Imaflex (CVE:IFX) Is Growing Earnings But Are They A Good Guide?

As a general rule, we think profitable companies are less risky than companies that lose money. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Imaflex's (CVE:IFX) statutory profits are a good guide to its underlying earnings.

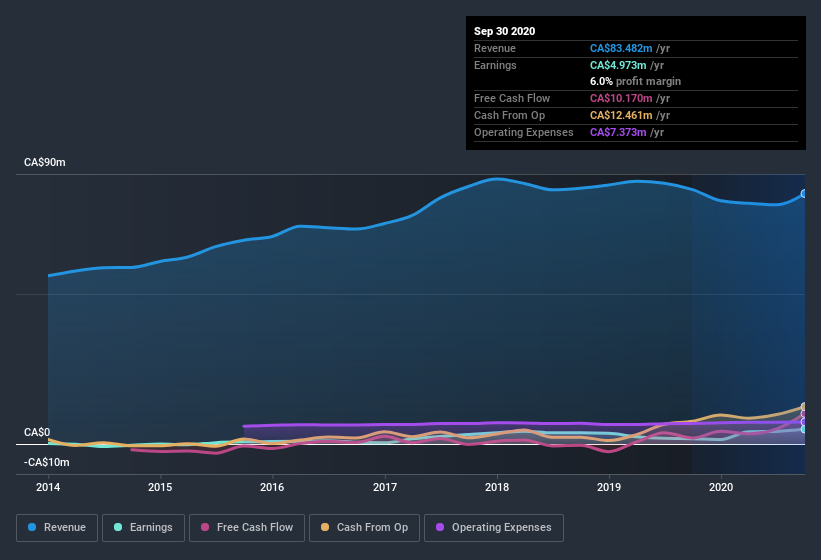

It's good to see that over the last twelve months Imaflex made a profit of CA$4.97m on revenue of CA$83.5m. Even though its revenue is down over the last three years, its profit has actually increased, as you can see, below.

See our latest analysis for Imaflex

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Today, we'll discuss Imaflex's free cashflow relative to its earnings, and consider what that tells us about the company. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Zooming In On Imaflex's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Imaflex has an accrual ratio of -0.13 for the year to September 2020. That indicates that its free cash flow was a fair bit more than its statutory profit. Indeed, in the last twelve months it reported free cash flow of CA$10m, well over the CA$4.97m it reported in profit. Imaflex's free cash flow improved over the last year, which is generally good to see.

Our Take On Imaflex's Profit Performance

As we discussed above, Imaflex has perfectly satisfactory free cash flow relative to profit. Based on this observation, we consider it likely that Imaflex's statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at an extremely impressive rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Imaflex at this point in time. In terms of investment risks, we've identified 3 warning signs with Imaflex, and understanding them should be part of your investment process.

This note has only looked at a single factor that sheds light on the nature of Imaflex's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Imaflex, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:IFX

Imaflex

Develops, manufactures, and sells flexible packaging materials for agriculture and packaging industries in Canada, the United States, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)