- Canada

- /

- Metals and Mining

- /

- TSXV:REG

TSX Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic adjustment with the Bank of Canada reducing interest rates to support growth, investors are keeping a close eye on opportunities that may arise in this shifting landscape. Penny stocks, though an old term, continue to capture attention for their potential value, particularly among smaller or newer companies that can offer intriguing prospects. By focusing on those with solid financials and clear growth potential, investors might uncover promising opportunities within this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.43 | CA$63.47M | ✅ 3 ⚠️ 4 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.88 | CA$256.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.25 | CA$2.09M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.315 | CA$45.81M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.02 | CA$632.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.31 | CA$373.04M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.91 | CA$194.9M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.98 | CA$187.48M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.51 | CA$8.51M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 425 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

EMX Royalty (TSXV:EMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMX Royalty Corporation explores for and generates royalties from metals and minerals properties, with a market cap of CA$501.70 million.

Operations: The company derives $29.86 million in revenue from its operations focused on acquiring, managing, and generating royalties.

Market Cap: CA$501.7M

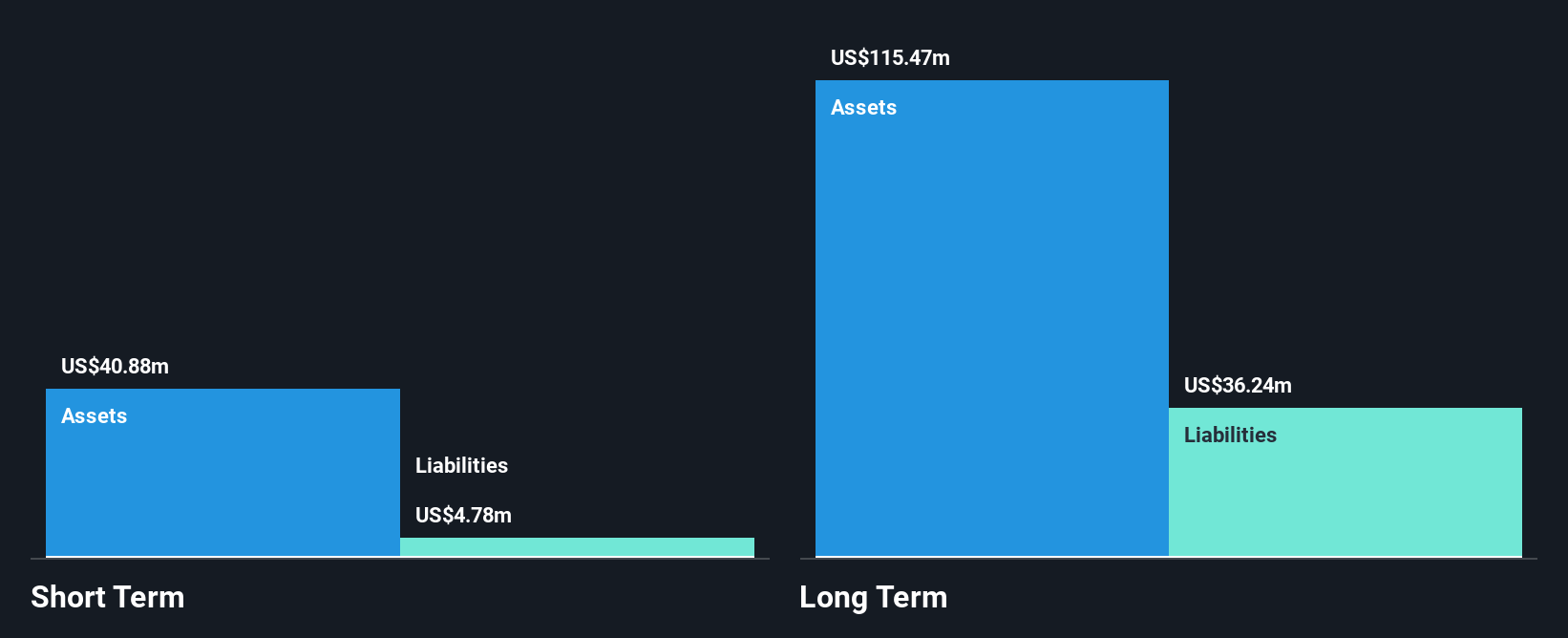

EMX Royalty Corporation, with a market cap of CA$501.70 million, has demonstrated recent profitability and revenue growth, reporting US$14.66 million in sales for the first half of 2025. Despite a low return on equity at 4.2%, EMX's financial health is supported by satisfactory debt levels and strong asset coverage for liabilities. The company has strategically expanded through an exploration alliance in Morocco with Avesoro Holdings LTD, enhancing its portfolio with fully funded projects in promising mineral belts. Additionally, EMX completed a share buyback program worth CA$3.8 million, reflecting confidence in its valuation below estimated fair value by 19.7%.

