- Canada

- /

- Metals and Mining

- /

- TSX:WDO

Is Wesdome Gold Mines an Opportunity After a 13% Pullback Despite Strong 2025 Growth?

Reviewed by Bailey Pemberton

If you’ve been watching Wesdome Gold Mines’ stock lately, you know it’s been anything but boring, right? Investors are buzzing about whether this gold miner is a hidden gem or just another name jumping around with the market. Let’s break it down together and see whether the recent moves are cause for concern or an opportunity waiting to be seized.

Take a look at the numbers: Wesdome is up an impressive 53.8% year-to-date and an eye-popping 66.0% over the past year. The past three years? A staggering 153.1%. Even with this kind of long-term strength, the last seven days have seen a sharp dip of 13.1%, and it’s essentially flat over the past 30 days. This kind of volatility is the type of thing that stops investors in their tracks and makes you wonder if something’s changed or if the market is just catching its breath.

So what’s been going on? Recent headlines suggest shifts in investor sentiment toward the broader gold sector, including renewed interest as inflation fears persist and ongoing debates about the timing of interest rate changes. M&A rumors are swirling around midsize gold companies, plus a recent uptick in drilling results has had investors recalibrating their expectations. All of this has pushed gold miners as a group in and out of favor faster than usual, but Wesdome’s long-term story stands out when you look at the numbers.

Here is where things get really interesting: Wesdome earns a perfect 6 out of 6 on our valuation score, meaning by every check we run for undervaluation, they come out on top. In other words, it is the kind of setup value-minded investors appreciate. But before we dive into each valuation method, let’s look at why textbook checklists don’t always tell the whole story. Stick around for a perspective you won’t want to miss at the end.

Approach 1: Wesdome Gold Mines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating how much cash Wesdome Gold Mines is expected to generate in the future and then bringing those cash flows back to today’s value. This helps investors get a sense of what the company is truly worth now, based on projected future performance rather than market mood swings.

For Wesdome, the most recent reported Free Cash Flow comes in at CA$128.1 million. Analysts expect this figure to rise sharply, with projections reaching CA$522.9 million by 2027. Beyond 2027, Simply Wall St’s model carries those projections forward, with 2035 free cash flow forecasted at CA$719.7 million. All of these projections are presented in Canadian dollars, aligning with Wesdome’s reporting currency.

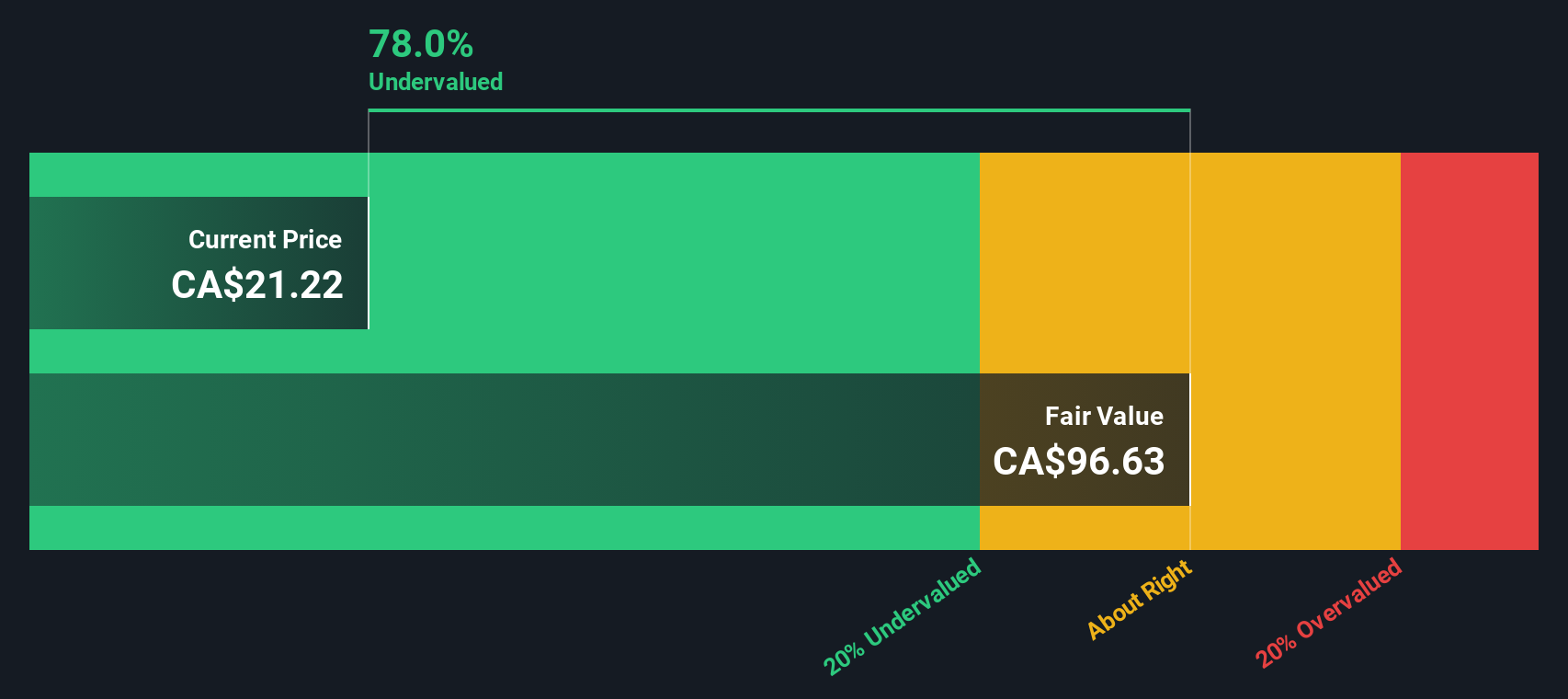

Taking these figures together, the DCF estimates Wesdome’s intrinsic value at CA$92.41 per share. This is a striking result because the model implies the shares are trading at a 77.6% discount compared to what the long-term cash flows are worth today. For investors searching for value in the gold mining sector, this signals potential opportunity.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wesdome Gold Mines is undervalued by 77.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Wesdome Gold Mines Price vs Earnings (PE)

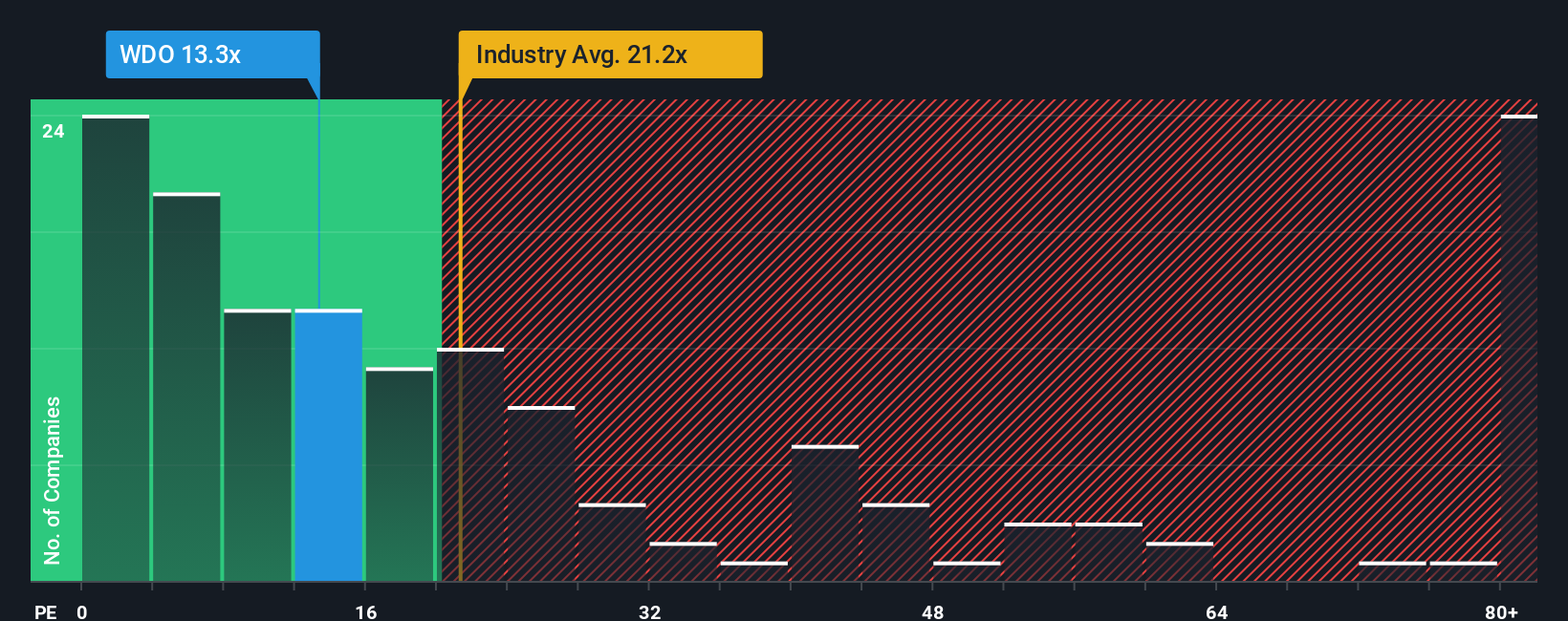

The Price-to-Earnings (PE) ratio is the preferred valuation tool for companies like Wesdome Gold Mines that are firmly profitable. This metric is a popular benchmark because it captures what investors are willing to pay today for a company’s future earnings. For profitable miners, the PE ratio helps cut through short-term noise by showing how earnings growth prospects stack up against the current share price.

