- Canada

- /

- Metals and Mining

- /

- TSXV:BIG

Hercules Metals And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As Canadian markets navigate a period of stabilized yields and moderated inflation, investors are exploring diverse opportunities for growth. Penny stocks, a term that may seem outdated but still holds relevance, represent an intriguing investment avenue, especially when backed by strong financial health. In this article, we highlight three TSX penny stocks that stand out for their potential to offer significant returns while maintaining solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.71 | CA$174.02M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$451.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$659.81M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.83 | CA$379.19M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.84 | CA$309.32M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$3.90 | CA$3.19B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.95 | CA$191.47M | ★★★★★☆ |

Click here to see the full list of 932 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hercules Metals (TSXV:BIG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hercules Metals Corp., a junior mining company, focuses on the exploration and development of mineral properties in the United States with a market cap of CA$162.55 million.

Operations: Hercules Metals Corp. currently does not report any revenue segments.

Market Cap: CA$162.55M

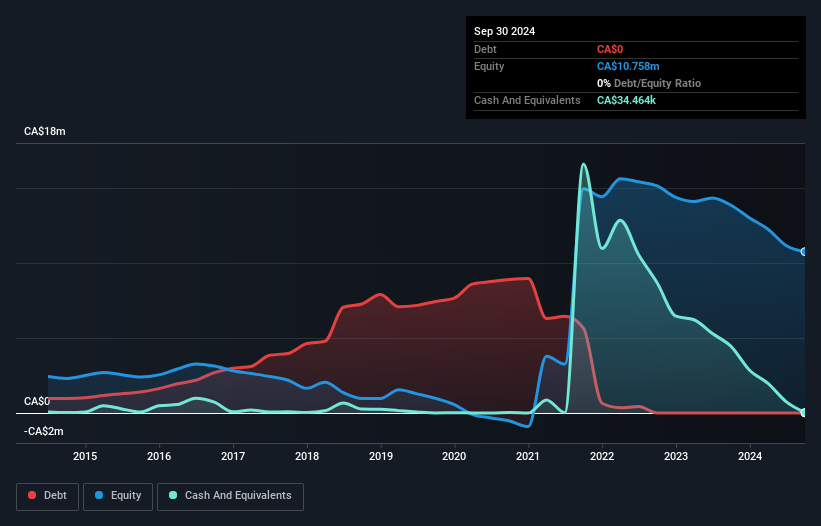

Hercules Metals Corp., a pre-revenue junior mining company, is focused on exploration at its Hercules Property in Idaho. Recent drilling results indicate promising copper equivalent (CuEq) intercepts, with notable findings such as 354m of 0.47% CuEq and higher-grade intervals of up to 1.22% CuEq. The company is fully financed for its 2025 drilling campaign, targeting areas with potential high-grade mineralization and utilizing advanced geophysical surveys to refine exploration strategies. Despite having no revenue streams currently, Hercules Metals maintains a stable financial position with short-term assets exceeding liabilities and no long-term debt obligations.

- Click to explore a detailed breakdown of our findings in Hercules Metals' financial health report.

- Gain insights into Hercules Metals' past trends and performance with our report on the company's historical track record.

International Lithium (TSXV:ILC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: International Lithium Corp. is an exploration stage company focused on investing in, exploring, and developing mineral properties in Canada, Zimbabwe, and Ireland with a market cap of CA$3.73 million.

Operations: International Lithium Corp. does not currently report any revenue segments as it is in the exploration stage, focusing on mineral properties in Canada, Zimbabwe, and Ireland.

Market Cap: CA$3.73M

International Lithium Corp. is a pre-revenue exploration stage company with a market cap of CA$3.73 million, operating in Canada, Zimbabwe, and Ireland. The company recently announced a private placement to raise up to CA$600,000, involving directors and insiders. Despite having no debt and an experienced management team with an average tenure of 7.3 years, the firm faces challenges such as increased losses over five years and short-term assets not covering liabilities. Although its share price has been highly volatile recently, the lack of meaningful revenue remains a significant concern for potential investors.

- Unlock comprehensive insights into our analysis of International Lithium stock in this financial health report.

- Learn about International Lithium's historical performance here.

NeoTerrex Minerals (TSXV:NTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NeoTerrex Minerals Inc. focuses on the evaluation, acquisition, and exploration of mineral properties for rare earth elements and lithium in Canada, with a market cap of CA$8.09 million.

Operations: NeoTerrex Minerals Inc. has not reported any revenue segments.

Market Cap: CA$8.09M

NeoTerrex Minerals Inc., with a market cap of CA$8.09 million, is a pre-revenue company focused on mineral exploration for rare earth elements and lithium in Canada. Recent developments include the successful completion of its maiden drill program at the Valour Project in Quebec and promising discoveries at both the Revolver and Galactic projects, highlighting significant potential for critical minerals such as Neodymium, Dysprosium, Zirconium, and Tantalum. Despite being debt-free with sufficient cash runway exceeding one year, NeoTerrex faces challenges due to its high share price volatility and lack of meaningful revenue streams.

- Dive into the specifics of NeoTerrex Minerals here with our thorough balance sheet health report.

- Gain insights into NeoTerrex Minerals' historical outcomes by reviewing our past performance report.

Taking Advantage

- Click this link to deep-dive into the 932 companies within our TSX Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hercules Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BIG

Hercules Metals

A junior mining company, engages in the exploration and development of mineral properties in the United States.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion