- Canada

- /

- Metals and Mining

- /

- TSXV:LVX

3 TSX Penny Stocks With Market Caps Under CA$30M To Consider

Reviewed by Simply Wall St

As the Canadian market navigates uncertainties around tariffs and trade, with potential impacts on economic growth and inflation, investors are encouraged to focus on diversification and quality investments. Penny stocks, though often seen as relics of past market eras, continue to offer intriguing opportunities for those seeking value in smaller or newer companies. By examining penny stocks with strong financials, investors can uncover under-the-radar opportunities that may provide both stability and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.97 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.63 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.54 | CA$124.55M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$235.26M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.465 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.72 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.96 | CA$26.6M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$397.63M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

East Africa Metals (TSXV:EAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: East Africa Metals Inc. is a mineral exploration company engaged in the identification, acquisition, exploration, development, and sale of base and precious mineral resource properties in Ethiopia and Tanzania, with a market cap of CA$24.68 million.

Operations: East Africa Metals Inc. does not have any reported revenue segments at this time.

Market Cap: CA$24.68M

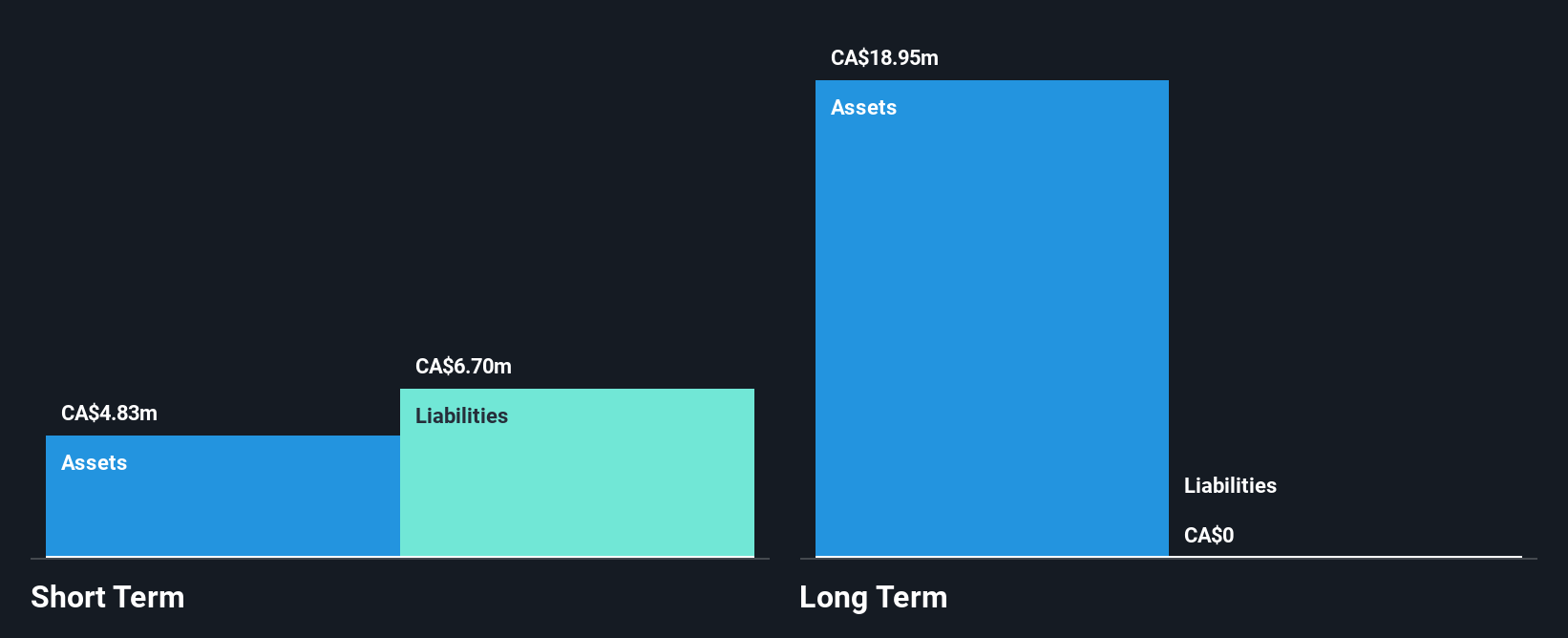

East Africa Metals Inc., with a market cap of CA$24.68 million, remains a pre-revenue company focused on mineral exploration in Ethiopia and Tanzania. Despite its unprofitability, the company has not experienced significant shareholder dilution over the past year and maintains a satisfactory net debt to equity ratio of 3.9%. Recent private placements raised CA$503,586.25, indicating strategic investor confidence in its assets and potential growth prospects. However, East Africa Metals faces challenges with high share price volatility and short-term liabilities exceeding assets by CA$1.6 million as of September 2024, highlighting financial risks typical for penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of East Africa Metals.