However, a “normal” or “fair” PE ratio is not universal. It depends on how quickly investors expect the company to grow and the underlying risks. Higher expected earnings growth or lower risk can justify a richer PE, while slower growth or higher uncertainty typically mean a lower PE is warranted.

Wesdome is currently trading at a PE ratio of 13x. When you stack this up against key benchmarks, it is below the Metals and Mining industry average of 21.2x and well under the peer group average of 47.3x. But rather than stopping at industry and peer comparisons, Simply Wall St’s proprietary Fair Ratio steps in, calculating what a reasonable PE multiple for Wesdome should be given its own earnings growth, risk profile, margins, market cap, and its specific industry circumstances. For Wesdome, the Fair Ratio comes out to 22.6x, which is considerably above the company’s current level.

The Fair Ratio is a more tailored assessment because it considers many nuances that industry or peer averages miss, accounting for Wesdome's risk and growth position as well as its own profitability and size. With the company currently trading well below its Fair Ratio, this suggests the shares are meaningfully undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wesdome Gold Mines Narrative

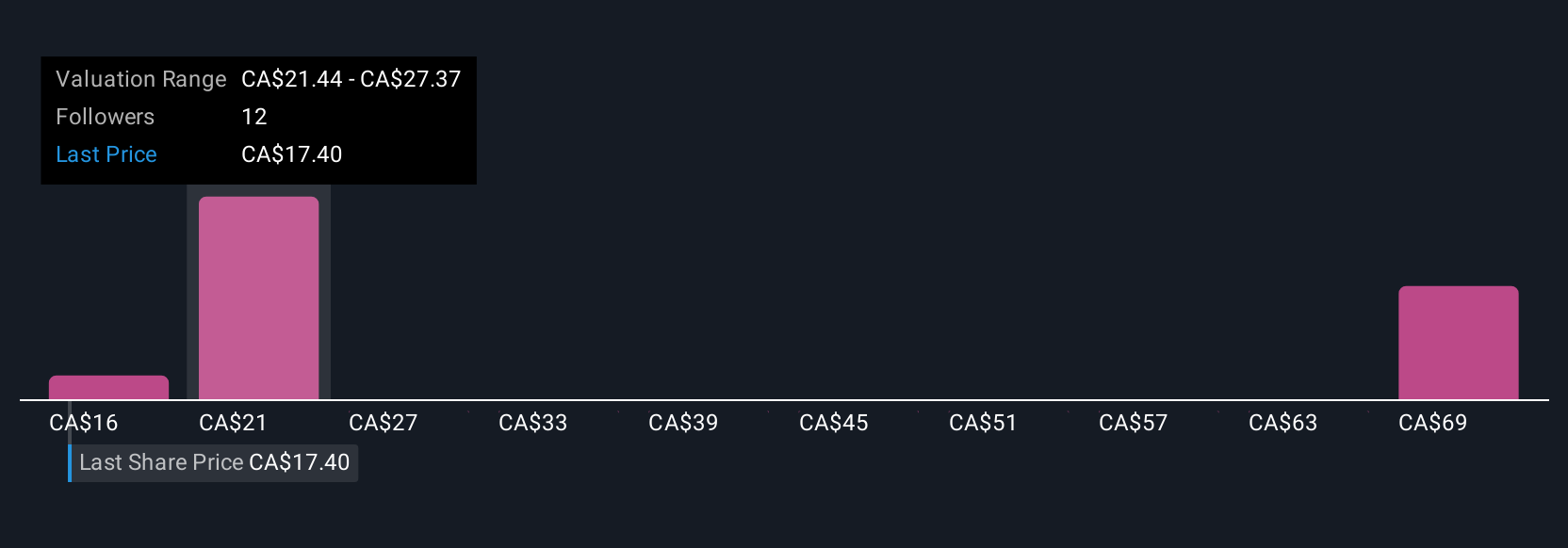

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple, powerful tool that allows you to give your own story and perspective behind a company, linking their real-world prospects to your estimates for future revenue, earnings, margins, and ultimately what you believe is a fair value for the stock.

Rather than relying on one-size-fits-all ratios or static models, Narratives connect the company’s story (like a new mine expansion, cost improvements, or changing gold prices) to a financial forecast and a fair value, all in a way that reflects your assumptions. You can easily create and edit Narratives on Simply Wall St’s Community page, the same platform used by millions of investors globally. This way, you can see a rich mix of opinions and scenarios.

With Narratives, you can compare your fair value to Wesdome’s current market price, helping you decide whether now is the right time to buy or sell. Your Narrative will even update dynamically as new information, such as earnings or news, becomes available.

For example, some investors see upside and forecast a CA$27.00 fair value based on bullish production and gold price trends, while others are more cautious, setting their fair value as low as CA$19.00 to highlight operational and cost risks. Both perspectives can be quickly reviewed and compared in the Community.

Do you think there's more to the story for Wesdome Gold Mines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)