- Click to explore a detailed breakdown of our findings in EMX Royalty's financial health report.

- Assess EMX Royalty's future earnings estimates with our detailed growth reports.

Midnight Sun Mining (TSXV:MMA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midnight Sun Mining Corp. acquires and explores mineral properties in Africa, with a market cap of CA$166.14 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$166.14M

Midnight Sun Mining Corp., with a market cap of CA$166.14 million, remains pre-revenue as it focuses on exploration activities in Zambia. Recent developments include the commencement of a second diamond drill at its Dumbwa Target, part of the Solwezi Project, to expedite exploration efforts. The company has identified high-grade copper anomalies and is conducting detailed geological surveys to better understand mineralization patterns similar to nearby significant mines. Despite being unprofitable with increasing losses over recent years, Midnight Sun's financial position is bolstered by sufficient cash reserves exceeding its liabilities and no meaningful shareholder dilution recently.

- Dive into the specifics of Midnight Sun Mining here with our thorough balance sheet health report.

- Explore historical data to track Midnight Sun Mining's performance over time in our past results report.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company with operations in Canada and Peru, and it has a market cap of CA$304.90 million.

Operations: Regulus Resources Inc. does not report any revenue segments, focusing instead on mineral exploration activities in Canada and Peru.

Market Cap: CA$304.9M

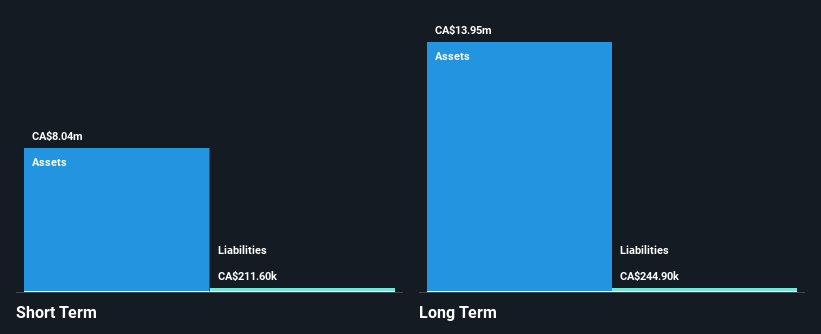

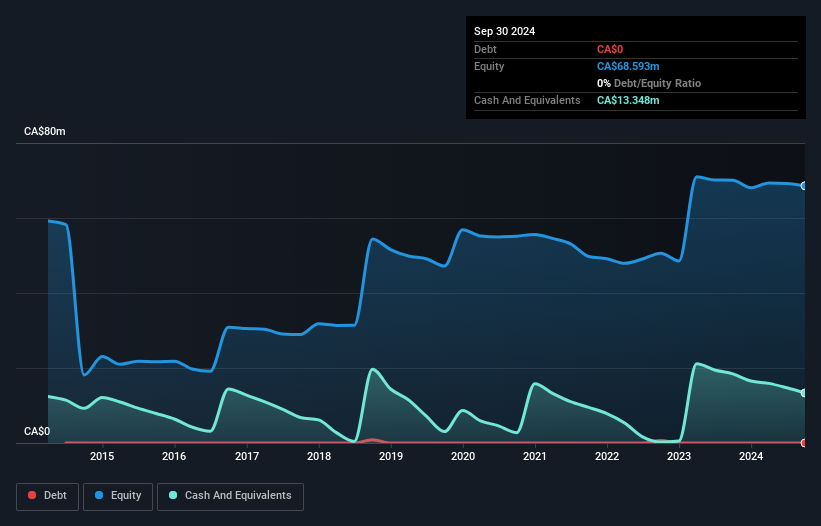

Regulus Resources Inc., with a market cap of CA$304.90 million, is pre-revenue and focuses on mineral exploration in Canada and Peru. The company is debt-free, has no long-term liabilities, and its short-term assets significantly exceed liabilities. Despite being unprofitable, Regulus has reduced its losses by 22% annually over the past five years. It maintains a stable weekly volatility of 4% and offers shareholders stability with no significant dilution recently. The management team averages 12.1 years in tenure, reflecting seasoned leadership as they navigate exploration challenges while maintaining a cash runway for over two years at current growth rates.

- Jump into the full analysis health report here for a deeper understanding of Regulus Resources.

- Gain insights into Regulus Resources' historical outcomes by reviewing our past performance report.

Next Steps

- Jump into our full catalog of 425 TSX Penny Stocks here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:REG

Regulus Resources

Operates as a mineral exploration company in Canada and Peru.

Flawless balance sheet and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)