- Review our historical performance report to gain insights into East Africa Metals' track record.

FTI Foodtech International (TSXV:FTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FTI Foodtech International Inc. is involved in the resale of liquidation merchandise in Canada, with a market cap of CA$3.44 million.

Operations: FTI Foodtech International Inc. does not have any reported revenue segments.

Market Cap: CA$3.44M

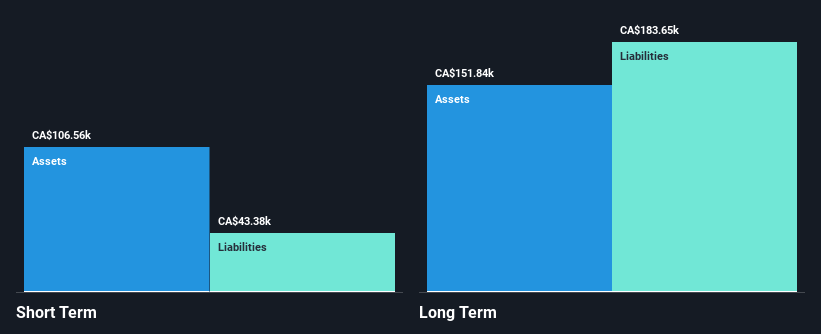

FTI Foodtech International Inc., with a market cap of CA$3.44 million, operates in the resale of liquidation merchandise and is currently pre-revenue, generating less than US$1 million (CA$91K). The company recently completed a private placement, raising CA$240,000 through the issuance of units that include common shares and warrants. Despite being unprofitable with increasing losses over five years, FTI has improved its financial position by transitioning from negative to positive shareholder equity. However, it faces challenges such as high net debt to equity ratio (558.8%) and short-term assets not covering long-term liabilities.

- Click to explore a detailed breakdown of our findings in FTI Foodtech International's financial health report.

- Examine FTI Foodtech International's past performance report to understand how it has performed in prior years.

Leviathan Gold (TSXV:LVX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Leviathan Gold Ltd. focuses on acquiring, exploring, and evaluating resource properties in Australia with a market cap of CA$1.99 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$1.99M

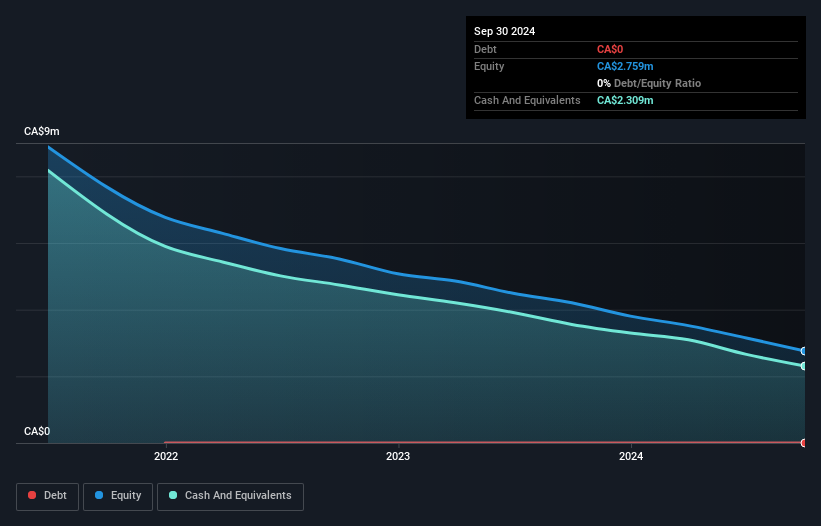

Leviathan Gold Ltd., with a market cap of CA$1.99 million, is pre-revenue and focuses on resource properties in Australia. The company recently entered into an agreement to acquire FMC, securing a 100% interest in the Foca Project in Bosnia and Herzegovina, which presents promising exploration prospects. Leviathan is debt-free, with short-term assets of CA$2.3 million covering its liabilities of CA$298.1K and has a cash runway exceeding one year based on current free cash flow. Despite high share price volatility over recent months, shareholders have not faced significant dilution this past year.

- Dive into the specifics of Leviathan Gold here with our thorough balance sheet health report.

- Explore historical data to track Leviathan Gold's performance over time in our past results report.

Key Takeaways

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 941 more companies for you to explore.Click here to unveil our expertly curated list of 944 TSX Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LVX

Leviathan Metals

Engages in the acquisition, exploration, and evaluation of resource properties in Australia and Botswana.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)