This article will reflect on the compensation paid to Joe Abbandonato who has served as CEO of Imaflex Inc. (CVE:IFX) since 1993. This analysis will also assess whether Imaflex pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Imaflex

Comparing Imaflex Inc.'s CEO Compensation With the industry

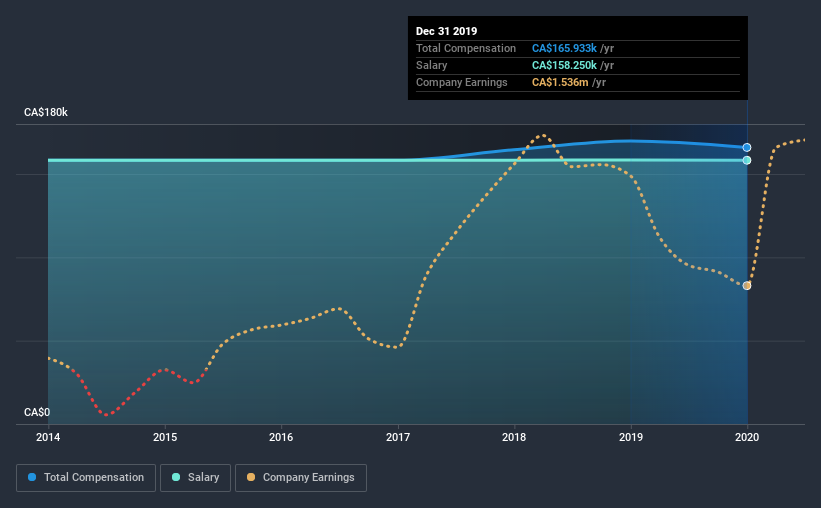

At the time of writing, our data shows that Imaflex Inc. has a market capitalization of CA$39m, and reported total annual CEO compensation of CA$166k for the year to December 2019. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at CA$158.3k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$260m, we found that the median total CEO compensation was CA$102k. This suggests that Joe Abbandonato is paid more than the median for the industry. Furthermore, Joe Abbandonato directly owns CA$15m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$158k | CA$158k | 95% |

| Other | CA$7.7k | CA$11k | 5% |

| Total Compensation | CA$166k | CA$170k | 100% |

Speaking on an industry level, nearly 38% of total compensation represents salary, while the remainder of 62% is other remuneration. Imaflex is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Imaflex Inc.'s Growth

Imaflex Inc.'s earnings per share (EPS) grew 9.8% per year over the last three years. In the last year, its revenue is down 8.2%.

We generally like to see a little revenue growth, but the modest EPSgrowth gives us some relief. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Imaflex Inc. Been A Good Investment?

Given the total shareholder loss of 5.6% over three years, many shareholders in Imaflex Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Joe receives almost all of their compensation through a salary. As we touched on above, Imaflex Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. The growth in the business has been uninspiring, but the shareholder returns for Imaflex have arguably been worse, over the last three years. This doesn't look great when you consider Joe is taking home compensation north of the industry average. All things considered, we believe shareholders would be disappointed to see Joe's compensation grow without first seeing an improvement in the performance of the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Imaflex that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Imaflex or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:IFX

Imaflex

Develops, manufactures, and sells flexible packaging materials for agriculture and packaging industries in Canada, the United States, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)