- Canada

- /

- Capital Markets

- /

- NEOE:INXD

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of economic uncertainty, with the Bank of Canada cutting rates due to potential U.S. tariff impacts and a slight contraction in GDP observed in November. For investors interested in exploring opportunities beyond established names, penny stocks—often associated with smaller or newer companies—remain an intriguing option despite their somewhat outdated label. These stocks can offer affordability and growth potential, particularly when backed by strong financials, making them worth considering amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$184.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.74 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$440.43M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$122.01M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$619.87M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$15.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.97 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities, with a market cap of CA$18.96 million.

Operations: The company generates revenue primarily from its Digital Assets segment, amounting to $0.93 million.

Market Cap: CA$18.96M

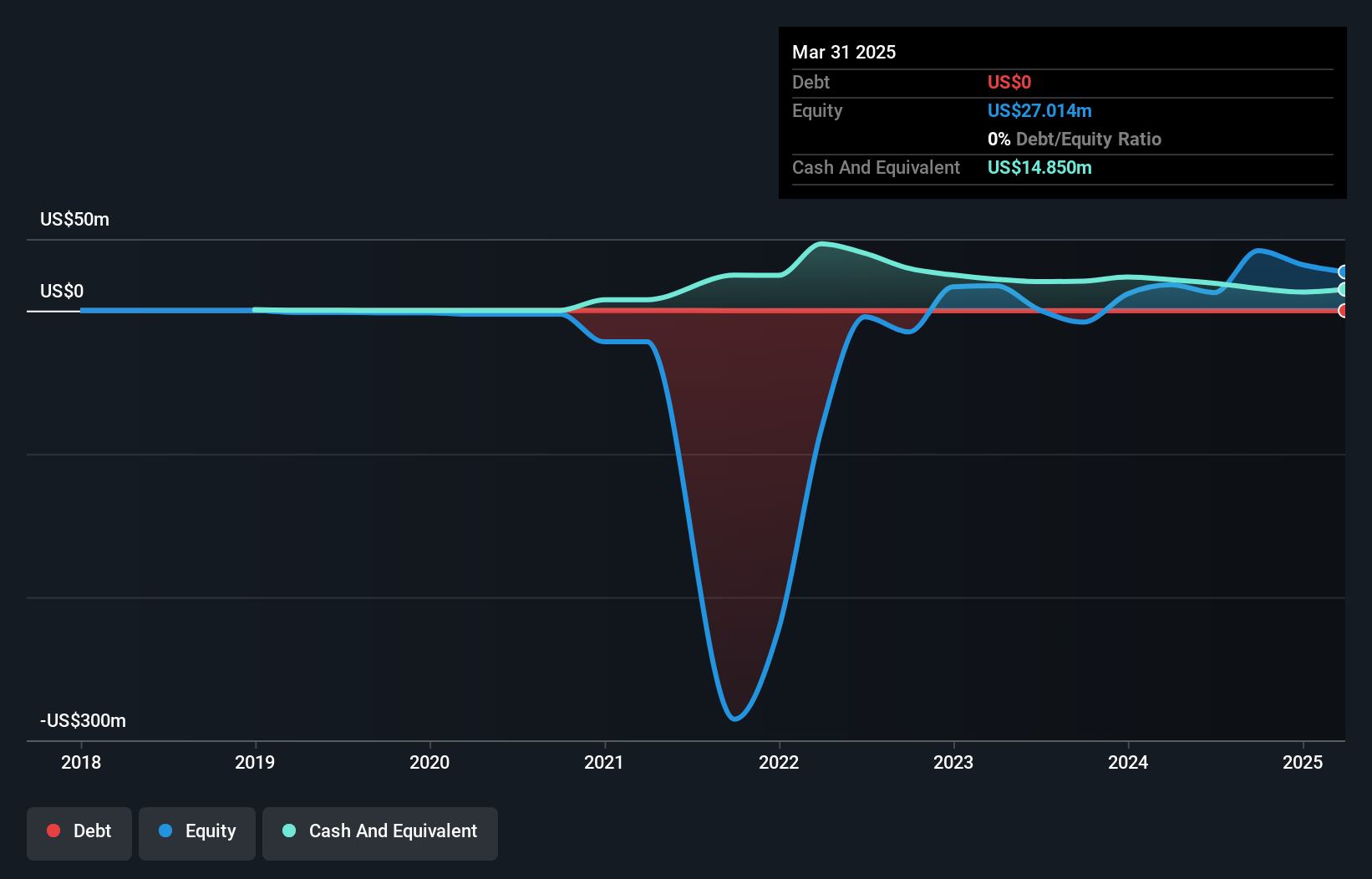

INX Digital Company, Inc., with a market cap of CA$18.96 million, has recently transitioned to profitability, marking a significant milestone for this penny stock. Despite generating minimal revenue from its digital assets segment (US$0.041 million over nine months), the company achieved a net income of US$29.27 million in the same period, reversing previous losses. Its financial health is underscored by zero debt and short-term assets exceeding liabilities significantly (US$58.3M vs US$26.1M). However, share price volatility remains high compared to peers, and recent buyback initiatives have not been executed as planned.

- Click to explore a detailed breakdown of our findings in INX Digital Company's financial health report.

- Gain insights into INX Digital Company's past trends and performance with our report on the company's historical track record.

Quarterhill (TSX:QTRH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quarterhill Inc., along with its subsidiaries, operates in the intelligent transportation system sector both in Canada and internationally, with a market cap of CA$194.52 million.

Operations: The company generates revenue of $157.24 million from its Intelligent Transportation Systems segment.

