- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Does Thor Explorations (TSXV:THX) London Spotlight Sharpen Its West African Gold Investment Narrative?

Reviewed by Sasha Jovanovic

- Thor Explorations’ President and CEO, Olusegun Lawson, recently presented at the Mines and Money @ Resourcing Tomorrow conference at London’s Business Design Centre, highlighting the company’s position in the West African gold sector.

- This high-profile conference appearance put Thor’s leadership and project story in front of a concentrated mining investor audience, potentially sharpening market focus on its growth plans and risk profile.

- We’ll now examine how Thor’s London conference appearance with its CEO on stage could influence the company’s existing investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Thor Explorations Investment Narrative Recap

To own Thor Explorations, you need to believe its West African gold assets can keep generating strong cash flow while it gradually reduces dependence on the Segilola mine. The CEO’s appearance at Mines and Money in London helps visibility but does not materially change the near term production and cost guidance, or the key risk that any disruption at Segilola could still have an outsized impact on earnings.

The most relevant recent announcement is Thor’s updated 2025 guidance, which tightened production to 90,000 oz to 95,000 oz and AISC to US$900 to US$1,000 per ounce. That clarity on current year delivery frames how investors might interpret the CEO’s conference messaging about growth projects, and how much weight to put on future diversification versus the company’s existing single mine exposure.

But while Thor’s conference presence may boost interest, investors should also be aware of the concentration risk around Segilola and how...

Read the full narrative on Thor Explorations (it's free!)

Thor Explorations' narrative projects $128.9 million revenue and $65.3 million earnings by 2028. This implies a 20.1% yearly revenue decline and a $72.1 million earnings decrease from $137.4 million today.

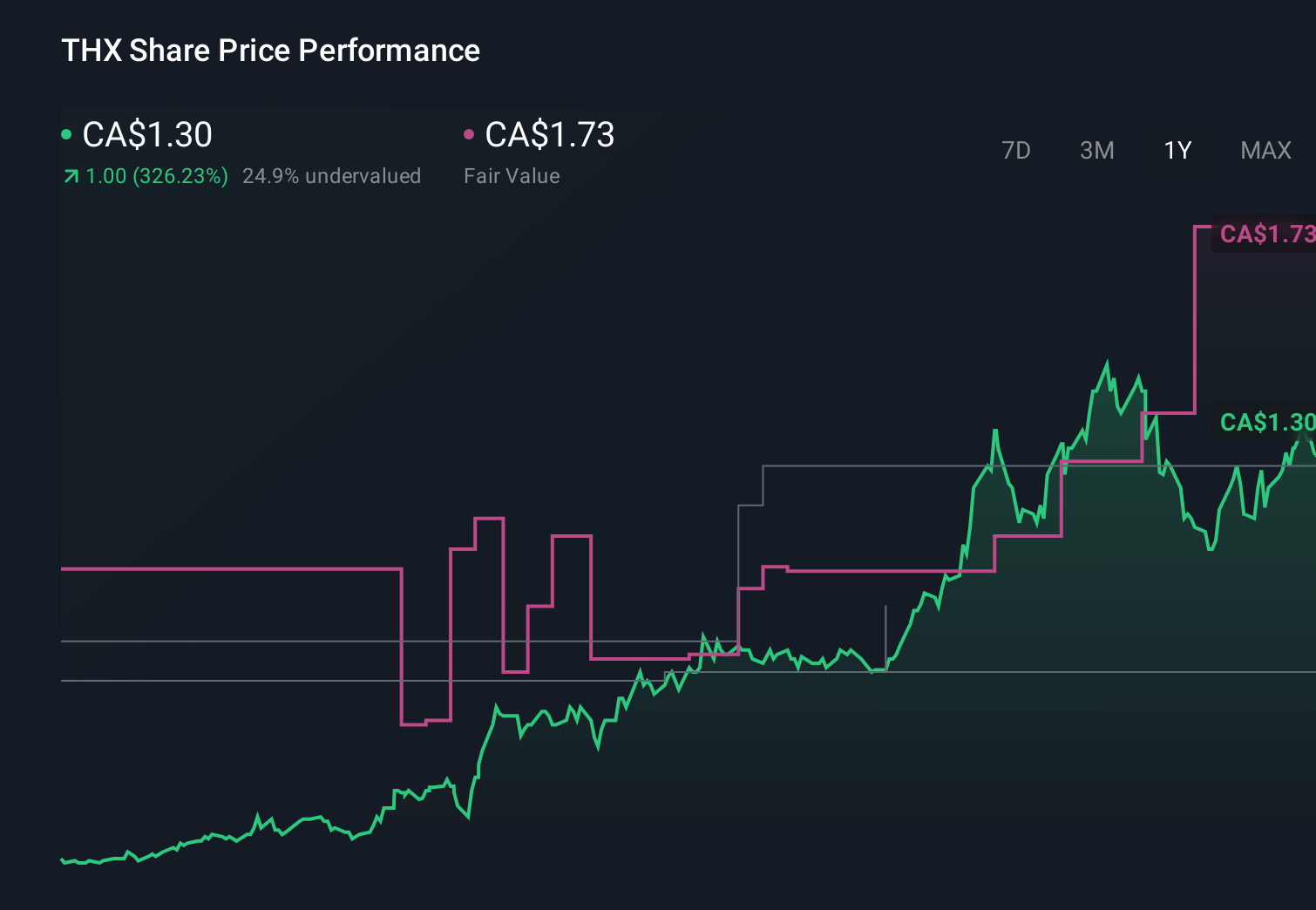

Uncover how Thor Explorations' forecasts yield a CA$1.73 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for Thor range from CA$0.16 to CA$4.81, with views spread right across the buckets. Against that wide dispersion, the continued reliance on Segilola as a single core cash generating asset is an important consideration for how you think about the company’s resilience over time.

Explore 9 other fair value estimates on Thor Explorations - why the stock might be worth less than half the current price!

Build Your Own Thor Explorations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thor Explorations research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thor Explorations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thor Explorations' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026