- Canada

- /

- Metals and Mining

- /

- TSXV:LME

Promising TSX Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by strong employment figures and cautious monetary policy from the Bank of Canada, investors are turning their attention to smaller opportunities that may be overlooked by larger indices. Penny stocks, despite their somewhat outdated moniker, continue to intrigue those seeking potential growth in lesser-known companies. When backed by solid financials, these stocks can present unique opportunities for value and growth, offering a compelling case for consideration among discerning investors.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.58 | CA$64.46M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.01M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.355 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$931.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.80 | CA$463.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.34 | CA$173.58M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.02 | CA$205.05M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.78 | CA$9.96M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 406 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alta Copper (TSX:ATCU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alta Copper Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and Peru, with a market cap of CA$63.99 million.

Operations: No revenue segments are reported for this mineral exploration company.

Market Cap: CA$63.99M

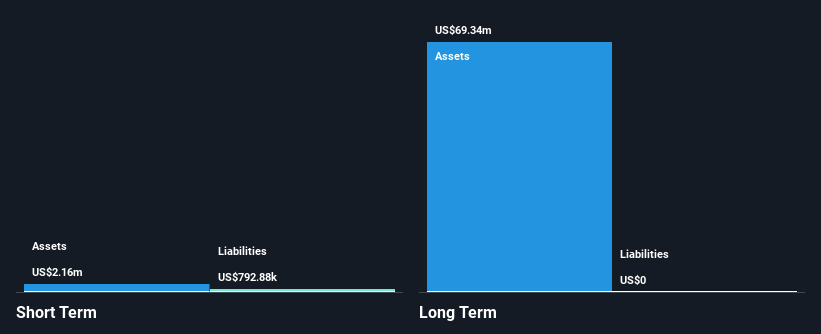

Alta Copper Corp. is a pre-revenue mineral exploration company with a market cap of CA$63.99 million, focusing on projects in Canada and Peru. Despite its unprofitable status and declining earnings over the past five years, the company maintains no long-term liabilities and remains debt-free, which could be seen as financial prudence in this high-risk sector. Short-term assets significantly exceed short-term liabilities, although it faces less than a year of cash runway at current free cash flow rates. Recent presentations at investor conferences indicate active engagement with potential investors despite ongoing challenges in profitability and revenue generation.

- Click here to discover the nuances of Alta Copper with our detailed analytical financial health report.

- Explore historical data to track Alta Copper's performance over time in our past results report.

Grid Metals (TSXV:GRDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grid Metals Corp. is involved in the exploration and development of base and precious metal mineral properties in Canada, with a market cap of CA$35.77 million.

Operations: Grid Metals Corp. does not have any reported revenue segments at this time.

Market Cap: CA$35.77M

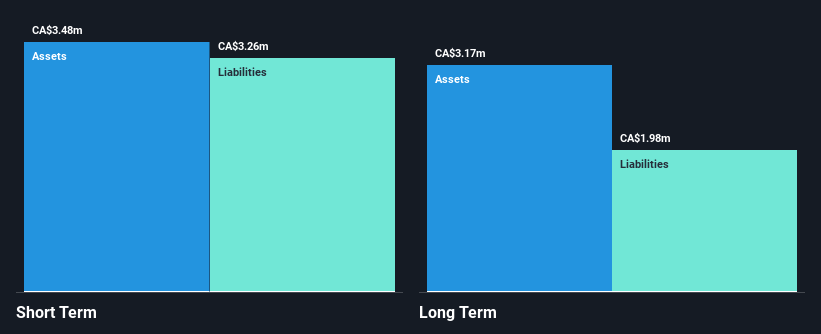

Grid Metals Corp., with a market cap of CA$35.77 million, is a pre-revenue entity engaged in mineral exploration and development. The company recently announced a non-brokered private placement aiming to raise up to CA$4.03 million, which could bolster its cash position given its limited runway based on past free cash flow estimates. Grid Metals is debt-free and has short-term assets exceeding liabilities, providing some financial stability amidst high volatility and unprofitability. Recent developments include securing an exploration permit for the Falcon West property targeting cesium—a rare critical metal—and advancing exploration at the Makwa Ni-Cu-PGE project with promising nickel sulfide discoveries.

- Dive into the specifics of Grid Metals here with our thorough balance sheet health report.

- Gain insights into Grid Metals' historical outcomes by reviewing our past performance report.

