- Canada

- /

- Food and Staples Retail

- /

- TSX:CRRX

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The Canadian market continues to navigate its third year of a bull market, with the TSX gaining 67% since October 2022, supported by easing inflation and potential interest rate cuts from the Bank of Canada. As investors seek opportunities beyond established giants, penny stocks—often representing smaller or newer companies—remain a relevant area for exploration. Despite their vintage name, these stocks can offer surprising value when backed by strong financials and have the potential to deliver significant returns in today's evolving economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.68 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.62 | CA$263.96M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.20 | CA$798.36M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$1.96 | CA$838.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.70 | CA$436.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.42 | CA$173.58M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.09 | CA$197.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 407 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CareRx (TSX:CRRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CareRx Corporation, along with its subsidiaries, offers pharmacy services to senior homes and other congregate care settings in Canada, with a market cap of CA$232.40 million.

Operations: The company generates revenue primarily from its Specialty Pharmacy segment, which amounted to CA$365.96 million.

Market Cap: CA$232.4M

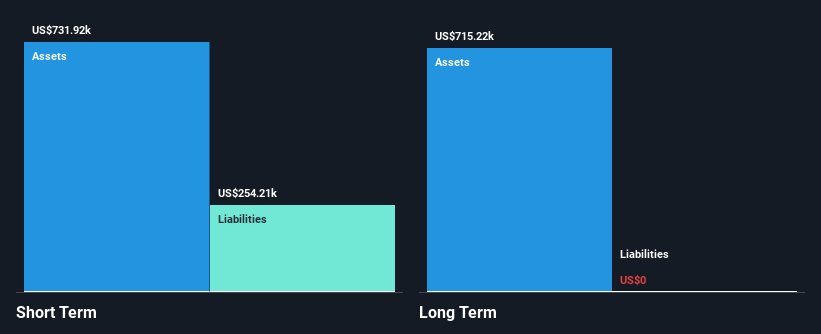

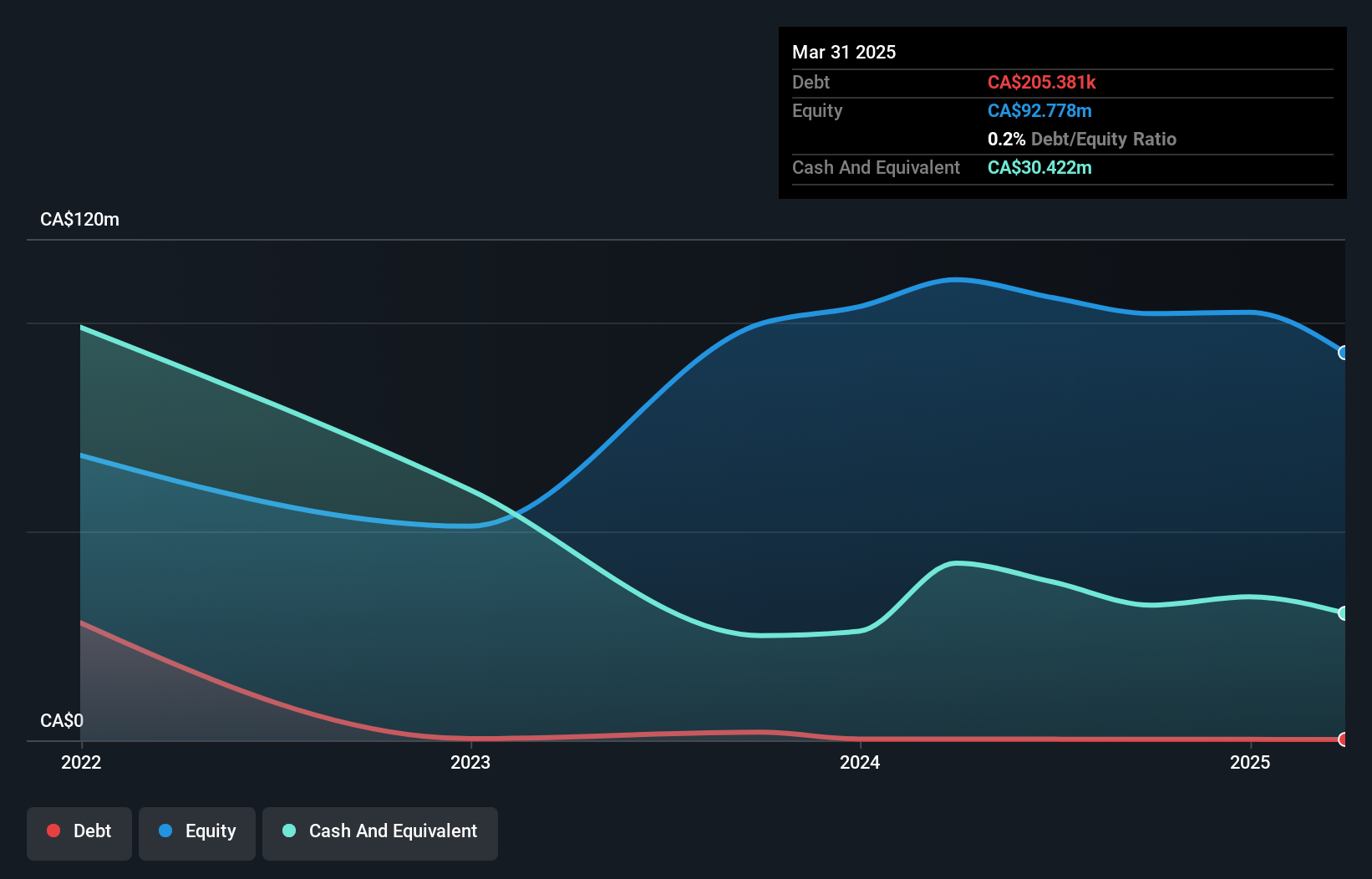

CareRx Corporation, with a market cap of CA$232.40 million, has shown resilience despite being unprofitable. The company forecasts earnings growth of 44.84% annually and has reduced losses by 39.3% per year over the past five years. While its short-term assets cover short-term liabilities, they fall short for long-term obligations. CareRx's net debt to equity ratio is high at 40%, but it maintains a positive cash flow runway exceeding three years. Recent developments include a share repurchase program and the issuance of dividends, reflecting strategic efforts to enhance shareholder value amidst stable revenue streams from its Specialty Pharmacy segment.

- Take a closer look at CareRx's potential here in our financial health report.

- Gain insights into CareRx's outlook and expected performance with our report on the company's earnings estimates.

Scandium International Mining (TSXV:SCY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scandium International Mining Corp. is engaged in the exploration, evaluation, and development of specialty metals assets in Australia, with a market cap of CA$53.22 million.

Operations: Scandium International Mining Corp. does not report any revenue segments.

Market Cap: CA$53.22M

Scandium International Mining Corp., with a market cap of CA$53.22 million, is pre-revenue and currently unprofitable, but has been reducing losses at a rate of 36.5% per year over the past five years. The company is debt-free and its management team and board are considered experienced, with average tenures of 3.5 and 9.6 years respectively. Despite having sufficient cash runway for more than a year based on current free cash flow, the company's share price remains highly volatile. Recent earnings reports indicate increased net losses compared to the previous year, highlighting ongoing financial challenges in its operations.

- Unlock comprehensive insights into our analysis of Scandium International Mining stock in this financial health report.

- Understand Scandium International Mining's track record by examining our performance history report.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WonderFi Technologies Inc, along with its subsidiaries, focuses on developing and acquiring technology platforms for digital asset investments and has a market cap of CA$209.35 million.

Operations: The company's revenue is primarily generated from its Trading segment, which accounts for CA$52.31 million, and its Payments segment, contributing CA$1.26 million.

Market Cap: CA$209.35M

WonderFi Technologies, with a market cap of CA$209.35 million, is navigating financial challenges as reflected in its recent earnings report showing increased net losses. Despite this, the company maintains a robust cash position, with short-term assets exceeding liabilities and more cash than total debt. Revenue is primarily driven by its Trading segment at CA$52.31 million annually, while the Payments segment contributes minimally. The company's stock volatility has significantly decreased over the past year. However, it remains unprofitable and isn't expected to achieve profitability within the next three years despite forecasted revenue growth of 22.36% per year.

- Navigate through the intricacies of WonderFi Technologies with our comprehensive balance sheet health report here.

- Evaluate WonderFi Technologies' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Take a closer look at our TSX Penny Stocks list of 407 companies by clicking here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRRX

CareRx

Provides pharmacy services to senior homes and other congregate care settings in Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)