- Canada

- /

- Metals and Mining

- /

- TSXV:ABI

A Rising Share Price Has Us Looking Closely At Abcourt Mines Inc.'s (CVE:ABI) P/E Ratio

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's great to see Abcourt Mines (CVE:ABI) shareholders have their patience rewarded with a 36% share price pop in the last month. And the full year gain of 36% isn't too shabby, either!

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

View our latest analysis for Abcourt Mines

Does Abcourt Mines Have A Relatively High Or Low P/E For Its Industry?

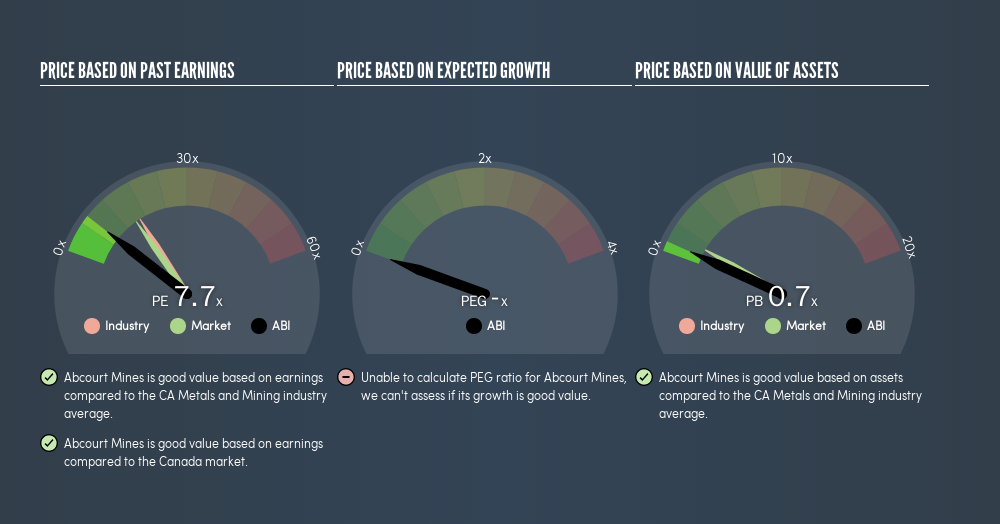

We can tell from its P/E ratio of 7.74 that sentiment around Abcourt Mines isn't particularly high. We can see in the image below that the average P/E (15.9) for companies in the metals and mining industry is higher than Abcourt Mines's P/E.

Abcourt Mines's P/E tells us that market participants think it will not fare as well as its peers in the same industry.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. When earnings grow, the 'E' increases, over time. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

It's great to see that Abcourt Mines grew EPS by 16% in the last year.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. So it won't reflect the advantage of cash, or disadvantage of debt. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting Abcourt Mines's P/E?

Since Abcourt Mines holds net cash of CA$1.6m, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Verdict On Abcourt Mines's P/E Ratio

Abcourt Mines trades on a P/E ratio of 7.7, which is below the CA market average of 15.1. The net cash position gives plenty of options to the business, and the recent improvement in EPS is good to see. One might conclude that the market is a bit pessimistic, given the low P/E ratio. What we know for sure is that investors are becoming rather less uncomfortable about Abcourt Mines's prospects, since they have pushed its P/E ratio from 5.7 to 7.7 over the last month. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you're more sensitive to price, then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

But note: Abcourt Mines may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:ABI

Abcourt Mines

Engages in the acquisition, exploration, evaluation, and exploitation of gold mining properties in Canada.

Medium-low risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)