This Analyst Just Made A Massive Upgrade To Their Itafos (CVE:IFOS) Earnings Forecasts

Itafos (CVE:IFOS) shareholders will have a reason to smile today, with the covering analyst making substantial upgrades to next year's statutory forecasts. The analyst greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

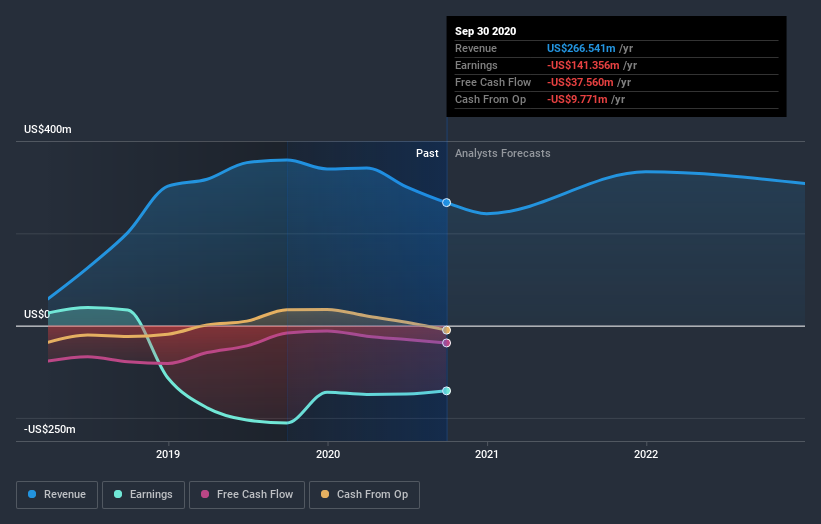

Following the upgrade, the latest consensus from Itafos' sole analyst is for revenues of US$333m in 2021, which would reflect a sizeable 25% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 96% to US$0.03. Yet before this consensus update, the analyst had been forecasting revenues of US$274m and losses of US$0.16 per share in 2021. We can see there's definitely been a change in sentiment in this update, with the analyst administering a sizeable upgrade to next year's revenue estimates, while at the same time reducing their loss estimates.

See our latest analysis for Itafos

The consensus price target rose 20% to CA$0.90, with the analyst encouraged by the higher revenue and lower forecast losses for next year.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Itafos' past performance and to peers in the same industry. For example, we noticed that Itafos' rate of growth is expected to accelerate meaningfully, with revenues forecast to grow 25%, well above its historical decline of 26% a year over the past year. Compare this against analyst estimates for the wider industry, which suggest that (in aggregate) industry revenues are expected to grow 5.9% next year. Not only are Itafos' revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analyst reduced their loss per share estimates for next year, reflecting increased optimism around Itafos' prospects. Fortunately, the analyst also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Itafos could be worth investigating further.

The covering analyst is clearly in love with Itafos at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 3 other warning signs we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Itafos, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:IFOS

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)