- Canada

- /

- Energy Services

- /

- TSX:MCB

TSX Penny Stocks To Watch With Market Caps Larger Than CA$60M

Reviewed by Simply Wall St

The Canadian stock market has shown resilience amid global tariff uncertainties, with the TSX rising over 2% recently, contrasting the decline in U.S. indices. Despite ongoing economic challenges, investors continue to seek opportunities in various sectors, including penny stocks—an area often overlooked but ripe for potential growth. While the term "penny stocks" may seem outdated, these investments can offer significant value when backed by solid financials and strategic positioning within the market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.58 | CA$60.69M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.54 | CA$66.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.585 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.20 | CA$690.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$275.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$181.71M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$512.47M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.71 | CA$69.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.51 | CA$13.75M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.15 | CA$43.93M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies to replace synthetic, petrochemical-based chemicals across various regions globally, with a market cap of CA$234.12 million.

Operations: The company generates revenue primarily from its Biopolymer Nanosphere Technology Platform, amounting to $18.54 million.

Market Cap: CA$234.12M

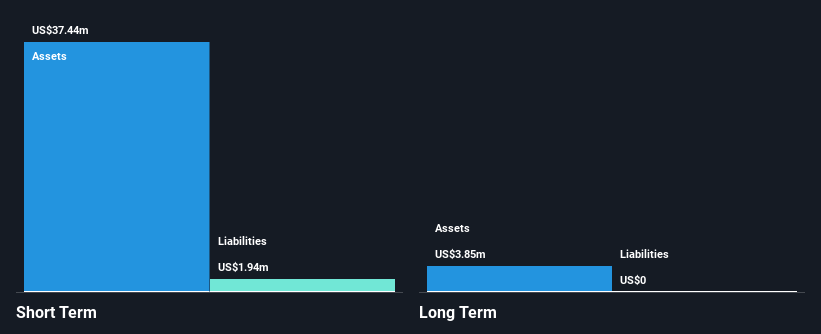

EcoSynthetix, with a market cap of CA$234.12 million, reported US$18.54 million in revenue for 2024 and reduced its net loss to US$1.37 million from the previous year. Despite being unprofitable, the company is debt-free and has sufficient cash runway for over three years due to positive free cash flow. Recent developments include securing a commercial account with a global pulp manufacturer for its bio-based SurfLock product, highlighting potential growth in the billion-dollar pulp and packaging market. Additionally, EcoSynthetix completed a share buyback program without significant shareholder dilution over the past year.

- Navigate through the intricacies of EcoSynthetix with our comprehensive balance sheet health report here.

- Gain insights into EcoSynthetix's historical outcomes by reviewing our past performance report.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. offers equipment and technologies for tubular running operations to improve wellbore integrity and data collection in the energy industry across various global regions, with a market cap of CA$69.84 million.

Operations: The company's revenue is primarily generated from its Energy Products & Services segment, which reported CA$77.52 million.