Laurion Mineral Exploration (TSXV:LME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Laurion Mineral Exploration Inc. focuses on the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$109.64 million.

Operations: Laurion Mineral Exploration Inc. does not report any revenue segments.

Market Cap: CA$109.64M

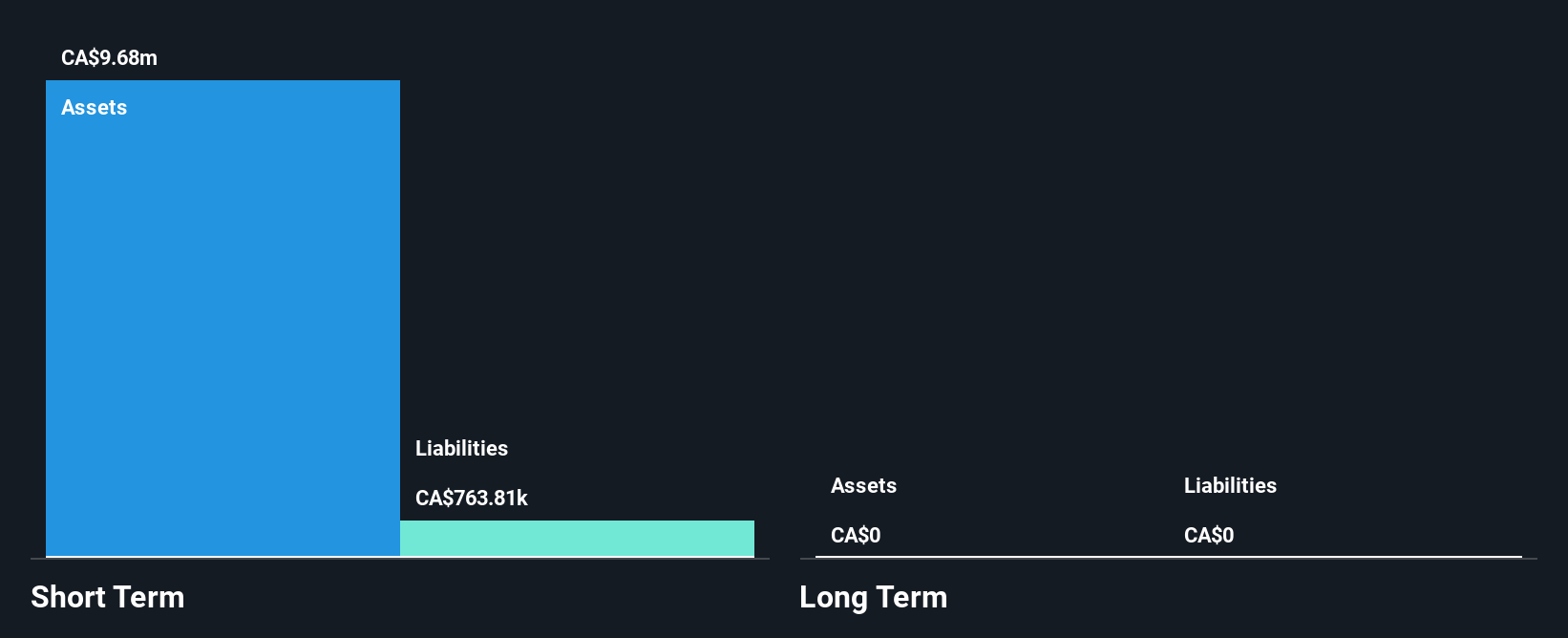

Laurion Mineral Exploration Inc., with a market cap of CA$109.64 million, is a pre-revenue company focusing on mineral exploration in Canada. Recent developments at its Ishkoday Project have revealed promising gold-bearing structures, particularly at the Twin Falls area, reinforcing its potential for further exploration. The company has completed significant portions of its 2025 drilling program and continues to integrate advanced geophysical surveys to enhance structural targeting. Despite being unprofitable, Laurion benefits from a strong cash position with no debt and short-term assets surpassing liabilities, providing financial stability as it advances exploration efforts.

- Navigate through the intricacies of Laurion Mineral Exploration with our comprehensive balance sheet health report here.

- Learn about Laurion Mineral Exploration's historical performance here.

Next Steps

- Unlock our comprehensive list of 406 TSX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LME

Laurion Mineral Exploration

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)