Market Cap: CA$194.52M

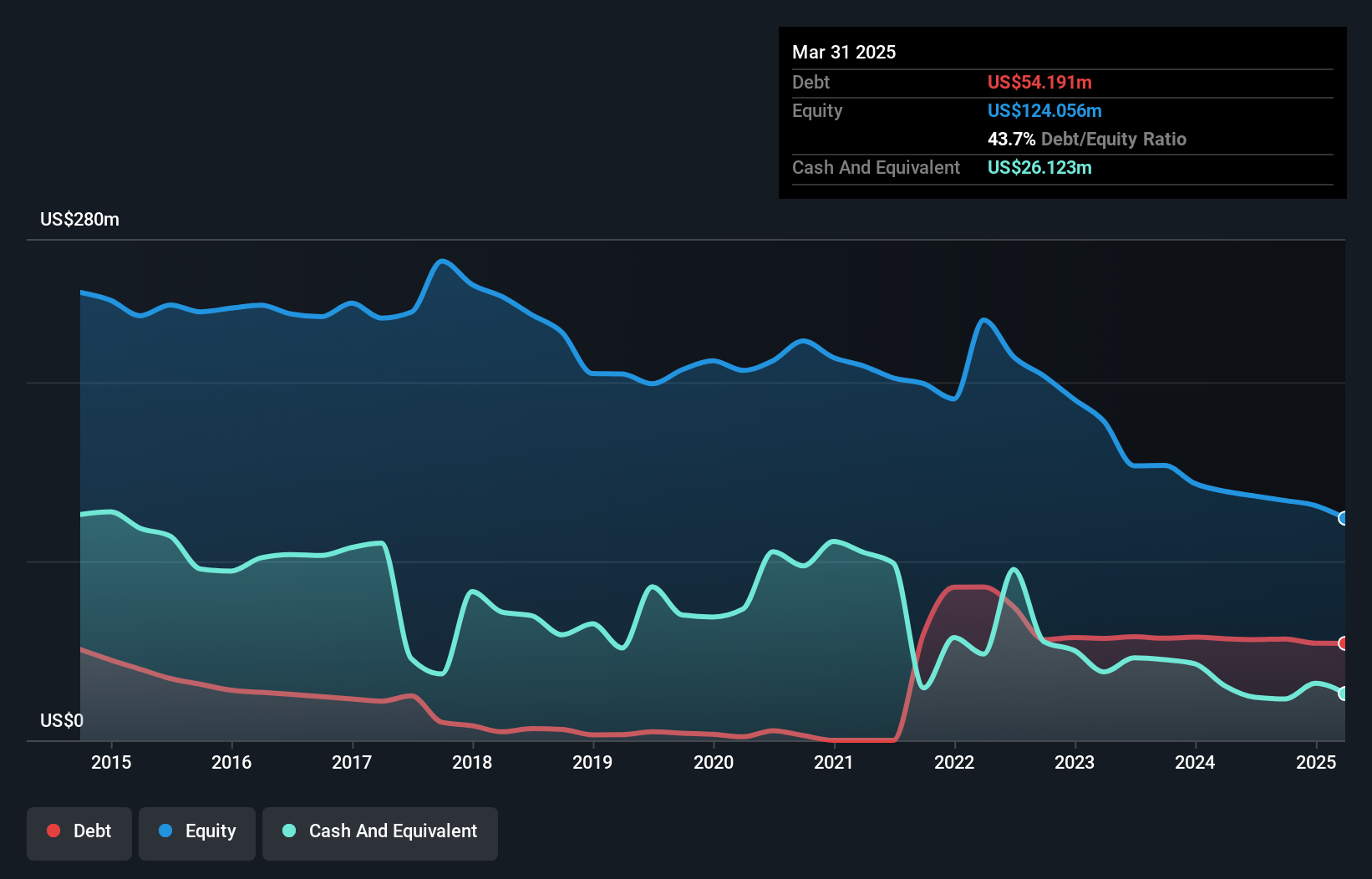

Quarterhill Inc., with a market cap of CA$194.52 million, operates in the intelligent transportation sector and faces challenges typical of penny stocks. Despite generating US$157.24 million in revenue from its Intelligent Transportation Systems segment, it remains unprofitable, with losses increasing over the past five years. Recent contracts, such as a US$40 million deal to upgrade Alameda County's I-580 Express Lanes and a project with Brussels Mobility for weigh-in-motion technology, highlight growth potential but also underscore reliance on project-based income. The company's debt levels have risen significantly over five years, though short-term assets exceed liabilities comfortably.

- Jump into the full analysis health report here for a deeper understanding of Quarterhill.

- Gain insights into Quarterhill's future direction by reviewing our growth report.

Scandium International Mining (TSXV:SCY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scandium International Mining Corp. is an exploration stage company engaged in the exploration, evaluation, and development of specialty metals assets in Australia, with a market cap of CA$12.42 million.