Market Cap: CA$69.84M

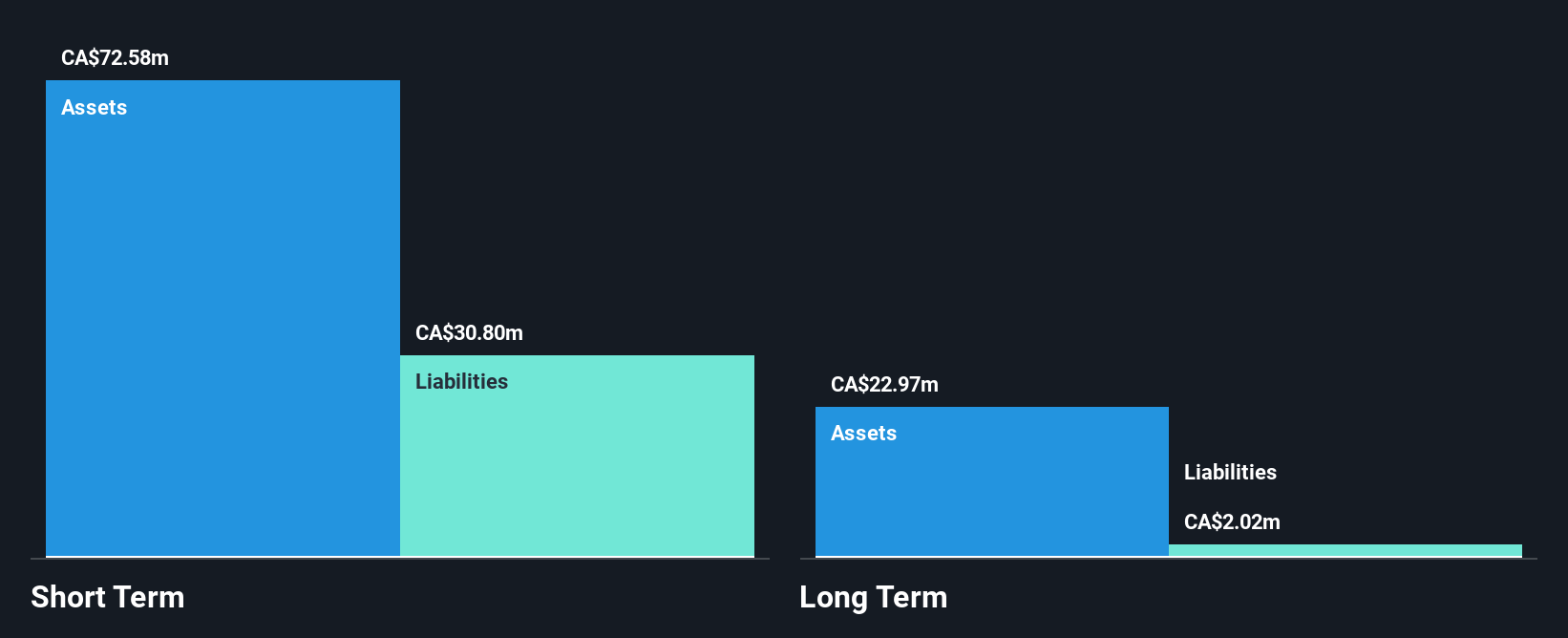

McCoy Global, with a market cap of CA$69.84 million, reported CA$77.52 million in revenue for 2024 and net income of CA$8.87 million, reflecting a solid earnings growth trajectory over the past five years. The company is debt-free, enhancing its financial stability and eliminating concerns about interest coverage. Despite trading significantly below estimated fair value, McCoy's return on equity remains low at 13.4%. Recent developments include an increased quarterly dividend to CA$0.025 per share and participation in industry conferences like the Planet MicroCap Showcase: VEGAS 2025, indicating active engagement with investors and stakeholders.

- Get an in-depth perspective on McCoy Global's performance by reading our balance sheet health report here.

- Learn about McCoy Global's future growth trajectory here.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$69.08 million.

Operations: Chesapeake Gold Corp. does not report any revenue segments as it is primarily engaged in the exploration and evaluation of precious metal deposits.

Market Cap: CA$69.08M

Chesapeake Gold Corp., with a market cap of CA$69.08 million, remains pre-revenue as it focuses on exploring and evaluating precious metal deposits. The company benefits from having no debt, which simplifies its financial structure and reduces risk associated with interest obligations. Chesapeake has sufficient cash runway for over a year based on current free cash flow levels, providing some operational stability despite ongoing losses that have increased by 25.7% annually over the past five years. Recent leadership changes include appointing Mr. Justin Black as Chief Metallurgical Officer, bringing extensive experience in optimizing mining processes and managing large-scale projects to the team.

- Click to explore a detailed breakdown of our findings in Chesapeake Gold's financial health report.

- Assess Chesapeake Gold's previous results with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 923 more companies for you to explore.Click here to unveil our expertly curated list of 926 TSX Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MCB

McCoy Global

Provides equipment and technologies designed to support tubular running operations that enhance wellbore integrity and assist with collecting data for the energy industry in the United States, Latin America, the Middle East, Africa, Europe, the Asia Pacific, and Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives