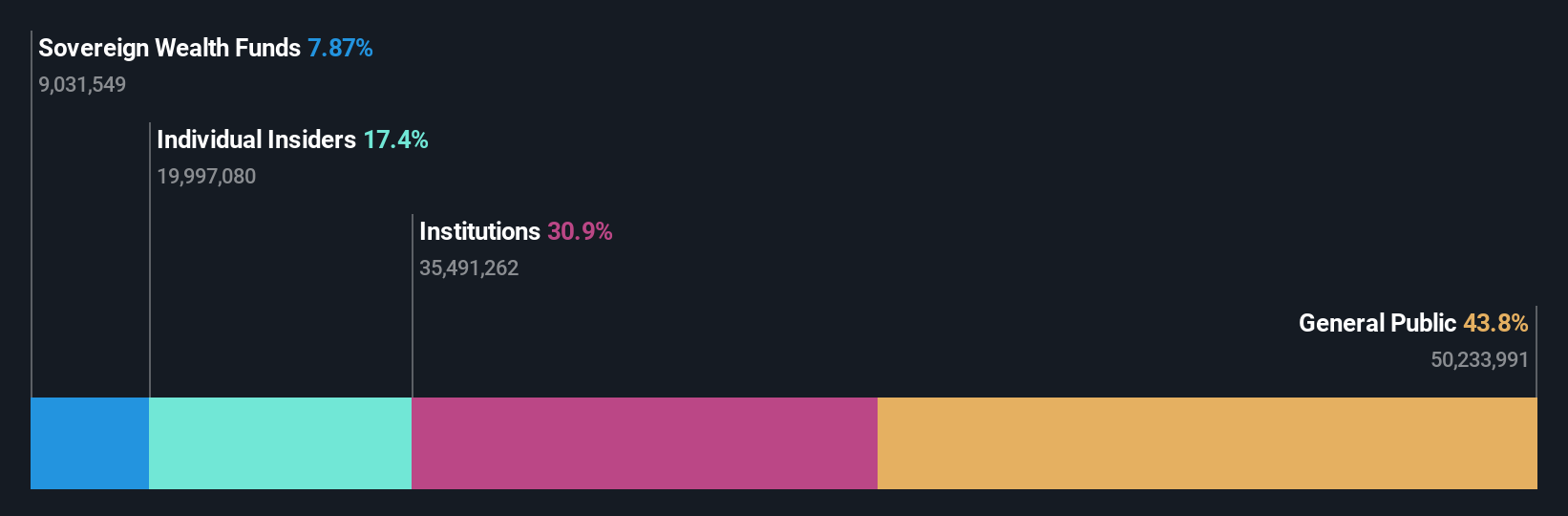

Insider Ownership: 25.7%

Earnings Growth Forecast: 79.6% p.a.

Stingray Group exhibits potential with insider ownership remaining strong despite high debt levels. Recent earnings showed a rise in net income to C$15.68 million from C$9.07 million year-over-year, and the company is trading below fair value estimates. While revenue growth is slower than the market at 4.5% annually, profitability is expected within three years, aligning with above-average market growth forecasts and analyst expectations for price appreciation by 37.7%.

- Unlock comprehensive insights into our analysis of Stingray Group stock in this growth report.

- Our valuation report unveils the possibility Stingray Group's shares may be trading at a discount.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$419.34 million.

Operations: The company generates revenue of CA$152.71 million from its gold mining operations in West Africa.

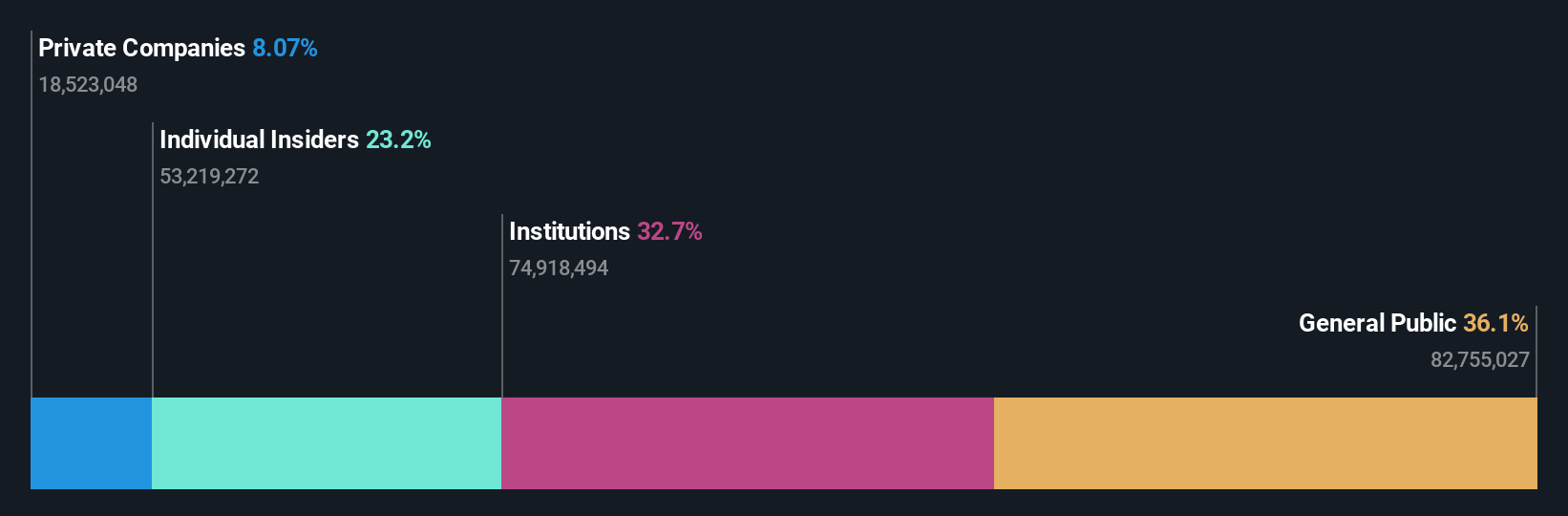

Insider Ownership: 25.7%

Earnings Growth Forecast: 141.5% p.a.

Robex Resources is positioned for significant growth, with revenue forecasted to increase by 53.2% annually, outpacing the Canadian market. The company recently secured a US$105 million debt facility to fund its Kiniero Gold Project in Guinea, aiming for first gold pour by late 2025. Despite past shareholder dilution, Robex trades below fair value estimates and is expected to become profitable within three years, supported by high insider ownership and strategic project developments.

- Click to explore a detailed breakdown of our findings in Robex Resources' earnings growth report.

- Our valuation report here indicates Robex Resources may be undervalued.

Summing It All Up

- Get an in-depth perspective on all 35 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RBX

Robex Resources

Engages in the exploration, development, and production of gold in West Africa.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives