As the bull market marks its third anniversary, Canadian equities have shown impressive resilience, with the TSX gaining 67% since October 2022. For investors willing to explore beyond well-known stocks, penny stocks—often representing smaller or newer companies—offer intriguing opportunities amidst current market conditions. Despite their somewhat outdated name, these stocks can still present surprising value when supported by strong financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.60 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.31 | CA$233.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.08 | CA$725.17M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.22M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.29 | CA$915.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.90 | CA$153.28M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.11 | CA$206.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform serving Canada, the United States, and international markets with a market cap of CA$145.78 million.

Operations: The company generates revenue of $70.71 million from its cloud-based platform through development, marketing, and support management activities.

Market Cap: CA$145.78M

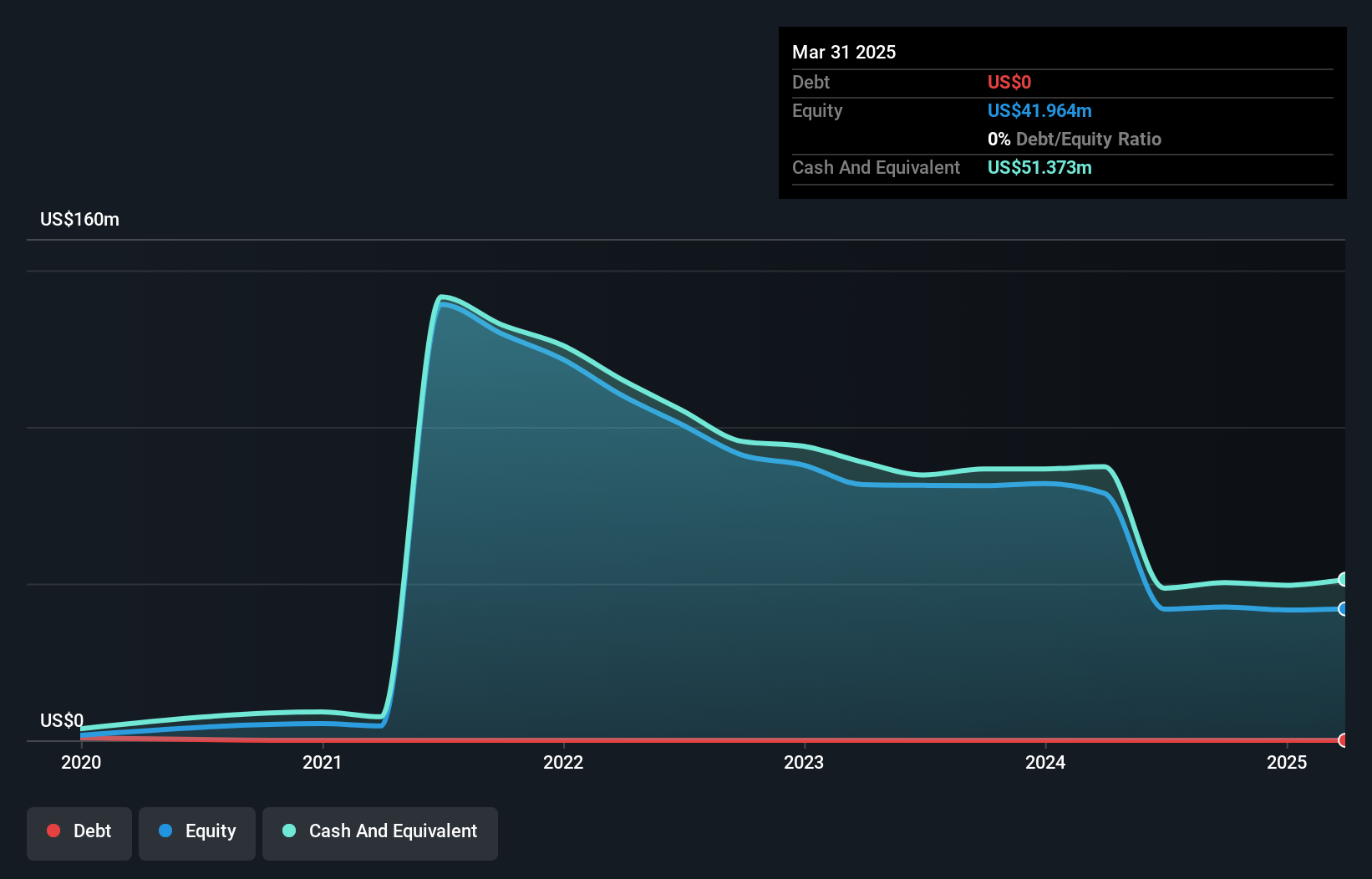

Thinkific Labs has shown a strong financial position with no debt and short-term assets exceeding liabilities. The company has become profitable over the past five years, achieving high-quality earnings and trading at a significant discount to its estimated fair value. Recent earnings reports indicate stable revenue growth, with second-quarter sales reaching US$18.1 million, up from US$16.21 million the previous year. Although net income decreased slightly compared to last year’s quarter, Thinkific's profitability remains intact with consistent earnings per share. Additionally, the company completed a share buyback program, reflecting confidence in its valuation and future prospects.

- Dive into the specifics of Thinkific Labs here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Thinkific Labs' future.

Almadex Minerals (TSXV:DEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almadex Minerals Ltd. is involved in acquiring and exploring mineral resource properties across Canada, the United States, and Mexico, with a market capitalization of CA$29.98 million.

Operations: The company's revenue is derived from the acquisition and exploration of mineral resource properties, totaling CA$0.05 million.

Market Cap: CA$29.98M

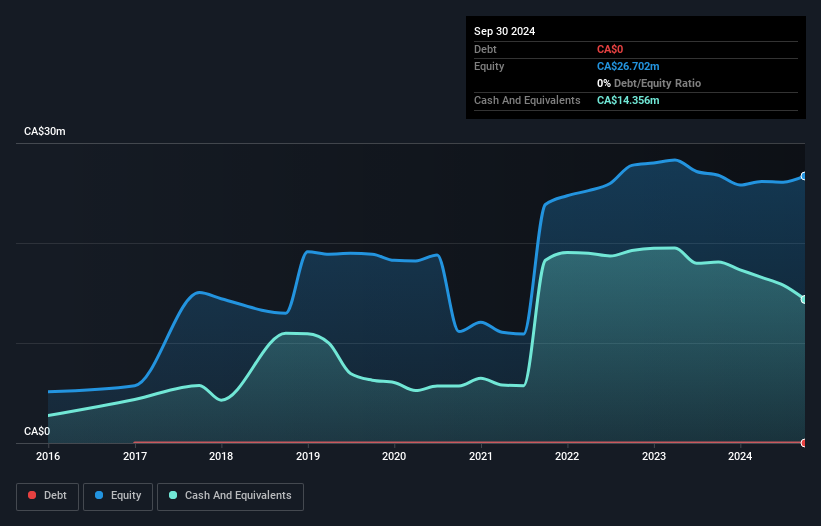

Almadex Minerals Ltd., with a market cap of CA$29.98 million, is a pre-revenue company focused on mineral exploration across North America. Recent developments include acquiring the Rattlesnake Project in Arizona, which shows promising early-stage assay results indicating potential for copper and silver deposits. The company also secured an option-joint venture agreement with Azucar Minerals for projects in Nevada. Despite its high share price volatility and low return on equity of 2.6%, Almadex benefits from no long-term liabilities and has not diluted shareholders recently, positioning it to capitalize on future exploration successes without financial strain.

- Unlock comprehensive insights into our analysis of Almadex Minerals stock in this financial health report.

- Gain insights into Almadex Minerals' past trends and performance with our report on the company's historical track record.

Trailbreaker Resources (TSXV:TBK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Trailbreaker Resources Ltd. is a mineral exploration company dedicated to acquiring, evaluating, exploring, and developing mineral assets in Canada, with a market cap of CA$11.60 million.

Operations: Trailbreaker Resources Ltd. has not reported any revenue segments.

Market Cap: CA$11.6M

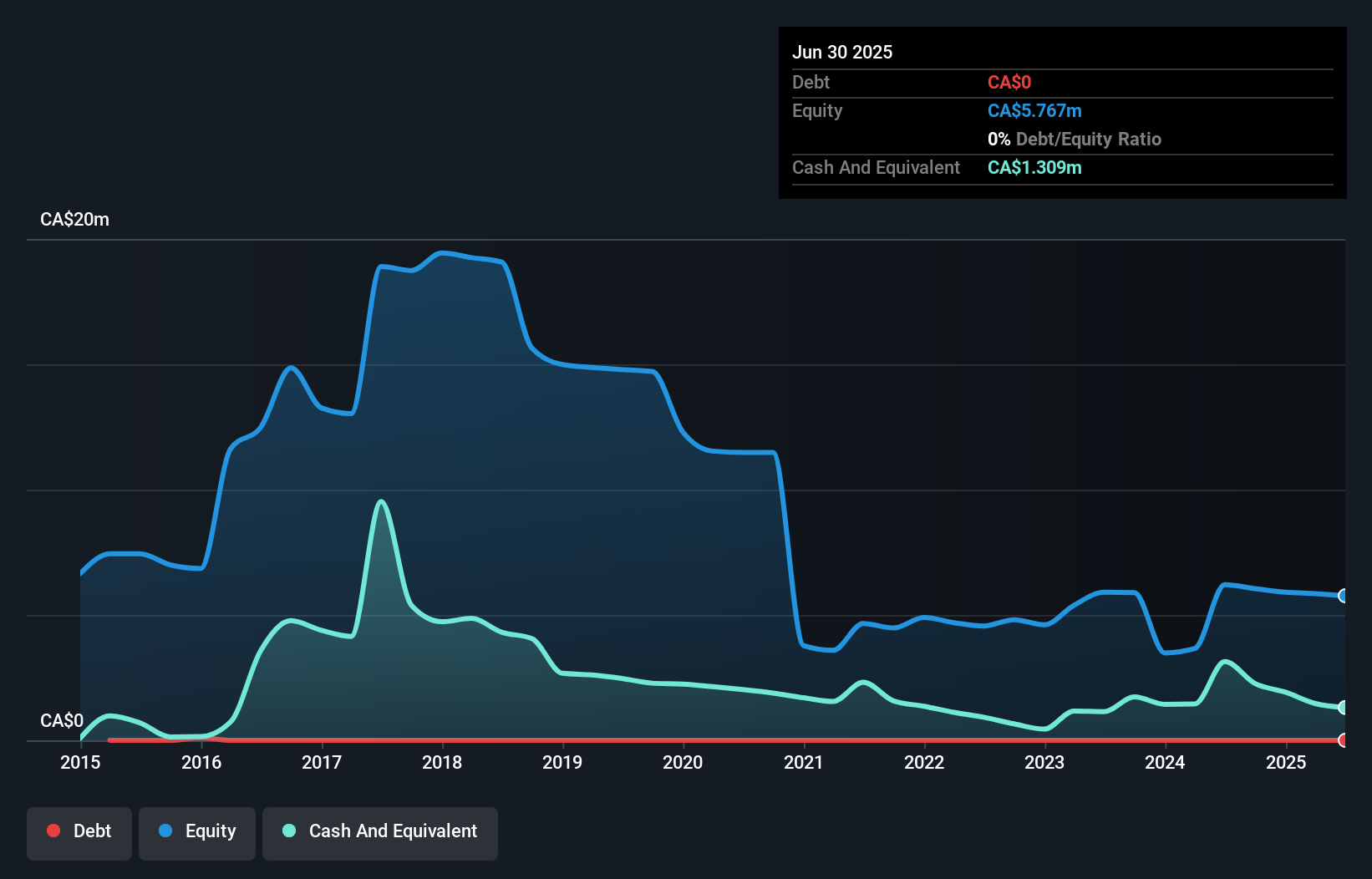

Trailbreaker Resources Ltd., with a market cap of CA$11.60 million, is a pre-revenue mineral exploration company focused on its Atsutla Gold project in British Columbia. Recent mobilization efforts aim to explore newly consolidated ground within the property, which hosts high-grade gold samples. Despite being debt-free and having experienced management, Trailbreaker faces challenges with less than a year of cash runway and increased share price volatility. The company has reduced losses over five years but remains unprofitable. Short-term assets cover liabilities, offering some financial stability as it advances exploration efforts for potential discoveries.

- Navigate through the intricacies of Trailbreaker Resources with our comprehensive balance sheet health report here.

- Explore historical data to track Trailbreaker Resources' performance over time in our past results report.

Next Steps

- Get an in-depth perspective on all 412 TSX Penny Stocks by using our screener here.

- Interested In Other Possibilities? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Thinkific Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:THNC

Thinkific Labs

Engages in the development, marketing, and support management of cloud-based platform in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)