Operations: Scandium International Mining Corp. does not report any revenue segments as it is currently in the exploration stage, focusing on specialty metals assets in Australia.

Market Cap: CA$12.42M

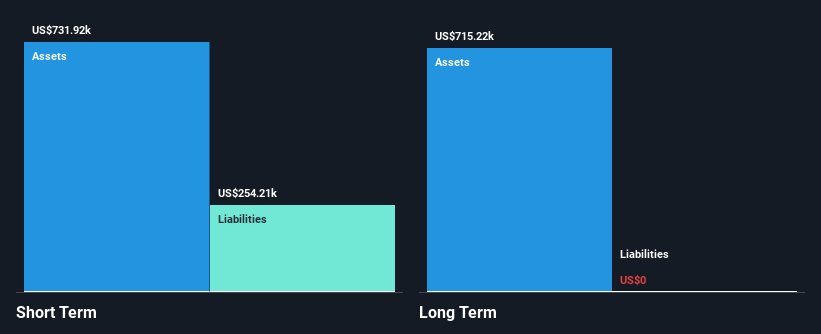

Scandium International Mining Corp., with a market cap of CA$12.42 million, is pre-revenue and unprofitable, focusing on specialty metals in Australia. The company recently transitioned its primary listing to the TSX Venture Exchange from the Toronto Stock Exchange as of February 4, 2025. Despite being debt-free and having experienced management and board members, it faces high share price volatility compared to most Canadian stocks. Short-term assets exceed liabilities, providing some financial stability. While losses have decreased annually by 49% over five years, its negative return on equity remains a concern for investors seeking profitability improvements.

- Dive into the specifics of Scandium International Mining here with our thorough balance sheet health report.

- Assess Scandium International Mining's previous results with our detailed historical performance reports.

Where To Now?

- Discover the full array of 933 TSX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:INXD

INX Digital Company

Operates trading platform for cryptocurrencies and digital securities.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives