- Canada

- /

- Metals and Mining

- /

- TSXV:LRA

TSX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

The Canadian market faces potential challenges from escalating tariffs, which could impact economic growth and consumer prices. Despite this uncertainty, the fundamental economic backdrop remains supportive with above-trend growth and historically low unemployment rates. In such a climate, penny stocks—often smaller or newer companies—can offer unique opportunities for growth at lower price points when they boast strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1B | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$177.31M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.70 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.45 | CA$120.49M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$628.96M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$236.24M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.99 | CA$26.06M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$176.7M | ★★★★★☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally with a market cap of CA$98.21 million.

Operations: The company generates revenue through its Direct-To-Consumer segment, which accounts for CA$219.79 million, and from Partners and Other channels, contributing CA$40.56 million.

Market Cap: CA$98.21M

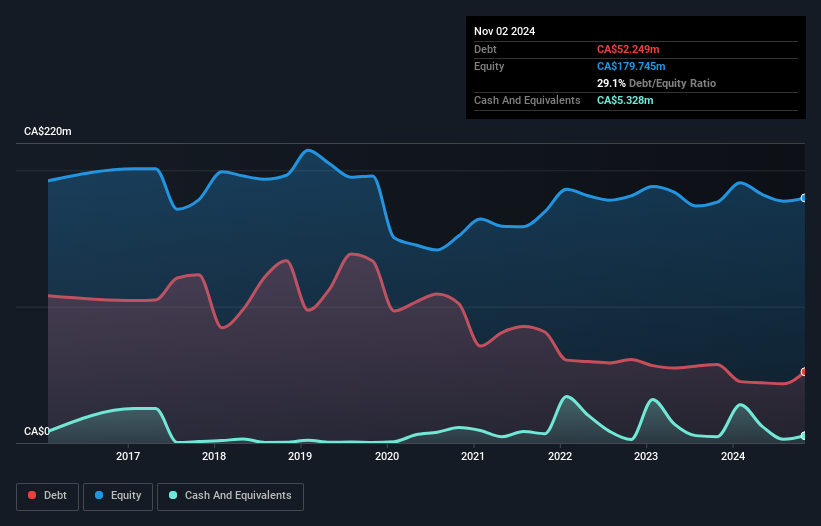

Roots Corporation's recent performance highlights its potential within the penny stock landscape, driven by a substantial earnings growth of 918.7% over the past year and improved net profit margins from 0.1% to 1.1%. The company reported third-quarter sales of CA$66.91 million, up from CA$63.53 million a year ago, with net income rising to CA$2.39 million compared to CA$0.519 million previously. While short-term liabilities are covered by assets, long-term liabilities remain uncovered, and interest payments are not well-covered by EBIT (1.7x). Despite these challenges, Roots trades at a significant discount to estimated fair value and has reduced its debt ratio over time.

- Take a closer look at Roots' potential here in our financial health report.

- Gain insights into Roots' outlook and expected performance with our report on the company's earnings estimates.

Kutcho Copper (TSXV:KC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kutcho Copper Corp. is a resource development company focused on acquiring and exploring resource properties in Canada, with a market cap of CA$25.17 million.

Operations: Kutcho Copper Corp. does not report any revenue segments.

Market Cap: CA$25.17M

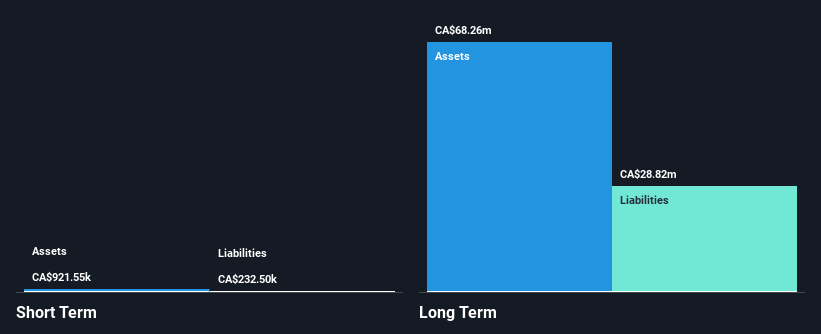

Kutcho Copper Corp. remains a speculative investment due to its pre-revenue status and high share price volatility. The company has made advancements in its exploration efforts, particularly with drill targeting for its copper-zinc project in British Columbia, identifying several promising targets like Esso West and Hamburger for 2025 testing. Despite having no current revenue streams, Kutcho Copper benefits from strategic partnerships and financial backing from Wheaton Precious Metals, which supports mine development through a precious metals stream agreement. While the company is debt-free, short-term assets do not cover long-term liabilities, posing potential financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Kutcho Copper.

- Understand Kutcho Copper's track record by examining our performance history report.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lara Exploration Ltd. is involved in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile with a market cap of CA$76.62 million.

Operations: Lara Exploration Ltd. currently does not report any revenue segments.

Market Cap: CA$76.62M

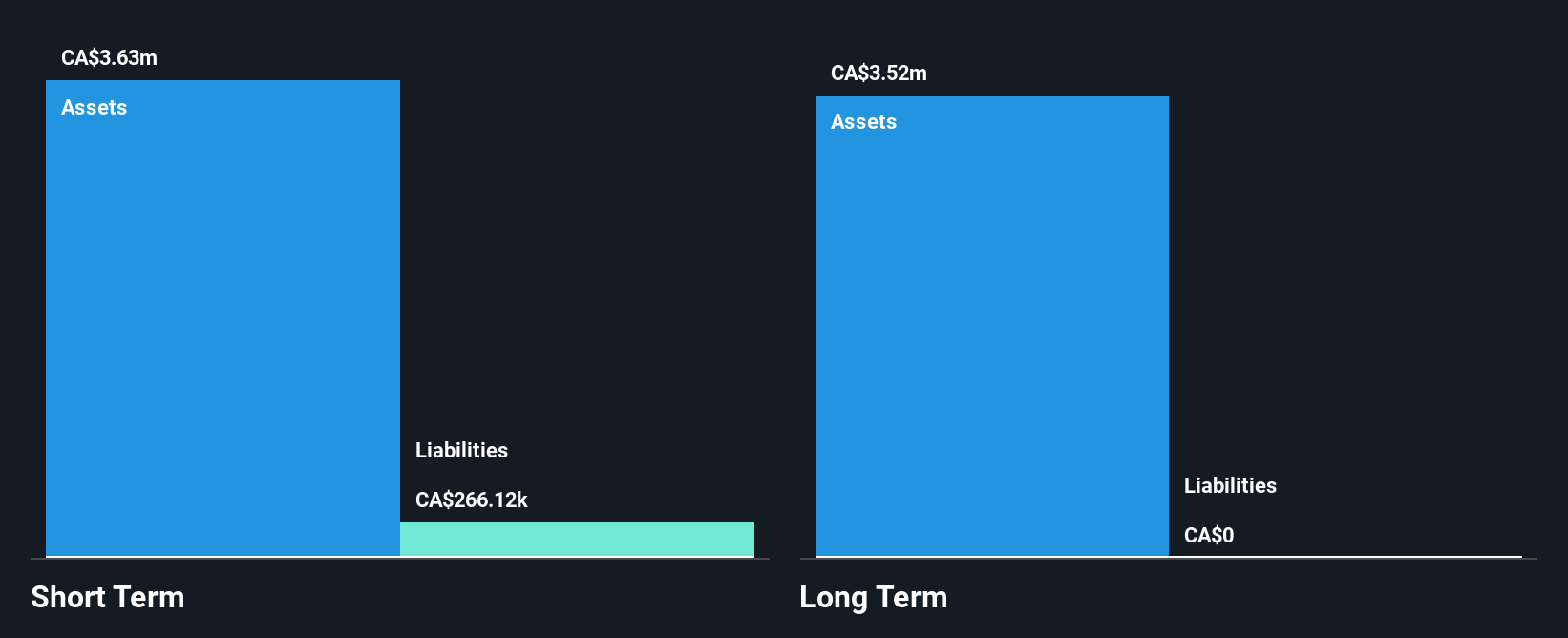

Lara Exploration Ltd. is a pre-revenue company with a market cap of CA$76.62 million, focusing on mineral properties in South America. Despite being debt-free and having short-term assets (CA$3.1M) that exceed its liabilities (CA$231.2K), the company faces financial constraints with less than a year of cash runway if current cash flow trends persist. Recent earnings reports show an improvement, with net income for Q3 2024 at CA$0.061 million compared to a loss the previous year, though overall profitability remains elusive due to historical losses increasing by 6.5% annually over five years.

- Get an in-depth perspective on Lara Exploration's performance by reading our balance sheet health report here.

- Gain insights into Lara Exploration's historical outcomes by reviewing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 937 TSX Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lara Exploration, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LRA

Lara Exploration

Through its subsidiaries, engages in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile.

Flawless balance sheet slight.

Market Insights

Community Narratives